|

|

08-10-2009, 06:48 AM

08-10-2009, 06:48 AM

|

#21

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2005

Location: Lake Livingston, Tx

Posts: 4,204

|

RunningMan,

Did you mean to say 'tax cuts' that are sure to pass? Seems to me tax increases are sure to pass.

__________________

If it is after 5:00 when I post I reserve the right to disavow anything I posted.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

08-10-2009, 08:41 AM

08-10-2009, 08:41 AM

|

#22

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

Quote: Quote:

Originally Posted by Rustic23

RunningMan,

Did you mean to say 'tax cuts' that are sure to pass? Seems to me tax increases are sure to pass.

|

Ooops! Yes in my haste to finish I said cuts, I meant to say tax increases.

__________________

But then what do I really know?

https://www.early-retirement.org/forums/f44/why-i-believe-we-are-about-to-embark-on-a-historic-bull-market-run-101268.html

|

|

|

08-10-2009, 09:39 AM

08-10-2009, 09:39 AM

|

#23

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2006

Posts: 1,558

|

What about the trillions of dollars the Fed is printing and handing out?

I gotta think that those are going to have an effect down the road.

Quote: Quote:

Originally Posted by Running_Man

TheHill.com - Deficit grew by $181 billion in July

For a macro view of the deflationary situation, the current budget deficit ytd is about 1.2 trillion. 529 billion of that increased is caused by increased government spending, primarily giving Freddie Mac and Fannie May funds to give to the Chinese government to keep the bonds from blowing up. Tax revenues meanwhile fell by 350 billion of which 100 billion is stimulus money from tax reductions. That leaves about 250 billion of tax shortfall from a government assume a 40 percent tax rate and you get a reduction of 600 billion of income, despite the federal goverment spending an additional 529 billion. You can mulitply this problem across 50 states as well.

There simply is no view in sight yet of any inflation, indeed I contend deflation is beginning to accelerate. With the tax cuts that are sure to pass this fall (you can't keep spending more and getting in less forever else the Feds will go belly up as well), you'll see economic activity get crushed. Nothing appears in sight that is going to prevent this catastrophe. The Fed surely sees this problem which are why short term rates are still near zero.

|

|

|

|

08-10-2009, 10:50 AM

08-10-2009, 10:50 AM

|

#24

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2009

Location: Austin

Posts: 1,142

|

Lost decades (plural)

And then there is deleveraging and its effect on the economy. This from Bloomberg via Barry Ritholtz The U.S. economy may be just as sluggish during the next 20 years as Japan’s economy was in the last 20, according to Comstock Partners, a money manager founded and run by Charles Minter.

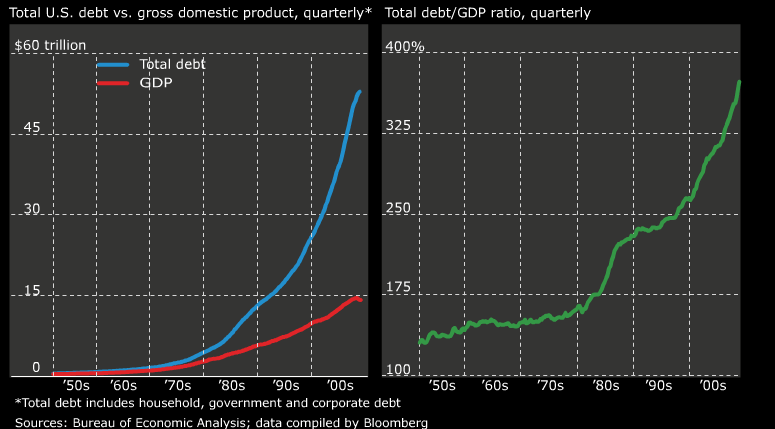

The CHART OF THE DAY shows U.S. total debt and gross domestic product since 1952, along with the ratio between them, based on data compiled by Bloomberg. The ratio rose in the first quarter to 372 percent even as household borrowing dropped for a second straight quarter, an unprecedented streak.

The U.S. is headed for “a deleveraging period” in which the amount of so-called private debt, including consumer borrowing, collapses as government borrowing explodes, Comstock wrote.

I just wish that they had taken this chart back to WWII so that we could see how this compares to the war debt.

|

|

|

08-10-2009, 10:59 AM

08-10-2009, 10:59 AM

|

#25

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

I've seen the debt to GDP graph in the WW2 era. Ours is currently only a little higher than it was circa 1945. The differences, though, are that (1) there were far fewer unsustainable entitlements in the first few years after 1945, and (2) the economy grew very robustly for about a quarter century after WW2 ended. Both of these helped the debt to GDP ratio shrink sharply into the 1950s and beyond.

