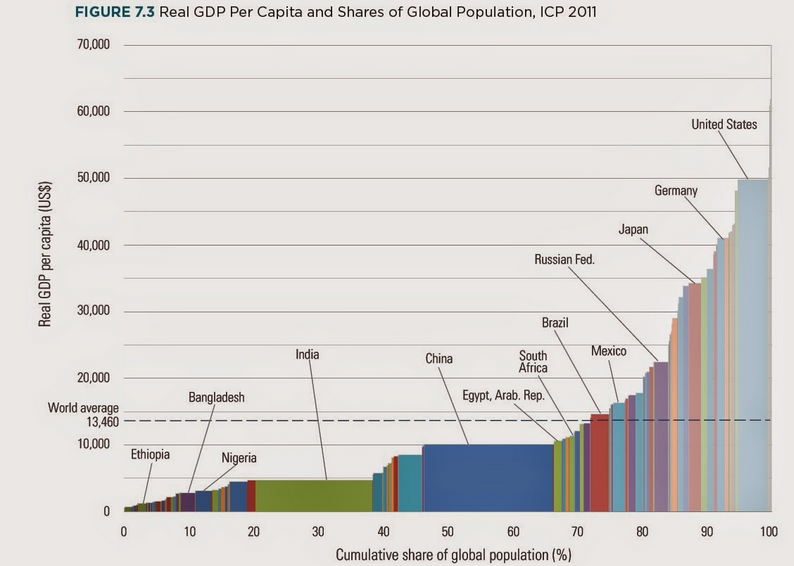

That is per capita... here is total.. China will pass us by in total sometime, but I do not think they will come close to per capita...

Also,

Gross domestic product 2013

(millions of

Ranking

Economy

US dollars)

1

United States

16,800,000

2

China

9,240,270

3

Japan

4,901,530

4

Germany

3,634,823

5

France

2,734,949

6

United Kingdom

2,522,261

7

Brazil

2,245,673

8

Russian Federation

2,096,777

9

Italy

2,071,307

10

India

1,876,797

11

Canada

1,825,096

12

Australia

1,560,597

13

Spain

1,358,263

14

Korea, Rep.

1,304,554

15

Mexico

1,260,915

16

Indonesia

868,346

17

Turkey

820,207

18

Netherlands

800,173

19

Saudi Arabia

745,273

20

Switzerland

650,782

21

Argentina

611,755

22

Sweden

557,938

23

Nigeria

522,638

24

Poland

517,543

25

Norway

512,580

California would rank 10th

Texas would rank 16th