|

|

09-09-2015, 10:06 AM

09-09-2015, 10:06 AM

|

#161

|

|

Moderator

Join Date: Oct 2010

Posts: 10,723

|

Quote: Quote:

Originally Posted by FIREd

I recently described my strategy here. |

That's a pretty logical approach....I like it. No need to "slam" anything, which might generate regrets. It's not greedy; trying to get the last dime is usually not profitable.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

September 1, 2015 Trigger Action, Finally

10-07-2015, 11:36 AM

10-07-2015, 11:36 AM

|

#162

|

|

Moderator

Join Date: Oct 2010

Posts: 10,723

|

September 1, 2015 Trigger Action, Finally

Quote: Quote:

Originally Posted by sengsational

If you look at the document in the original post, it gives an example of using PE 10 points of 24 and 15, with a trailing percent of 6. The procedure outlined was to check on the first of every month.

Well, we got past 24 back in November of 2013, and it ratcheted up, getting as high as 27 on February 1st 2015. So 94% of that is 25.38. September 1 is the first first of the month that it's below 25.36, so we have a trigger!

This is a very rare event, since there have been only 4 other sell triggers based on that outlined methodology since 1881.

|

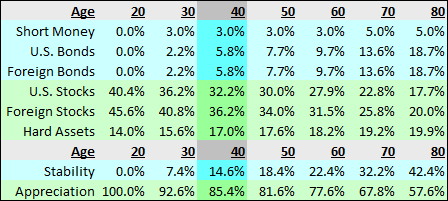

I didn't do it right away, but I finally took action yesterday: changed from and asset allocation designed for a 50 year old, to one designed for an 80 year old.

My plan is to stick with the 80 year old asset allocation unless and until the buy signal comes.

I probably would not have done this if I didn't have somewhere "good" to put the proceeds, but in my ex employer's 401k, there's a guaranteed income fund that's on target to exceed a 3.5% return this year.

I probably would not have done this if I hadn't just been reading Shiller's "Irrational Exuberance" book, where he makes note of quite a few very long periods in history where, after adjusting for inflation, the stock market return did not exceed long treasuries. He basically argues that when the CAPE is high, owners of the market are not being properly compensated for the level of risk that they are taking-on.

I expended a lot of mental energy on this, since it's been drilled into me that stocks are the best/only long-term bet that exceeds inflation. That, and also selling in a downdraft was like finger nails on a chalkboard to me. But that's my plan; shifting my AA based on this DMT methodology that has historically had one in the market about 82% of the time, and only has round-tripped 4 times in 134 years (the next buy signal will complete the 5th round trip).

Here's my spreadsheet. Not the most efficient construction of formulas, but you should be able to watch the trigger mechanism, experiment with values other than 24 and 15, etc.

https://drive.google.com/file/d/0B72...ew?usp=sharing

|

|

|

10-07-2015, 01:37 PM

10-07-2015, 01:37 PM

|

#163

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2005

Posts: 4,366

|

Too slow for me I think, but good luck!

|

|

|

10-07-2015, 03:45 PM

10-07-2015, 03:45 PM

|

#164

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by sengsational

Does changing your asset allocation very occasionally based on a measured parameter (and not on emotion) make one a DMT? I wouldn't think so.

|

Who cares? The same people who call you a DMT will be green with envy or crying sour grapes if the market tanks. It's your money to do as you wish.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

10-07-2015, 04:29 PM

10-07-2015, 04:29 PM

|

#165

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by NW-Bound

Who cares? The same people who call you a DMT will be green with envy or crying sour grapes if the market tanks. It's your money to do as you wish.

|

Right about that. In the end, nobody but us is responsible for our results. If we go with the consensus and it is wrong, we only have the compensation of plenty of company ... and that doesn't pay the bills.

|

|

|

10-07-2015, 04:46 PM

10-07-2015, 04:46 PM

|

#166

|

|

gone traveling

Join Date: Nov 2013

Location: Los Angeles

Posts: 202

|

"Market timing is impossible to perfect." -- Mark Rieppe

|

|

|

10-07-2015, 06:21 PM

10-07-2015, 06:21 PM

|

#167

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

This is the first time I heard of Mark Rieppe, but borrowing from the platitude I can make this generalization.

"Investing is impossible to perfect" -- NW-Bound

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

10-07-2015, 06:38 PM

10-07-2015, 06:38 PM

|

#168

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Quote: Quote:

Originally Posted by sengsational

I didn't do it right away, but I finally took action yesterday: changed from and asset allocation designed for a 50 year old, to one designed for an 80 year old.

My plan is to stick with the 80 year old asset allocation unless and until the buy signal comes.

I probably would not have done this if I didn't have somewhere "good" to put the proceeds, but in my ex employer's 401k, there's a guaranteed income fund that's on target to exceed a 3.5% return this year.

I probably would not have done this if I hadn't just been reading Shiller's "Irrational Exuberance" book, where he makes note of quite a few very long periods in history where, after adjusting for inflation, the stock market return did not exceed long treasuries. He basically argues that when the CAPE is high, owners of the market are not being properly compensated for the level of risk that they are taking-on.

I expended a lot of mental energy on this, since it's been drilled into me that stocks are the best/only long-term bet that exceeds inflation. That, and also selling in a downdraft was like finger nails on a chalkboard to me. But that's my plan; shifting my AA based on this DMT methodology that has historically had one in the market about 82% of the time, and only has round-tripped 4 times in 134 years (the next buy signal will complete the 5th round trip).

Here's my spreadsheet. Not the most efficient construction of formulas, but you should be able to watch the trigger mechanism, experiment with values other than 24 and 15, etc.

https://drive.google.com/file/d/0B72...ew?usp=sharing |

Is an 80 year old allocation 20% equities, or more?

__________________

Retired since summer 1999.

|

|

|

10-07-2015, 07:03 PM

10-07-2015, 07:03 PM

|

#169

|

|

gone traveling

Join Date: Nov 2013

Location: Los Angeles

Posts: 202

|

Quote: Quote:

Originally Posted by ETFs_Rule

"Market timing is impossible to perfect." -- Mark Rieppe

|

Mark Riepe | About Schwab

|

|

|

10-08-2015, 06:21 AM

10-08-2015, 06:21 AM

|

#170

|

|

Moderator

Join Date: Oct 2010

Posts: 10,723

|

Quote: Quote:

Originally Posted by audreyh1

Is an 80 year old allocation 20% equities, or more?

|

The appreciation category goes from about 82% to 58% in the full-on age 50 to 80 change. So some would say this is pretty aggressive to start with. I only did the US stocks right now, so I've got a bit of a hybrid going on. But my change decreased US stock by 40% and increased "U.S. Bonds" (where I'm substituting guaranteed income) a bunch.

|

|

|

10-08-2015, 07:10 AM

10-08-2015, 07:10 AM

|

#171

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Wow - so you reduced equities to 58%? Well, I guess 20% of that would be "hard assets" - whatever you are using for that. So maybe it's 38% equities.

Yeah - that's more aggressive than me at 53% equities. And I have a higher fixed income than the "80" column too.

__________________

Retired since summer 1999.

|

|

|

10-08-2015, 07:22 AM

10-08-2015, 07:22 AM

|

#172

|

|

Moderator

Join Date: Oct 2010

Posts: 10,723

|

Hard assets include real estate, precious metals, and REITs, so you could take at least some of the 20% away from the 58%.

Everything seems to travel in the same direction lately but, these hard assets, not quite lock-step with equities (I hope).

|

|

|

10-08-2015, 09:36 AM

10-08-2015, 09:36 AM

|

#173

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

I count REITs as stocks. They do seem to zig and zag differently than the other equities at least half the time. Precious metals - it really depends on how you invest. A lot of funds/ETFs buy stocks as a proxy. I don't invest in this area, so not clear.

__________________

Retired since summer 1999.

|

|

|

10-08-2015, 11:53 AM

10-08-2015, 11:53 AM

|

#174

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Does your house count as your real estate? Last I looked, VG small value had a lot of REITs.

|

|

|

Using Shiller PE to Time the Market

10-08-2015, 02:34 PM

10-08-2015, 02:34 PM

|

#175

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,720

|

Using Shiller PE to Time the Market

Quote: Quote:

Originally Posted by sengsational

Hard assets include real estate, precious metals, and REITs, so you could take at least some of the 20% away from the 58%.

Everything seems to travel in the same direction lately but, these hard assets, not quite lock-step with equities (I hope).

|

You're shaping up like an endowment manager. David Swensen.

How about alternative investments? I'm using BX as a proxy for that.

|

|

|

10-09-2015, 04:45 AM

10-09-2015, 04:45 AM

|

#176

|

|

Moderator

Join Date: Oct 2010

Posts: 10,723

|

Quote: Quote:

Originally Posted by target2019

You're shaping up like an endowment manager. David Swensen.

|

Just riding on MPT.

Quote: Quote:

Originally Posted by target2019

How about alternative investments? I'm using BX as a proxy for that.

|

I'd do the magic formula investing myself over BX. Maybe some day when I get bored.

|

|

|

10-09-2015, 08:22 AM

10-09-2015, 08:22 AM

|

#177

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,720

|

Quote: Quote:

Originally Posted by sengsational

Just riding on MPT.I'd do the magic formula investing myself over BX. Maybe some day when I get bored.

|

Thanks for posting the spreadsheet.

A minor addition that would improve your tool would be to add a simple explanation with each column for descriptive purpose.

Glad I picked up on this conversation.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|