I don't see either of these pulling us out of this morass this time. Recovery and fiscal sanity are likely to be a lot more painful than it was after WW2.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

08-10-2009, 11:54 AM

08-10-2009, 11:54 AM

|

#26

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 7,746

|

regarding the debt to GDP ratio - we also have a lot more individual assets today versus 1950, particularly houses. Today the median size of new houses is roughly 2400 sf. How many 2400 sf houses were being built in 1950? The median was probably closer to 1/2 that size. So we have more mortgage debt, but more collateral backing that debt.

|

|

|

08-10-2009, 12:00 PM

08-10-2009, 12:00 PM

|

#27

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 7,746

|

Quote: Quote:

Originally Posted by Midpack

Congress is never slow to jump on an idea that will buy them votes (with your kids money) - Cash for Clunkers has worked so well, stay tuned for Funds for Foreclosures. If you have owned your house for at least a year and it's worth less than your loan, Congress will give you $35,000 to $45,000 more than your appraised value if you buy a smaller, more energy efficient home. It doesn't have to be much smaller or much more efficient, just a little bit will be fine. But your old house has to be destroyed. Realtors make money, builders make money, banks loan money, and the next generation pays for it - what's not to like. Of course if you've been responsible and own your home, or your loan is less than the value of the house - you get squat. Wait until Congress comes back from vacation, you heard it here first...

|

Hey, you trying to steal my genius stimulus idea? I call it "Cash for Clunky Houses" but Funds for Foreclosures does have a nice ring to it. But I though up this idea first: http://www.early-retirement.org/foru...tml#post840628 So you heard it here first.

This would definitely help out with all those unemployed construction workers, mortgage brokers, real estate agents, etc!

|

|

|

08-10-2009, 12:15 PM

08-10-2009, 12:15 PM

|

#28

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Remember that after Katrina hit, some pundits said that the silver lining was that the rebuilding would boost up the GDP for the next year or two. Good grief!

How would you like to keep busy rebuilding your house every few years, instead of sitting on your butt surfing the Web?

No economist here, but one would think that by that logic, those Caribbean islands besieged by hurricanes would have really low unemployment and their GDP growing through the roof. Heck, talk about roofs, the one time I was driving through St. Thomas, I saw many houses still had tarp for a roof.

Yeah! Let's trash our houses, overturn and burn our clunkers! We should be busy rebuilding for years.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

08-10-2009, 12:23 PM

08-10-2009, 12:23 PM

|

#29

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 7,746

|

Quote: Quote:

Originally Posted by NW-Bound

Remember that after Katrina hit, some pundits said that the silver lining was that the rebuilding would boost up the GDP for the next year or two. Good grief!

How would you like to keep busy rebuilding your house every few years, instead of sitting on your butt surfing the Web?

No economist here, but one would think that by that logic, those Caribbean islands besieged by hurricanes would have really low unemployment and their GDP growing through the roof. Heck, talk about roofs, the one time I was driving through St. Thomas, I saw many houses still had tarp for a roof.

Yeah! Let's trash our houses, overturn and burn our clunkers! We should be busy rebuilding for years.

|

Well, that makes three of us in agreement. Anyone want to chip in a couple hundred thousand for a lobbyist and get this clunker of a bill rolling through Congress? Let's snap up a bunch of XHB first though...

It would probably never pass. Many of the laborers in construction (in my area at least) are, how shall we say, ineligible to vote due to citizenship reasons. Plus they aren't represented by unions. Guess there aren't any votes to buy there.

|

|

|

08-11-2009, 04:48 PM

08-11-2009, 04:48 PM

|

#30

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

U.S. productivity rises 6.4%, fastest in 6 years - MarketWatch

With today's GDP release, indication that shows wages increasing their rate of decline and another sign to me that deflation is much more likely than any inflation. The decline in per unit labor is actually quite amazing. This report dovetails and confirms what I am seeing in most companies, cost reductions are ocurring much more rapidly than the sales are falling off increasing profits. However that is not a very enduring model for an economy or stock prices.

__________________

But then what do I really know?

https://www.early-retirement.org/forums/f44/why-i-believe-we-are-about-to-embark-on-a-historic-bull-market-run-101268.html

|

|

|

08-12-2009, 07:33 AM

08-12-2009, 07:33 AM

|

#31

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2009

Location: Austin

Posts: 1,142

|

Signs of a bottom?

When I see charts like this, I just have to shake my head in wonder. The world economy really did fall off a cliff. But it is just as interesting to note how fast U.S. exports were growing before the crash. Surely exports weren't driven by the U.S. housing bubble.

Anyway, it is nice to see the cliff diving coming to an end.

TradeJune2009.jpg

from

http://www.calculatedriskblog.com/20...s-in-june.html

|

|

|

08-12-2009, 09:49 AM

08-12-2009, 09:49 AM

|

#32

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2009

Location: Miraflores,Peru

Posts: 1,992

|

Quote: Quote:

Originally Posted by IndependentlyPoor

|

I think exports were driven by the declining dollar, The redline (imports) were driven by the housing bubble and rampant consumerism.

|

|

|

08-14-2009, 08:53 AM

08-14-2009, 08:53 AM

|

#33

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2009

Location: Austin

Posts: 1,142

|

|

|

|

08-16-2009, 01:25 AM

08-16-2009, 01:25 AM

|

#34

|

|

Confused about dryer sheets

Join Date: Aug 2009

Posts: 3

|

Great recession

Every citizen should take part to solve this world wide problem of recession. This recession makes the whole world jobless.

