|

|

08-11-2014, 05:23 PM

08-11-2014, 05:23 PM

|

#41

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,021

|

Quote: Quote:

Originally Posted by dallas27

Taking it further, i ask myself is firecalc even valid since it focuses on us data only, the most successful country in the last century. Theres no reason to assume the USA will be the most successful in the future, or that the average of global stocks will match what the US did the last hundred.

People will scoff at that. Doesn't make it wrong, or right.

|

Doesn't matter. There's an asteroid out there with our name on it...

__________________

Numbers is hard

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

08-11-2014, 06:46 PM

08-11-2014, 06:46 PM

|

#42

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2014

Posts: 1,069

|

Quote: Quote:

Originally Posted by REWahoo

Doesn't matter. There's an asteroid out there with our name on it...

|

I don't think thats exactly the same thing, not even probabilistically.

Sent from my iPhone using Early Retirement Forum

|

|

|

08-11-2014, 06:54 PM

08-11-2014, 06:54 PM

|

#43

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,021

|

Quote: Quote:

Originally Posted by dallas27

I don't think thats exactly the same thing, not even probabilistically.

|

You absolutely certain of that?

__________________

Numbers is hard

|

|

|

08-11-2014, 08:51 PM

08-11-2014, 08:51 PM

|

#44

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2005

Posts: 17,241

|

Quote: Quote:

Originally Posted by dallas27

Taking it further, i ask myself is firecalc even valid since it focuses on us data only, the most successful country in the last century. Theres no reason to assume the USA will be the most successful in the future, or that the average of global stocks will match what the US did the last hundred.

People will scoff at that. Doesn't make it wrong, or right.

Sent from my iPhone using Early Retirement Forum

|

The US might not be the most successful country if measured by stock returns... but I think that it will be a huge force in the world economy as long as you and I are alive....

We are so much larger than a lot of other countries... it would take many many years of decline on our part added to unbelievable gains on theirs... this might happen over a couple of hundred years.... but not the next 30 to 50...

Of course an asteroid can come crashing down in the middle of the country and speed up the decline... but I am not going to worry about that one...

|

|

|

08-11-2014, 09:10 PM

08-11-2014, 09:10 PM

|

#45

|

|

Thinks s/he gets paid by the post

Join Date: May 2007

Posts: 1,525

|

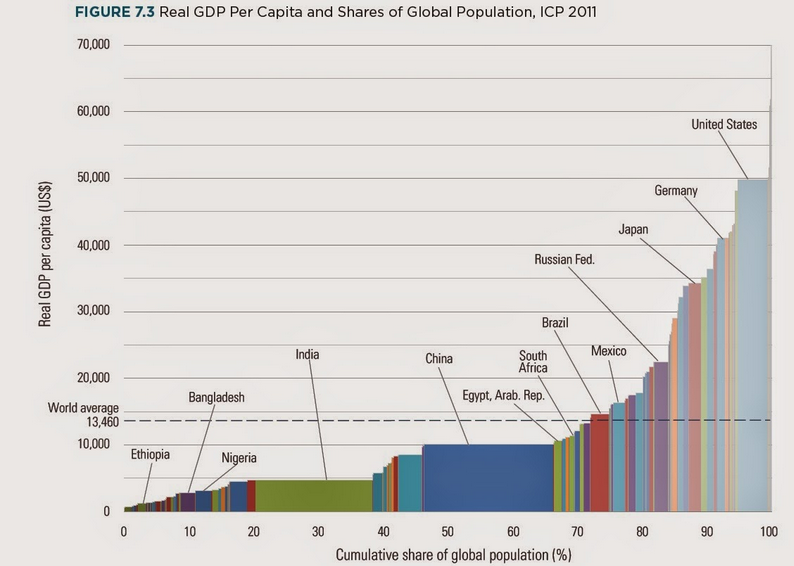

Here's an interesting chart on the US economy relative to other countries. The total area for each slice represents the country's GDP. The U.S. is indeed the world's largest economy on both an aggregate and per capita basis, with China following as second largest in aggregate.

Hard to say if it proves or disproves Texas Proud's hypothesis...

The World Bank summed up the entire global economy in one chart - Vox

__________________

No doubt a continuous prosperity, though spendthrift, is preferable to an economy thriftily moral, though lean. Nevertheless, that prosperity would seem more soundly shored if, by a saving grace, more of us had the grace to save.

Life Magazine editorial, 1956

|

|

|

08-11-2014, 09:35 PM

08-11-2014, 09:35 PM

|

#46

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2005

Posts: 17,241

|

That is per capita... here is total.. China will pass us by in total sometime, but I do not think they will come close to per capita...

Also,

Gross domestic product 2013

(millions of

Ranking

Economy

US dollars)

1

United States

16,800,000

2

China

9,240,270

3

Japan

4,901,530

4

Germany

3,634,823

5

France

2,734,949

6

United Kingdom

2,522,261

7

Brazil

2,245,673

8

Russian Federation

2,096,777

9

Italy

2,071,307

10

India

1,876,797

11

Canada

1,825,096

12

Australia

1,560,597

13

Spain

1,358,263

14

Korea, Rep.

1,304,554

15

Mexico

1,260,915

16

Indonesia

868,346

17

Turkey

820,207

18

Netherlands

800,173

19

Saudi Arabia

745,273

20

Switzerland

650,782

21

Argentina

611,755

22

Sweden

557,938

23

Nigeria

522,638

24

Poland

517,543

25

Norway

512,580

California would rank 10th

Texas would rank 16th

|

|

|

08-11-2014, 11:09 PM

08-11-2014, 11:09 PM

|

#47

|

|

Full time employment: Posting here.

Join Date: Dec 2013

Location: San Diego

Posts: 880

|

A couple of books I have read recently which get to the heart of the question of the American decline, "The Upside of Down" Charles Kenny talks about why the rise of the rest of the world does not equate to any required fall in the growth or standard of living in t he U.S. As an example look at the standard of living for the masses in the U.K. now vs. when they were masters of the world.

Another is Kurtzman's "Unleashing the Second American Century." His four points of why America will likely remain on top: 1) Soaring levels of creativity, 2) Massive new energy reserves, 3) Gigantic amounts of capital, 4) Unrivaled manufacturing depth.

Lots more in both of those books, good reads that I would recommend.

Since the beginning of the republic there have been predictions of America's eminent decline. My bet is that there is still a lot of life left in the old gal, it is not even certain that we have seen the best yet. And given the degree of risk in investing elsewhere, investing in the U.S. still seems to be a pretty good bet to me.

And as Texas Proud points out, worst case, our size and inertia should keep things going for the next few decades at least.

__________________

Merrily, merrily, merrily, merrily,

Life is but a dream.

|

|

|

08-12-2014, 05:46 PM

08-12-2014, 05:46 PM

|

#48

|

|

Recycles dryer sheets

Join Date: Apr 2008

Posts: 223

|

I would use the PE10 to decide where in the world to invest, as a comparison, but there is not accurate publicly available data on companies outside the US, thus making it very difficult to come up with PE10 numbers. Even if you look at websites like Yahoo and Morningstar, you get different numbers when look at such data on different countries. Plus there is some strange calculations by some data providers in which negative earnings are treated as positive earnings, which really skews the results.

|

|

|

08-12-2014, 07:53 PM

08-12-2014, 07:53 PM

|

#49

|

|

Confused about dryer sheets

Join Date: Jul 2014

Location: jersey city

Posts: 4

|

For your reference, CAPE Ratio this website provides shiller PE for individual US stocks and the newsletter gives list of best 25 stocks, as in with the lowest Shiller PE.

|

|

|

08-22-2014, 12:19 PM

08-22-2014, 12:19 PM

|

#50

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,720

|

I meant to post this link earlier. It lists CAPE for various countries. Food for thought, I suppose.

http://www.starcapital.de/research/stockmarketvaluation

|

|

|

08-22-2014, 01:13 PM

08-22-2014, 01:13 PM

|

#51

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2014

Posts: 1,069

|

Does the cape ratio hold water in non-us markets?

Sent from my iPhone using Early Retirement Forum

|

|

|

08-22-2014, 02:55 PM

08-22-2014, 02:55 PM

|

#52

|

|

Moderator

Join Date: Oct 2010

Posts: 10,723

|

Quote: Quote:

Originally Posted by target2019

|

Excellent addition to the non-US angle in this thread. Thanks!

|

|

|

08-23-2014, 08:02 AM

08-23-2014, 08:02 AM

|

#53

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2005

Posts: 17,241

|

I think that the biggest problem I have with this method is that it is using the last 10 years of profits to 'predict' the next 10 or more... I just do not see how they are correlated....

