easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,151

USA Today article:

How much risk can you handle during volatile markets?

IMO, Bring it on

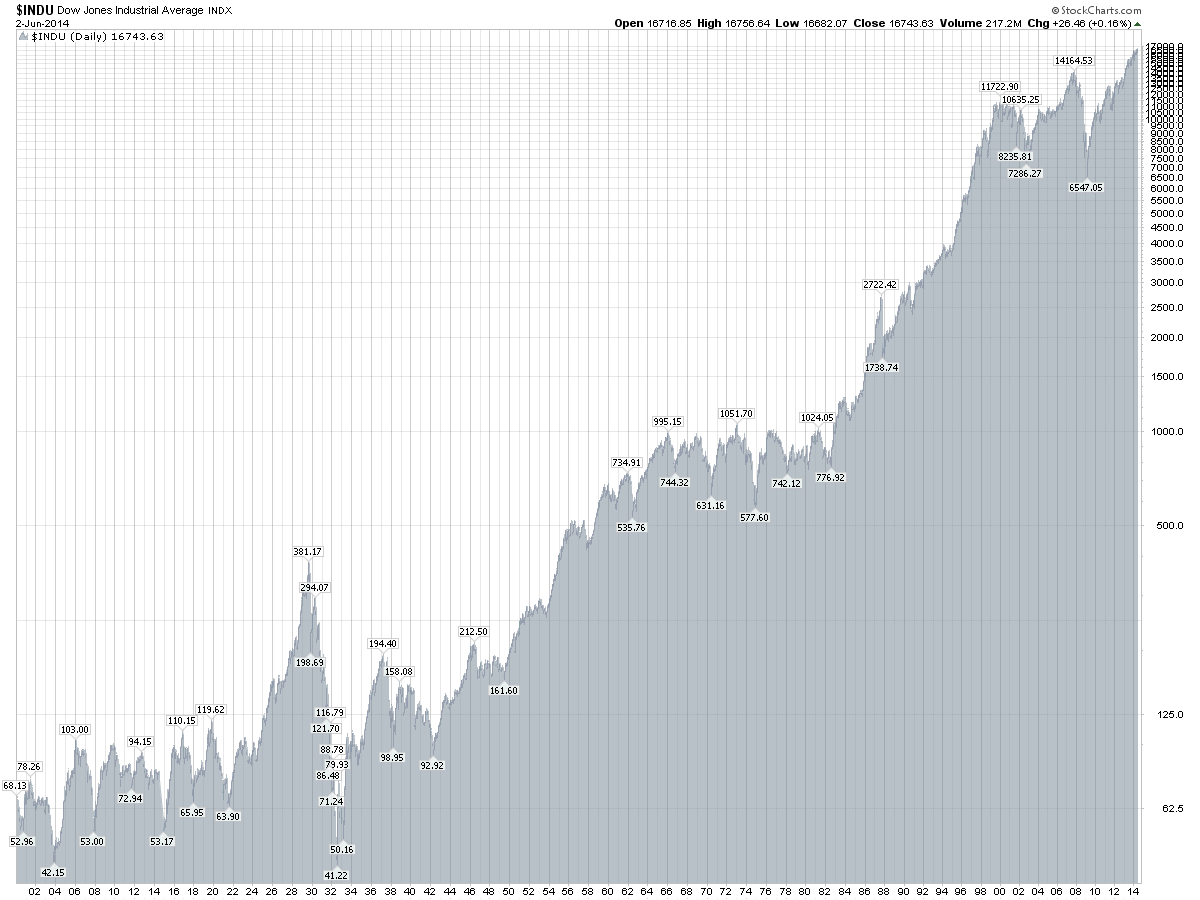

The wild movements recently are nothing compared to the meltdown of 2008.

How much risk can you handle during volatile markets?

IMO, Bring it on

The wild movements recently are nothing compared to the meltdown of 2008.