Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

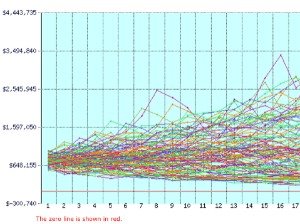

As (most) everyone here already knows - don't throw up your hands, but know that no plan provides any guarantees (that none of us can predict the future is but one of the reasons why). Just use FIRECALC or something like it with default returns and inflation to see what all the possible outcomes and success rates with every sequence of returns since 1871 have been, and hope that covers it. Monitor your progress throughout retirement, and have a plan B/C/D in case it doesn't...life is uncertain, always has been/always will be.

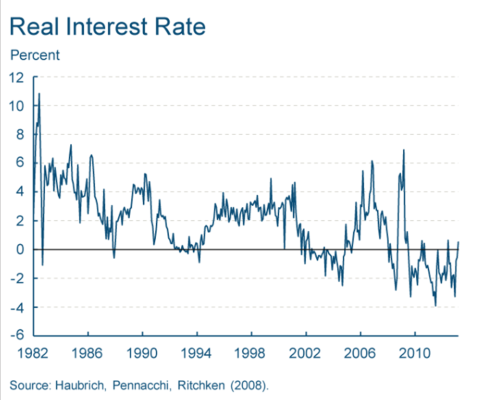

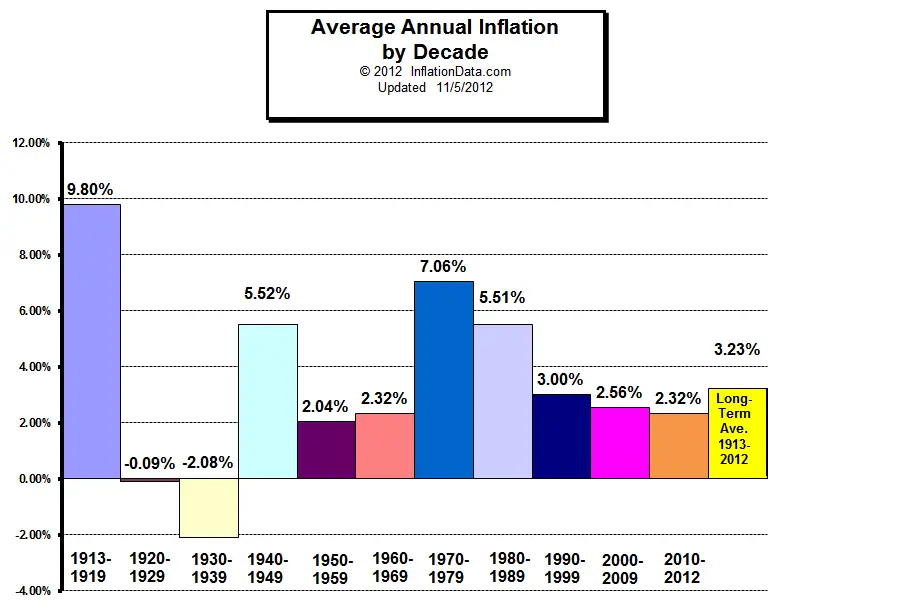

And if you want to play with real returns, duration, etc. from there to see how those inputs play out in comparison, might be instructive. YMMV

The possible outcomes in the future are probably at least as broad as the past...

And if you want to play with real returns, duration, etc. from there to see how those inputs play out in comparison, might be instructive. YMMV

The possible outcomes in the future are probably at least as broad as the past...

Attachments

Last edited: