aja8888

Moderator Emeritus

I have just transferred $100K into a PenFed IRA from my Schwab IRA (had cash recently uninvested). It's gone from Schwab but not posted yet at PenFed (it's in the wires somewhere).

I am about to retire 12/31 and just work part time (consulting) at the same firm. Maybe 25 - 50% if needed. Age is over 65, financially OK and good health. No debts, no kids at home, paid for house, etc.

and just work part time (consulting) at the same firm. Maybe 25 - 50% if needed. Age is over 65, financially OK and good health. No debts, no kids at home, paid for house, etc.

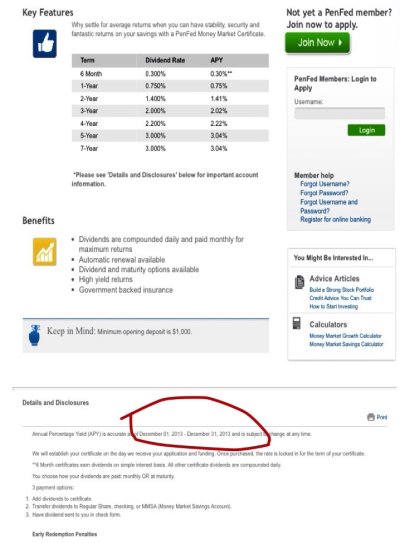

I have not determined how to split up the 100K into CDs. My first thought is 10 $5K 3% CDs @ 5 years and leave the rest cash until a few months go by to see if rates rise and I can then invest the balance or a portion of it into a higher rate CD. If rates don't rise, then ladder in 3% CDs $10K at a time for the rest of the year. Although doing this I don't feel so good about letting 50K sit there doing nothing for months.

Any thoughts on a better plan for the $100K?

Thanks,

Tony

I am about to retire 12/31

I have not determined how to split up the 100K into CDs. My first thought is 10 $5K 3% CDs @ 5 years and leave the rest cash until a few months go by to see if rates rise and I can then invest the balance or a portion of it into a higher rate CD. If rates don't rise, then ladder in 3% CDs $10K at a time for the rest of the year. Although doing this I don't feel so good about letting 50K sit there doing nothing for months.

Any thoughts on a better plan for the $100K?

Thanks,

Tony

Last edited: