Ed_The_Gypsy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have always been a big fan of John Greaney's work. He got me started.

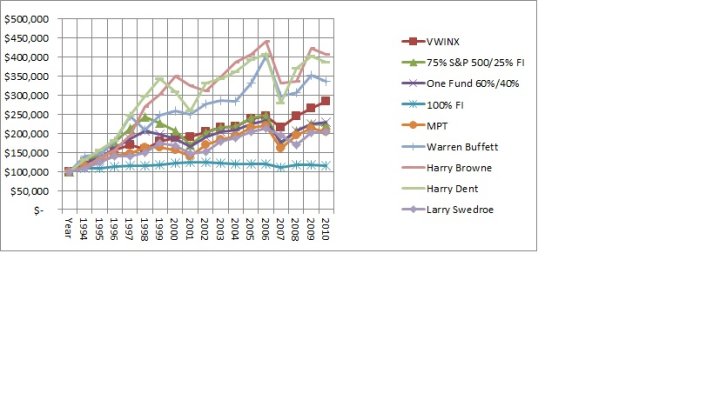

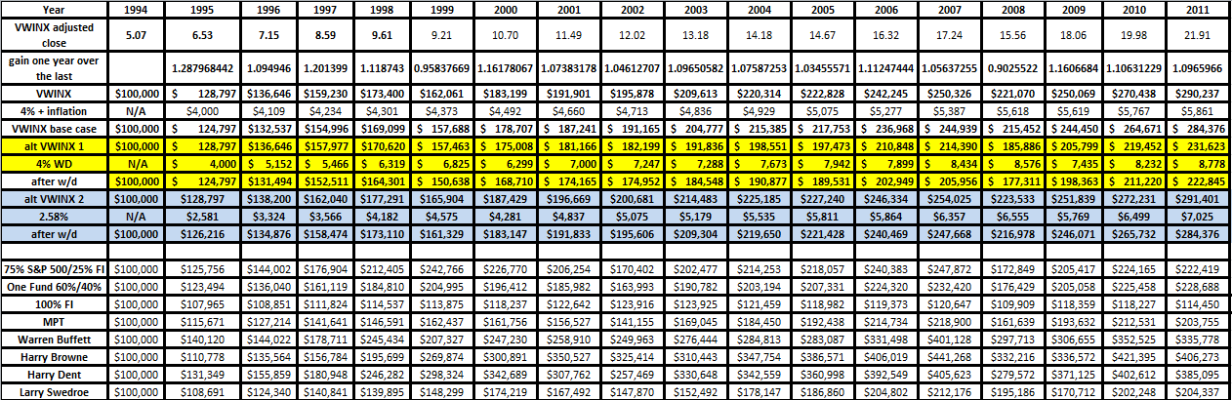

In 2011 Update: Real-Life Retiree Investment Returns he compares several investment strategies using the classic 4% of original pot withdrawal, adjusted annually for inflation from end-of-year 1994 (when John FIREd) and end-of-year 2011.

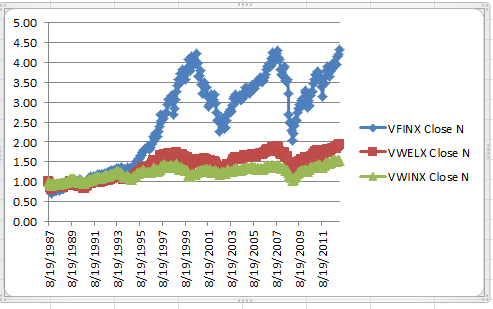

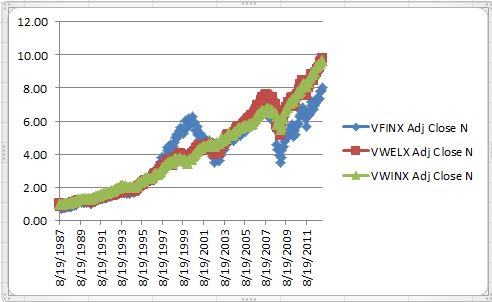

Out of curiosity, I compared Wellesley on the same basis using his data. VWINX did very well, with less volatility as well (makes it easier to sleep at night). I also calculated taking a straight 4% of the VWINX portfolio very year. The payouts were higher (+25% to +56%) as the growth exceeds 4% + inflation and the final balance in 2011 was a little less (~ $223,000 vs. ~ $284,000), as you would expect. I tried this because it would be easier than figuring out what inflation was every year.

It outperformed all but three "concentrated portfolios" (Warren Buffett, Harry Brown and Harry Dent--see link for details). Greaney considers these risky.

[FONT="]Continuing to fiddle, a straight 2.58% resulted in the same end amount in the pot in Dec 2011 as the 4% + inflation. The annual withdrawal size ranged from -35% to + 20% of the steady 4% + inflation withdrawal.

Note that John Greaney and Warren Buffett both made their big money on good stock picks but both recommend only index funds for us unwashed masses.

Bottom line: I am comfortable with my instructions to DW to sell everything and buy VWINX after I croak. She can take 4% per year. Now if I can only do as well as VWINX in the accumulation phase.

[/FONT]

In 2011 Update: Real-Life Retiree Investment Returns he compares several investment strategies using the classic 4% of original pot withdrawal, adjusted annually for inflation from end-of-year 1994 (when John FIREd) and end-of-year 2011.

Out of curiosity, I compared Wellesley on the same basis using his data. VWINX did very well, with less volatility as well (makes it easier to sleep at night). I also calculated taking a straight 4% of the VWINX portfolio very year. The payouts were higher (+25% to +56%) as the growth exceeds 4% + inflation and the final balance in 2011 was a little less (~ $223,000 vs. ~ $284,000), as you would expect. I tried this because it would be easier than figuring out what inflation was every year.

It outperformed all but three "concentrated portfolios" (Warren Buffett, Harry Brown and Harry Dent--see link for details). Greaney considers these risky.

[FONT="]Continuing to fiddle, a straight 2.58% resulted in the same end amount in the pot in Dec 2011 as the 4% + inflation. The annual withdrawal size ranged from -35% to + 20% of the steady 4% + inflation withdrawal.

Note that John Greaney and Warren Buffett both made their big money on good stock picks but both recommend only index funds for us unwashed masses.

Bottom line: I am comfortable with my instructions to DW to sell everything and buy VWINX after I croak. She can take 4% per year. Now if I can only do as well as VWINX in the accumulation phase.

[/FONT]

Attachments

Last edited by a moderator:

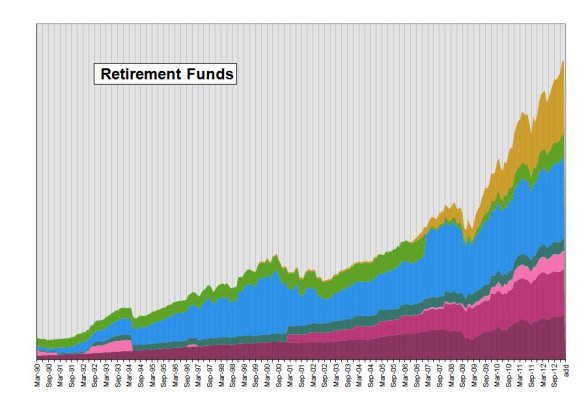

I didn't think of that since both obgyn and I are still in accumulation phase.

I didn't think of that since both obgyn and I are still in accumulation phase.