Using the work CAPE ratio.... the best country to invest in now is Russia.... how many people are going to take THAT advice

Edit... opps... missed Greece which has the lowest number... but still same question

|

|

|

08-23-2014, 08:29 AM

08-23-2014, 08:29 AM

|

#54

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2014

Posts: 1,069

|

Quote: Quote:

Originally Posted by Texas Proud

I think that the biggest problem I have with this method is that it is using the last 10 years of profits to 'predict' the next 10 or more... I just do not see how they are correlated....

Using the work CAPE ratio.... the best country to invest in now is Russia.... how many people are going to take THAT advice

Edit... opps... missed Greece which has the lowest number... but still same question |

Greece, (and italy) have terrible markets right now. I would absolutely invest in them. I am exposed through broad ETF's already, but I would place a extra bet if the right, low cost ETF were available. High unemployment, many friends in the EU, and access the Med see and EU markets. Rebound is inevitable.

Russia is a different story, as you have a political uncertainty that is highly volatile and makes a long term bet much more risky than greece. That said, I am exposed to russia as well.

|

|

|

08-23-2014, 08:52 AM

08-23-2014, 08:52 AM

|

#55

|

|

Full time employment: Posting here.

Join Date: Jan 2013

Posts: 681

|

Quote: Quote:

Originally Posted by target2019

I meant to post this link earlier. It lists CAPE for various countries. Food for thought, I suppose.

|

Thanks for the link. I have seen similar country by country comparisons before. They were one of the factors that convinced me to increase my international exposure, especially to emerging markets, earlier this year. It's not at all clear that this is the right move, but it's my attempt to find relative bargains at a time when there are so many warnings about extremely high prices in both U.S. equity and bond markets.

|

|

|

08-23-2014, 04:33 PM

08-23-2014, 04:33 PM

|

#56

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,720

|

If you look at CAPE for foreign markets, or even PE, keep in mind the wide disparity in how companies report earnings.

|

|

|

08-23-2014, 07:55 PM

08-23-2014, 07:55 PM

|

#57

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by target2019

If you look at CAPE for foreign markets, or even PE, keep in mind the wide disparity in how companies report earnings.

|

Right! Single data points in time are not enough. What about country inflation? Unemployment? Relative interest rates, etc.

|

|

|

08-23-2014, 08:55 PM

08-23-2014, 08:55 PM

|

#58

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2012

Posts: 1,570

|

https://www.gmo.com/America/CMSAttac...8UAGtIt6BuU%3d

Above is a Feb 2014 article from GMO, basically concluding that CAPE has been a way to determine valuations, and that the US markets are in overvalued territory, European and especially Emerging offer better value.

While CAPE doesn't predict what the market will do in the near term, it has had a pretty good record at helping figure out the probabilities of what my biggest concern is at this point in my life, suffering a significant "drawdown". Low CAPE, very low chance of a big decline, high CAPE...

Sent from my iPad using Early Retirement Forum

__________________

You know that suit they burying you in? Thar ainít no pockets in that suit, boy.

|

|

|

08-25-2014, 04:44 AM

08-25-2014, 04:44 AM

|

#59

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,720

|

Quote: Quote:

Originally Posted by gcgang

https://www.gmo.com/America/CMSAttac...8UAGtIt6BuU%3d

Above is a Feb 2014 article from GMO, basically concluding that CAPE has been a way to determine valuations, and that the US markets are in overvalued territory, European and especially Emerging offer better value.

While CAPE doesn't predict what the market will do in the near term, it has had a pretty good record at helping figure out the probabilities of what my biggest concern is at this point in my life, suffering a significant "drawdown". Low CAPE, very low chance of a big decline, high CAPE...

Sent from my iPad using Early Retirement Forum

|

Is that the article, "A CAPE Crusader?"

|

|

|

Using Shiller PE to Time the Market

08-25-2014, 01:35 PM

08-25-2014, 01:35 PM

|

#60

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2012

Posts: 1,570

|

Using Shiller PE to Time the Market

Yes, that's the title, A Cape Crusader a Defence Against the Dark Arts.

Sent from my iPad using Early Retirement Forum

__________________

You know that suit they burying you in? Thar ainít no pockets in that suit, boy.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|