My return was rejected because of a flaw in TurboTax, I thought I'd share in case it affects anyone else. Once corrected the return was accepted.

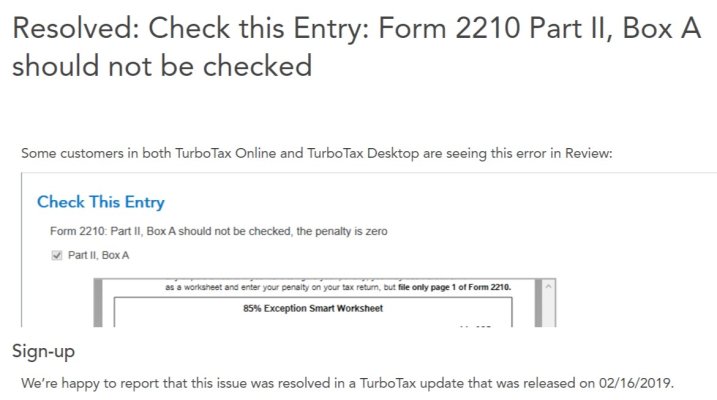

My estimated tax payments were greater than the tax due, so I have a refund. TT nonetheless completed and filed form 2210 - Underpayment of Estimated Tax, with the box "requesting a waiver' checked. IRS rejected this because the required explanation was not attached. The TT / IRS error message

The TT support forum says to delete the form but it can't be deleted - TT just generates a new one. The only thing that worked for me was to open the "step by step" to calculate a penalty and input all 2017 values with "0".

So, even though my estimated tax was greater than the tax due, I had to force TurboTax to calculate the underpayment penalty, then input bogus numbers for the previous year amounts.

My estimated tax payments were greater than the tax due, so I have a refund. TT nonetheless completed and filed form 2210 - Underpayment of Estimated Tax, with the box "requesting a waiver' checked. IRS rejected this because the required explanation was not attached. The TT / IRS error message

This is apparently a common complaint, Google search autofill went straight to "Form 2210" when I typed "TurboTax form" and '00's of hits showed with multiple suggestions.F2210-003 - If Form 2210, Part II, Line A checkbox 'WaiverOfEntirePenaltyInd' is checked, then [WaiverExplanationStatement] must be attached to Form 2210.

The TT support forum says to delete the form but it can't be deleted - TT just generates a new one. The only thing that worked for me was to open the "step by step" to calculate a penalty and input all 2017 values with "0".

So, even though my estimated tax was greater than the tax due, I had to force TurboTax to calculate the underpayment penalty, then input bogus numbers for the previous year amounts.