I still don't understand how CC statement and bank statements gets one down to the granularity to see where the money is going and make decisions.

We spend a lot at Costco, and grocery stores for example. But that doesn't tell me much of anything useful. Everything from toilet paper and water softener salt is bunched in with discretionary items.

Do you people actually go line-by-line on the cash register receipt and categorize each purchase? And how do you identify things like buying a high grade of something versus a lower grade? If I wanted to further economize, I might learn that buying lower grades of bacon, hamburger versus steak, etc, might save me $X per month. But that would seem to take a lot of figuring, a lot of judgement, a lot of categories. What does entering a prime steak as "grocery" versus entering hamburger as "grocery" tell me - they just both come up as "grocery"? But there is a savings there if I want to pursue it, but how would I see it?

I know what my total spending is (it only comes from two accounts, I just add up the withdraws, and add back any reimbursements or 'transfers' (like moving money from savings to fund a Roth IRA contribution). But I really don't know the detailed breakdown - after utilities, mortgage, insurance, property tax, etc - the big hitters. We try to be careful with our purchases, looking for value. I'm not sure what I'd gain with a bunch of penny-level numbers - what would they really mean to me? What action could I take based on them?

-ERD50

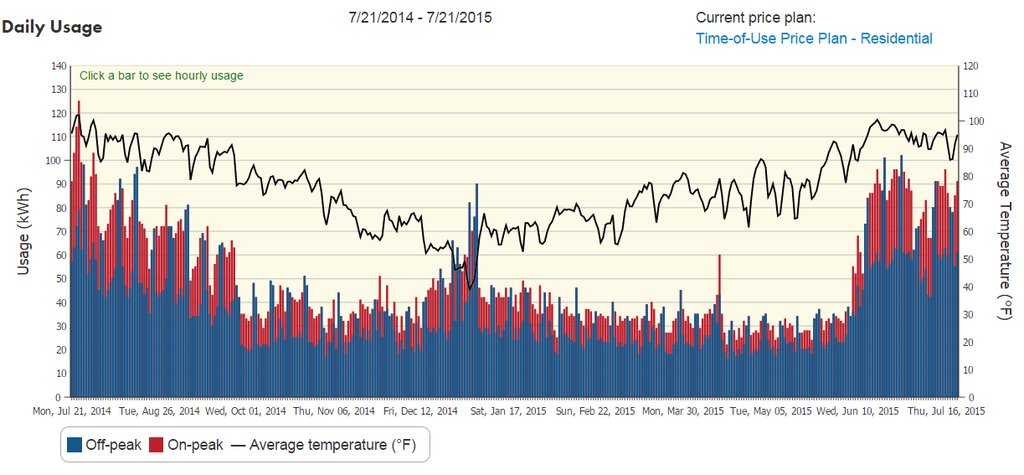

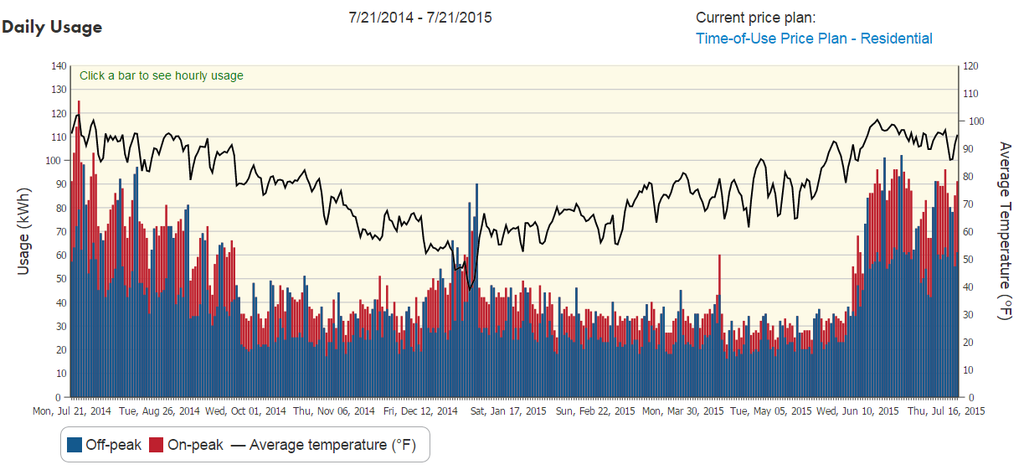

My wife thinks I'm crazy, but I do the same thing for both gas and electricity. I find it fascinating and it was amazing the drop in usage when we replaced the previous owner's incandescent floods with CFLs and LEDs. I'm eagerly awaiting the first month's returns with the new AC, the first 10 days looks promising.

My wife thinks I'm crazy, but I do the same thing for both gas and electricity. I find it fascinating and it was amazing the drop in usage when we replaced the previous owner's incandescent floods with CFLs and LEDs. I'm eagerly awaiting the first month's returns with the new AC, the first 10 days looks promising.