kyounge1956

Thinks s/he gets paid by the post

- Joined

- Sep 11, 2008

- Messages

- 2,171

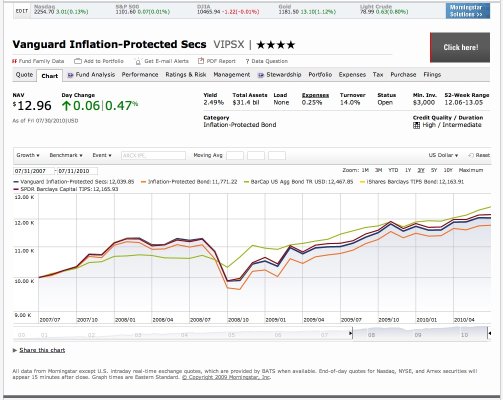

Part of my Roth IRA is in a TIPs ETF. I have recently been thinking of switching over to VIPSX, so I can automatically direct my monthly contributions into that fund—I can't set up auto-purchase of ETFs at my Roth custodian. Before doing so, I wanted to check and see whether VIPSX (which is not, strictly speaking, an index fund) tracks the index as closely as the ETF, which has matching the index as its objective. It took a while, but I eventually found an online chart (at Morningstar) which displays the index along with the fund performance. (see below—chart shows the last 3 years). It doesn't look like there is much difference between TIP (the ETF I have now), IPE (the other TIPs ETF) and VIPSX, but I was surprised to see how much all three of them differed from the index, especially how drastically they dropped along with the stock market in 2008, when the index hardly fell at all. It looks like my supposedly sober-minded bond allocation got irrationally exuberant as the bubble inflated, and then plunged along with equities (although not to as great an extent) when it popped. I thought the whole idea of having bonds in one's portfolio is that they zig when equities are zagging. Is this what people mean by "in a crash, nothing goes up except correlations"?

that was the index that came up when I asked for the chart of TIP. I wonder if I can change it to the right one. Time to leave for w*rk now, but if I can figure out how to get the correct index to display, I'll re-post the chart.

that was the index that came up when I asked for the chart of TIP. I wonder if I can change it to the right one. Time to leave for w*rk now, but if I can figure out how to get the correct index to display, I'll re-post the chart.