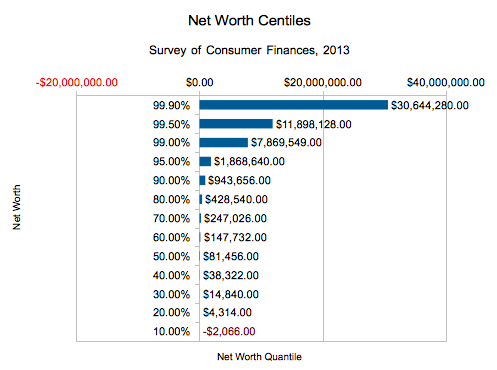

I have seen different statistics in terms of what is the minimum or median income, and minimum or median net-worth, in the top one percent of the United States, the top .5%, and the top .1%.

Anyone have reliable statistics for this?

If you are wondering why it matters, I think the answer is it does not matter. But I am confused by having seen very different statistics, and I thought someone must have reliable numbers. (I guess for net worth, it might depend on what one includes/excludes?)

Anyone have reliable statistics for this?

If you are wondering why it matters, I think the answer is it does not matter. But I am confused by having seen very different statistics, and I thought someone must have reliable numbers. (I guess for net worth, it might depend on what one includes/excludes?)