twaddle

Thinks s/he gets paid by the post

- Joined

- Jun 16, 2006

- Messages

- 1,703

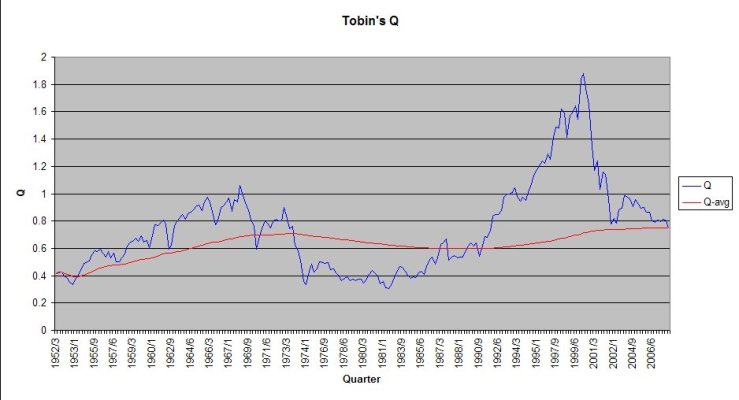

Time to shine the bat signal! Tobin's Q now indicates that the market is fairly valued. I think.

The fed just released 2007Q4's flow of funds report, so I decided to calculate Tobin's Q according to this site:

The Q-Ratio: Valuing the Stock Market

Q recently reverted to its long-term mean.

Thought you might want to know.

The fed just released 2007Q4's flow of funds report, so I decided to calculate Tobin's Q according to this site:

The Q-Ratio: Valuing the Stock Market

Q recently reverted to its long-term mean.

Thought you might want to know.