+1. Volatility is an entirely unsatisfactory way to describe "risk" as we know it in the real world. I can bury my money in a hole, have zero volatility (and "zero risk") and be virtually assured it will eventually be worth almost nothing. If I'm counting on that money for my living expenses, have I really taken the low-risk path?Again, that is fine if he doesn't care that his course of action minimizes volatility at the cost of loss of real value of his portfolio.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

update on Wellesley and Intermediate-Term Bond fund

- Thread starter obgyn65

- Start date

- Status

- Not open for further replies.

Major Tom

Thinks s/he gets paid by the post

I agree. Whenever Ob says that he is risk averse (which is often), I do the translation in my head and take that to mean that he is uncomfortable with volatile investments. That's what most people mean (with regards to investments) when they say they are risk averse."Risk averse" seems to really be a code for "averse to the risk of any volatility in the nominal amount of my portfolio." Risk averse does not mean averse to reduction of the real value of my portfolio since someone who was averse to that kind of risk wouldn't have a no equity portfolio.

As Meadbh says, he craves numerical predictability.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

He can do whatever he want with his money. I think advising others to do like him is a bad idea in most cases. But people coming here for advice are getting it for free, they should realize they may be only getting their money's worth!We all know that inflation is almost certainly going to run higher than that and most of us want our income to keep track of inflation, but Obgyn has already said that he is comfortable with losing spending power over time, so who are we to question that? He keeps telling us he's risk averse (in almost every post, it feels like) so I think he just might be telling us the truth

ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

I think risk aversion is not obgyn's profile. He craves numerical predictability. Hence, he is variability averse.

Yeah, or another way to look at it is that he is averse to letting go of control. Putting money in the market means, to some degree, that you lose control over what happens to it. He prefers having outcomes in his control.

Makes sense. A lot of doctors I know are like that. They need to feel like they are in control. Especially being an OB, he's in a high-risk profession where the threat of lawsuits is always looming. He has to make sure he stays on top of all the variables, gets everything right ... i.e., stays in control of the situation.

Putting money in the stock market requires letting go of control. I don't think OB likes to do that.

Which is fine. My brother is the same way. Everything in CDs. This way he knows it is secure; he doesn't have to worry about market fluctuations, when the next big crash is coming, etc. He knows exactly how much he'll have, down the road. Some people are willing to pay for that sense of predictability and control.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why does anyone care about what OBGYN does?? ...

His choice, and that's fine.

But what I do care about is, other readers seeing these statements from a prolific poster that a portfolio for an early retiree, w/o equities, and a 3.5% WR (which was in his sig for a long time) is 'conservative', or 'risk adverse'.

If that statement is not challenged, it might be accepted by others as truth. And as one can see from the numbers I posted earlier, you need to get to a very low WR to support a 40 year retirement w/o equities. If someone chooses that route, fine. But don't misrepresent it.

Meadbh hit the nail on the head with the differentiation between 'risk adverse', and 'craving numerical predictability'. And most of know that numbers that are not adjusted for inflation over time are numbers that are hiding reality from us. That 'numeric predictability' is an illusion, because inflation causes its buying power to vary, and inflation is not predictable.

TANSTAAFL.

-ERD50

rbmrtn

Thinks s/he gets paid by the post

Of course, Obgyn can choose to take whichever of those risks he wants to take, but I don't think he is at all risk averse. I think he is risk seeking. Again, that is fine if he doesn't care that his course of action minimizes volatility at the cost of loss of real value of his portfolio.

I think obgyns position is different than most. I couldn't find the post but somewhere in a thread he said he already had substantial assets, some thing like 2 maybe 5 mill, his income is in the 1% club and he spends like a pauper. Inflation really not concern for him, I think he'll probably be fine doing what he has been.

Most people here heavily count on the hoped for return from stocks to keep up with inflation or their plans don't work. I don't think he's in that situation. If you run firecalc with a big enough starting stash with fixed income it works out fine. Most of us aren't that lucky.

ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

But what I do care about is, other readers seeing these statements from a prolific poster that a portfolio for an early retiree, w/o equities, and a 3.5% WR (which was in his sig for a long time) is 'conservative', or 'risk adverse'.

If that statement is not challenged, it might be accepted by others as truth.

Anyone who bases their investment decisions on the posts of a single stranger in an online forum is ... dumb.

It's an illusion. He may be able to know exactly the number of US dollars will be n his account in the future, but not what their buying power will be. The buying power is the important thing, he's not controlling that, and that's what a 100% long-term CD investor is giving up.He knows exactly how much he'll have, down the road. Some people are willing to pay for that sense of predictability and control.

I guess I am missing something here, but the numbers posted show a gain, not a loss. So far he has increased the $20,000 investment by over $500 in 5 months. Annual return of close to 7% and far better than any current CD I am aware of. How is $10,000 to $10,787 a 1% loss? I am confused.

ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

It's an illusion. He may be able to know exactly the number of US dollars will be n his account in the future, but not what their buying power will be. The buying power is the important thing, he's not controlling that, and that's what a 100% long-term CD investor is giving up.

I think he must understand, by this point, that he is losing out on returns and/or purchasing power. Seems like that has been hammered home fairly thoroughly. I've only been here 6 months, and I've heard him poked fun at dozens of times. I gather that it's sort of a running joke on the forum.

Look, some people are willing to sacrifice a few percentage points (in returns or purchasing power) for a sense of control. "Sense of control" doesn't mean actual control. No one is actually in control of the economy or their returns or their future buying power or a host of other things. But some people are willing to pay for that sense/belief that things are under control.

So what? People spend money for a sense of control all the time. If he has money to burn (as rbmrtn said), and limited expenses, why shouldn't he sacrifice a few percentage points so that he feels more secure and in control? He's not hurting himself -- he can afford it. People spend money on stupider things. I might do the same, if I were in his position, just so I wouldn't have to worry about stocks and bonds, AA, rebalancing, watching the market go up and down, worrying about when the next crash is, etc.

Vanguard Intermediate-Term Bond Index Fund Institutional Shares (VBIMX) : Value of $10,000 : $10,286 in March / April and $9,793 latest (about 5% loss)

Vanguard Wellesley Income Fund Admiral Shares (VWIAX) : Value of $10,000 : $10,834 in March / April and $10,787 latest (about 1% loss)

I'm confused by the value of $10,000. Does this mean you purchased $10,000 of each VBIMX and VWIAX? If not, what does it mean?

Also, did you include dividends in these amounts? If so, were they reinvested?

I guess I am missing something here, but the numbers posted show a gain, not a loss. So far he has increased the $20,000 investment by over $500 in 5 months. Annual return of close to 7% and far better than any current CD I am aware of. How is $10,000 to $10,787 a 1% loss? I am confused.

I'm glad you brought this up again. I asked the same question earlier in the thread and never received a response. When I looked at the numbers, that is if you take this as his total portfolio, consisting of two assets, then he is up.

It looks like from his original investment of $20,000, it is currently (or was - maybe not after yesterday) worth $9,793 + $10,787 = $20,580. This is $580 more than his original investment. Plus, we don't know if this includes dividends or not.

Based on Obgyn's calculation, it looks like he's using the high value of his asset that was hit sometime in march/april, not his cost basis. Heck, if I did that, I'd be bummed out too.

But maybe we're missing something. Either way, it's a short time frame, but it would be good to get clarification on the numbers. If I'm missing something, I'd like to know.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think there is a lot of piling on going on, almost to the point of being unfair. He hasn't posted to this thread for a while so I'm guessing either he is in one of his "busy" times or is discouraged.

I agree with the posts that Ob's AA would not work for most people and only works for him because his WR is so low - and I think he understands that. That said, he recognizes that he is risk/volatility averse and has take a small step with his recent investments in Wellesley and the bond fund. I think these were a big step out of his comfort zone for him and I applaud his doing so.

I think it would be better of us to try to help rather than criticize. I suggest that we give him a chance to digest this thread and respond before piling on more.