|

|

|

08-16-2009, 01:57 PM

08-16-2009, 01:57 PM

|

#35

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,139

|

Quote: Quote:

Originally Posted by IndependentlyPoor

A chart contrived to scare the bejeezus out of you.

|

The key word there is "contrived".

|

|

|

09-11-2009, 02:23 PM

09-11-2009, 02:23 PM

|

#36

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2009

Location: Austin

Posts: 1,142

|

|

|

|

09-11-2009, 03:20 PM

09-11-2009, 03:20 PM

|

#37

|

|

Recycles dryer sheets

Join Date: Jul 2007

Posts: 71

|

I never have understood why mild deflation seems to be so scary. Every one seems quite happy with 3-say 5% inflation. On the other hand 3-5% deflation seems to be quite frightening? It just seems to me that with a fiat currency that sort of fluctuation around the mean or 0% inflation/deflation would be sort of a normal variation.

I understand that if you owe money then inflation helps you pay off your debt with cheaper money so if your are in debt then inflation is your friend. On the other hand if you have no debt and have cash or have loaned money then deflation would be your friend.

Why the panic when signs of deflation pop up? Why the helicopter money drops?

|

|

|

09-11-2009, 06:45 PM

09-11-2009, 06:45 PM

|

#38

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Quote: Quote:

Originally Posted by Running_Man

U.S. productivity rises 6.4%, fastest in 6 years - MarketWatch

With today's GDP release, indication that shows wages increasing their rate of decline and another sign to me that deflation is much more likely than any inflation. The decline in per unit labor is actually quite amazing. This report dovetails and confirms what I am seeing in most companies, cost reductions are ocurring much more rapidly than the sales are falling off increasing profits. However that is not a very enduring model for an economy or stock prices.

|

Wow, here's an example that behind every silver lining lurks a cloud.

Productivity growth is the ONLY way an economy increases wages and standards of living over time. It is increased productivity and associated profits that encourages businesses to higher more workers.

What you saw in the 2nd quarter is the result of businesses cutting costs below what the economic environment actually warranted. What we'll see after a couple of quarters of good profits is businesses starting to reverse that and adding to payrolls, perhaps aggressively.

With respect to stock prices, research the term "operating leverage". With the significant cost reduction that companies have achieved, the slightest bit of revenue growth will translate into massive earnings growth.

|

|

|

09-11-2009, 07:03 PM

09-11-2009, 07:03 PM

|

#39

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

Quote: Quote:

Originally Posted by Sevo

I never have understood why mild deflation seems to be so scary. Every one seems quite happy with 3-say 5% inflation. On the other hand 3-5% deflation seems to be quite frightening? It just seems to me that with a fiat currency that sort of fluctuation around the mean or 0% inflation/deflation would be sort of a normal variation.

|

Mild deflation for a short period of time isn't a big problem. Prolonged deflation is, as it leads to people postponing purchases and reducing economic activity for a long time.

Deflation is also a problem when the inflation most people "feel" in the essentials (food, utilities, health care, insurance, taxes) are rising even as we are told there is no inflation or even negative inflation because of electronics and big-ticket discretionary stuff.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

09-13-2009, 08:00 AM

09-13-2009, 08:00 AM

|

#40

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

Quote: Quote:

Originally Posted by . . . Yrs to Go

Wow, here's an example that behind every silver lining lurks a cloud.

Productivity growth is the ONLY way an economy increases wages and standards of living over time. It is increased productivity and associated profits that encourages businesses to higher more workers.

What you saw in the 2nd quarter is the result of businesses cutting costs below what the economic environment actually warranted. What we'll see after a couple of quarters of good profits is businesses starting to reverse that and adding to payrolls, perhaps aggressively.

With respect to stock prices, research the term "operating leverage". With the significant cost reduction that companies have achieved, the slightest bit of revenue growth will translate into massive earnings growth.

|

I have been a believer since 2007 that falling home prices would wreck havoc on the economy. I look at the period of 1981 to 2007 as the golden age of investment in that I don't think there was a bad decision to be made, merely which is the very greatest. The combination of falling mortgage rates and rising home prices provided the money to grow our economy, the rising home prices combined with lower interest rates encouraged personal debt. Throughout the '80's homeowners refinancing lead to a real decline in mortage expense and a real rise in disposable income to spend and an incentive to borrow against that equity.

That trend has ended, I view the odds that a new productivity trend to provide a robust economy as very low, but I certainly will be very happy to experience a new burst in economic prosperity. What I see, and it is a dark cloud in my sights, is in addition to the ending of the home equity pool of income real wages are falling too, while the economic army may have some fine looking corporate horses but the number of nails available to let that horse run fast and safe are becoming too scarce. At present the party on the other side trying to stem the tide of a trend that has ended is the US government running unprecedented deficits, which will also call inevitably demand for income from the same nail-makers who have a shrinking pool of resources. I will take the comment of look up "operating leverage" and hold on for a couple of quarters to see how this battle fares.

__________________

But then what do I really know?

https://www.early-retirement.org/forums/f44/why-i-believe-we-are-about-to-embark-on-a-historic-bull-market-run-101268.html

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|