I was referring to the underlying economic assumptions impacting long-term pension affordability, not those used for ongoing regulatory valuation of pension obligations. But my wording could have better. I'm quite sure the latter is flawless.

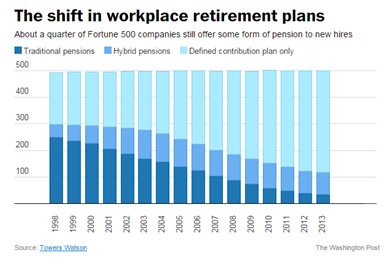

In any case, my main point about refocusing retention resources and changing compensation philosophy is something I don't see written about a lot in the context of the demise of traditional DB pensions. This is usually attributed to demographic shifts which adversely affect affordability. But it seems to me, if corporations wanted to preserve the compensation philosophy of pensions and their universal retention effect, yet make them more affordable, there's a path toward that end (increased retirement age, COL adjustments, etc). Not popular with employees, no doubt, but there's a path nonetheless.

But that's not the path chosen by most corporations. Perhaps Koolau is right and the employer/employee relationship had already transitioned to such a fluid state, that corporations were merely providing a more "portable" retirement option, which would be more suitable (and thus valuable) for such transient employees. Having been a quasi-insider into this dilemma for one specific Megacorp, I can tell you that was not the intent in our case. It was to remove a fixed and growing element of compensation expense that benefited all employees more-or-less equally, and instead redirect those dollars to the specific employees, which the company desperately wanted to retain for long-term competitiveness.