I agree with the posts that Ob's AA would not work for most people and only works for him because his WR is so low - and I think he understands that. That said, he recognizes that he is risk/volatility averse and has take a small step with his recent investments in Wellesley and the bond fund. I think these were a big step out of his comfort zone for him and I applaud his doing so.

I think it would be better of us to try to help rather than criticize. I suggest that we give him a chance to digest this thread and respond before piling on more.

Last edited:

I agree that this thread has taken an unfortunate tone of "Let's pile on OB for his lack of resolve in the face of an extremely minor market downturn." Perhaps I'm missing something, but I haven't seen any indication that OB intends to sell, or that he started this thread with that intent. The feedback he's been given here is consistently "stay the course" with an occassional "buy more in a down market" for good measure. We'll see how he responds to such advice.I think there is a lot of piling on going on, almost to the point of being unfair. He hasn't posted to this thread for a while so I'm guessing either he is in one of his "busy" times or is discouraged.

I agree with the posts that Ob's AA would not work for most people and only works for him because his WR is so low - and I think he understands that. That said, he recognizes that he is risk/volatility averse and has take a small step with his recent investments in Wellesley and the bond fund. I think these were a big step out of his comfort zone for him and I applaud his doing so.

I think it would be better of us to try to help rather than criticize. I suggest that we give him a chance to digest this thread and respond before piling on more.

Gatordoc50

Full time employment: Posting here.

pb4uski said:I think there is a lot of piling on going on, almost to the point of being unfair. He hasn't posted to this thread for a while so I'm guessing either he is in one of his "busy" times or is discouraged.

I agree with the posts that Ob's AA would not work for most people and only works for him because his WR is so low - and I think he understands that. That said, he recognizes that he is risk/volatility averse and has take a small step with his recent investments in Wellesley and the bond fund. I think these were a big step out of his comfort zone for him and I applaud his doing so.

I think it would be better of us to try to help rather than criticize. I suggest that we give him a chance to digest this thread and respond before piling on more.

Agreed. He can mitigate losses due to inflation by working a few more years. A very reasonable approach.

I think there is a lot of piling on going on, almost to the point of being unfair. He hasn't posted to this thread for a while so I'm guessing either he is in one of his "busy" times or is discouraged.

I agree with the posts that Ob's AA would not work for most people and only works for him because his WR is so low - and I think he understands that. That said, he recognizes that he is risk/volatility averse and has take a small step with his recent investments in Wellesley and the bond fund. I think these were a big step out of his comfort zone for him and I applaud his doing so.

I think it would be better of us to try to help rather than criticize. I suggest that we give him a chance to digest this thread and respond before piling on more.

I agree with you. A lot disagree with Obgyn's approach and are taking him to task for complaining about his short-term perspective, etc. But I think a lot can be learned from Obgyn's foray in volatile funds and how to build a good portfolio.

I rarely respond to threads here, but for some reason, I found this situation interesting so I wrote up a response at: http://www.early-retirement.org/for...mediate-term-bond-fund-67920.html#post1348361

My goal was to understand his goals, focus on the numbers, so Obgyn can build a good portfolio that meets his objectives. I don't think that's happening right now and I'm still puzzled - as I mention in previous posts - about his goals with this experiment. If he's willing to go down this path - which I think is great - then at least we can provide positive feedback on his approach.

Personally, I've seen others do experiments on this board (for example, Nords and his mortgage) and I think these posts are interesting, especially when we can track it over a longer time frame. We all model to death, but there's nothing like a real live experiment with actual dollars behind it.

As for Obgyn and how he invests, I doubt that he'll ever go to a 100% balanced portfolio. Let's face it, that's just not his goal and it's not our goal to convince him otherwise. But if he's willing to put a few dollars to run a real life experiment, why not follow along and add constructive feedback?

ER,I think he must understand, by this point, that he is losing out on returns and/or purchasing power. Seems like that has been hammered home fairly thoroughly. I've only been here 6 months, and I've heard him poked fun at dozens of times.

Sorry, the "he" I was referring to was your brother, not obgyn. Darn personal pronouns!

I don't think obgyn's approach is one I would recommend to anyone except perhaps someone who was very old (not likely to live long enough to let inflation decimate the portfolio, and market volatility was a bigger "risk" than erosion of buying power through inflation) or someone willing to save up so that a 1.5 to 2% WR would work. I think obgyn may be in this second category. But there aren't many folks wiling to work so many extra years or curtail their retirement spending so much that this approach woukd be a good option for them.

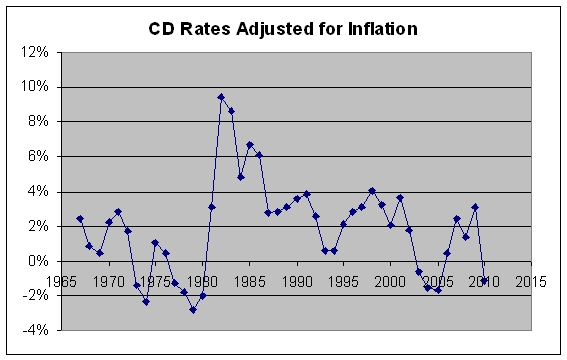

Above: Spread between CCDI and CPI. From this site.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Anyone who bases their investment decisions on the posts of a single stranger in an online forum is ... dumb.

Absolutely.

However, if that statement is made and no one challenges it, it could appear that is the general consensus of many successful FIRE'd posters, not just one single stranger.

As to the recent posts saying the OP is being 'criticized', or 'piled on' - I just don't see that. What I see are explanations. It's a fact - equities have NAVs that will rise and fall and rise and fall. Short term views mean nothing. And inflation eats buying power - $1 will have unpredictable buying power variations over time, but almost certainly downward.

His numbers appear off, or maybe are just not clear. Are divs included, or not? Actual transaction dates are needed, esp for such a short term analysis.

And I am unclear what the goal is. I don't understand buying a bond fund if the goal was to increase the equity AA. Has he actually determined a target AA? If so, one generally dollar cost averages into that AA. And why buy a balanced fund to increase the equity position of a portfolio with zero equities? Might as well go straight stock index to get a clearer picture of the two.

Or is this an 'experiment'? You really don't need to experiment to know that equities rise and fall. Look at any chart. I just don't understand. It's like saying I need to experiment and travel to Hawaii in December to learn that it is warm there.

-ERD50

Major Tom

Thinks s/he gets paid by the post

I think it is indeed an experiment - but not one to determine whether an equities/bonds portfolio will rise and fall. He's experimenting to determine his comfort level with this type of volatility.Absolutely.

Or is this an 'experiment'? You really don't need to experiment to know that equities rise and fall. Look at any chart. I just don't understand. It's like saying I need to experiment and travel to Hawaii in December to learn that it is warm there.

-ERD50

I find it quite amusing how we spend a lot of time talking about Ob and speculating about his strategy. Even though he's a prolific poster, his posts are often very brief. The numerous posts he makes keeps him uppermost in our minds, yet the relative lack of information in them creates a vacuum that we step in to attempt to fill. It approaches troll-like behavior, though I know that is not his intention - it is merely the end result of his lack of time to put detailed and thoughtful posts together, and his unwillingness to share too much information due to the belief that he will be overly criticized.

Last edited:

ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

Absolutely.

However, if that statement is made and no one challenges it, it could appear that is the general consensus of many successful FIRE'd posters, not just one single stranger.

Hmm, well, I think that would be an equally dumb inference. It's the internet. Ridiculous stuff gets posted all the time. It would be stupid (imo) to assume that just because no one challenges a statement, that it is therefore the general consensus.

I just don't understand. It's like saying I need to experiment and travel to Hawaii in December to learn that it is warm there.

I need to conduct that experiment. For science!

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Hmm, well, I think that would be an equally dumb inference. It's the internet. Ridiculous stuff gets posted all the time. It would be stupid (imo) to assume that just because no one challenges a statement, that it is therefore the general consensus. ....

