REWahoo

Give me a museum and I'll fill it. (Picasso) Give

You work?

Argumentative. I'm not going there.

You work?

What does that have to do with kittens?Argumentative. I'm not going there.

I have one, too. I use it to watch kitten videos and argue with strangers on the internet.

What does that have to do with kittens?

Logic aside, there must be some reason why today's millennial crop of workers are fiercely wedded to the belief that their parents and grandparents had it better than they do.

My "company"'s internal social media, where many highly-educated young workers hang out, makes this clear. They moan and groan about student loans, which they're looking for somebody to take off their backs, and cite Internet memes such as "Old Economy Steve" (who is roughly my age, apparently, yet lived in a world I don't recognize) to support their fetish.

They may have it "worse" in some ways, but I doubt anybody my age would hesitate to change places with them. Just sayin'.

Amethyst

And you're questioning the subject by avoiding the change. So trying.Sigh. Trying to avoid the question by changing the subject. Typical.

And you're questioning the subject by avoiding the change. So trying.

Logic aside, there must be some reason why today's millennial crop of workers are fiercely wedded to the belief that their parents and grandparents had it better than they do.

My "company"'s internal social media, where many highly-educated young workers hang out, makes this clear. They moan and groan about student loans, which they're looking for somebody to take off their backs, and cite Internet memes such as "Old Economy Steve" (who is roughly my age, apparently, yet lived in a world I don't recognize) to support their fetish.

They may have it "worse" in some ways, but I doubt anybody my age would hesitate to change places with them. Just sayin'.

Amethyst

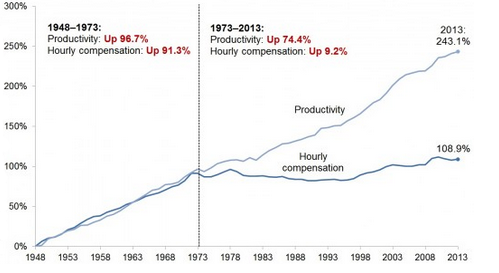

I agree with the letter generally, but Buffett seems to understate the root problem that is causing so much anger and angst. The link between productivity growth and wage growth has been broken for a very long time.

So, yes, even at 2% growth the nation as a whole will be much richer in the future. But we can't assume based on the past 40 years of experience that most folks will be happy with that outcome if we don't also find a way to fix the above chart.

Your avatar is dumb and you misspelled a word.This is useless. I'm going to quit now and let you have the last word, knowing it will be misinformed, incorrect and off topic - again.

So whats the implication of that chart which one should walk away with? The break was due to the gold standard and fiat currency?

Sent from my iPhone using Early Retirement Forum

So whats the implication of that chart which one should walk away with? The break was due to the gold standard and fiat currency?

that 34.4% gain will produce a staggering $19,000 increase in real GDP per capita for the next generation. Were that to be distributed equally, the gain would be $76,000 annually for a family of four. Today’s politicians need not shed tears for tomorrow’s children.

Those wage earners would do well to find a way to benefit from that productivity growth as a way of hedging their bets if real wage growth stays flat and GDP continues to grow at a (relatively) quicker rate than wages. That's not happening much right now (and hasn't in a while) if the US savings rate is any indication. Can young workers save, or are their incomes just too low for that? Are they "poor" in an absolute sense, or a relative sense? If they compare their incomes to that of their parents (after their 30+ years in the workforce) they likely feel poor. One thing's for sure--if they save at the rates their parents did (on average), their future may be one of reduced prosperity.What's left unsaid in the quote is that the 1.2% of "something else" comes from productivity gains.

The chart shows that those productivity gains have not translated into higher wages for the past 40 years.

So unless we think that's going to change going forward, it's not clear how Buffet's caveat in bold below doesn't present a major obstacle to his thesis.

One thing's for sure--if they save at the rates their parents did (on average), their future may be one of reduced prosperity.

The babies being born in America today are the luckiest crop in history.

Right. I'm not defending Buffet's position, I disagree with significant parts of his assessment. And I think maybe the purpose of his letter is to "influence rather than inform." He's not a disinterested bystander in our nation's larger public debates at this busy time of public reflection and "deciding."Isn't that conceding the entire point? How can both that, and this be true?

I started high school?I'm sorry, but it is an intriguing chart, and has a obvious inflection point at 1973. How we can discuss it without singling out the event that caused it is just not possible for me. Inquiring minds want to know.

I think Mr Buffet's point is that the standard of living will continue to rise and our children will enjoy and benefit from that.