Eddie,

I just noticed your new avatar. It sort of give me the creeps.

obgyn65

Thinks s/he gets paid by the post

Yes to Tom's words below and also a big thanks to pb4uski for his kind words above. At work today but I will make sure to answer most posts above in much greater detail this weekend barring emergencies here. Take care everyone. Happy Friday .

I think it is indeed an experiment - but not one to determine whether an equities/bonds portfolio will rise and fall. He's experimenting to determine his comfort level with this type of volatility.

I find it quite amusing how we spend a lot of time talking about Ob and speculating about his strategy. Even though he's a prolific poster, his posts are often very brief. The numerous posts he makes keeps him uppermost in our minds, yet the relative lack of information in them creates a vacuum that we step in to attempt to fill. It approaches troll-like behavior, though I know that is not his intention - it is merely the end result of his lack of time to put detailed and thoughtful posts together, and his unwillingness to share too much information due to the belief that he will be overly criticized.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think it is indeed an experiment - but not one to determine whether an equities/bonds portfolio will rise and fall. He's experimenting to determine his comfort level with this type of volatility. ...

OK, I can see that (if it is actually the case). Sometimes you just need to get in the saddle to test your reaction.

It would have helped if the OP actually stated that. We aren't mind readers regarding his intent, or the days he purchased those funds.

-ERD50

In-control

Recycles dryer sheets

- Joined

- Mar 9, 2007

- Messages

- 319

Chill - this is a journey - not a weekend excursion

In 2008/09 when the financial picture for the US was dire people were panicking. I asked friends who were - do you believe that the US will collapse into chaos and be no more. They said no - Sounds like an opportunity then I said. They usually would walk away confused. I kept to my plan of investing into a balanced and Index funds( Wellesley, Fidelity Balanced Fund,VG Stk and BD index). I was rewarded nicely after 4 years. But their were times were most of my investments were in the red. I had faith that capitalism would prevail and it did.

This is why I had 5 yrs of living expenses in laddered CD's - to weather the storms and not fret the daily/monthly turmoil. I have a 40% Stk/50% Bds and 10% cash allocation. A week or so ago the S&P peaked and I reallocated because my Stk allocations were 42%. The next week the sell off began.

I try to focus more on the allocation % then the daily $ amount. Having the 5yrs of expenses stashed away helps me sleep and plan much more thoughtfully.

This is just my strategy, learned from so many others - i'm not suggesting that it would work for anyone else - just one example.

In 2008/09 when the financial picture for the US was dire people were panicking. I asked friends who were - do you believe that the US will collapse into chaos and be no more. They said no - Sounds like an opportunity then I said. They usually would walk away confused. I kept to my plan of investing into a balanced and Index funds( Wellesley, Fidelity Balanced Fund,VG Stk and BD index). I was rewarded nicely after 4 years. But their were times were most of my investments were in the red. I had faith that capitalism would prevail and it did.

This is why I had 5 yrs of living expenses in laddered CD's - to weather the storms and not fret the daily/monthly turmoil. I have a 40% Stk/50% Bds and 10% cash allocation. A week or so ago the S&P peaked and I reallocated because my Stk allocations were 42%. The next week the sell off began.

I try to focus more on the allocation % then the daily $ amount. Having the 5yrs of expenses stashed away helps me sleep and plan much more thoughtfully.

This is just my strategy, learned from so many others - i'm not suggesting that it would work for anyone else - just one example.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Regarding some of the earlier posts that called out 'criticism' or 'piling on' the OP - I searched for the earlier thread that the OP mentioned, and came across these comments to his own claims of 'criticism', that agree with my assessment:

-ERD50

My read of most of the threads you refer to, people are not critical of you for not taking more risk, they disagree with your way of assessing risk..... I was thinking of starting a new thread today about the losses in my bond funds over the last few weeks (since I bought them, in fact) and invite all those who have been critical of me for not taking more risks in the past to give their "expert advice"...

+1 - I couldn't have expressed it better myself.

....

-ERD50

- Status

- Not open for further replies.

Similar threads

- Replies

- 116

- Views

- 11K

- Replies

- 64

- Views

- 5K

- Replies

- 35

- Views

- 4K