Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This was a very good read IMO, provided by daylatedollarshort, that I thought deserved a thread of it's own (we'll see).

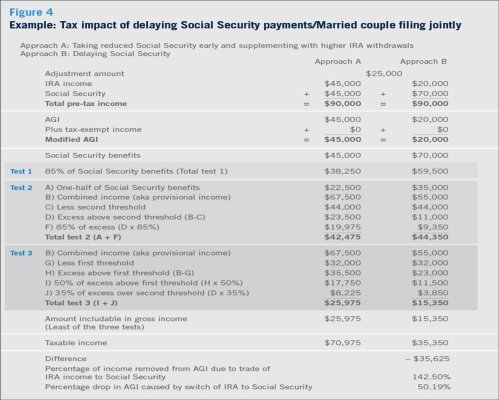

Just a piece of the whole retirement income enchilada, but a worthwhile piece (that may be overlooked). I am still trying to get my head around optimizing taxes long term re: Roth conversion, excess RMD, managing capital gains, projecting dividends/STCG, taxable withdrawals, real returns, when to take Soc Sec (considering taxes), etc.

The attached 3-pg pdf excerpt is what some have called the (Soc Sec) "tax torpedo." The advantage for many of taking Soc Sec at age 70 may not be as simple as total projected benefit before taxes.

Here's the whole 18-pg paper FWIW http://research.prudential.com/documents/rp/InnovativeSocialSecurityNov2012.pdf

Just a piece of the whole retirement income enchilada, but a worthwhile piece (that may be overlooked). I am still trying to get my head around optimizing taxes long term re: Roth conversion, excess RMD, managing capital gains, projecting dividends/STCG, taxable withdrawals, real returns, when to take Soc Sec (considering taxes), etc.

The attached 3-pg pdf excerpt is what some have called the (Soc Sec) "tax torpedo." The advantage for many of taking Soc Sec at age 70 may not be as simple as total projected benefit before taxes.

Here's the whole 18-pg paper FWIW http://research.prudential.com/documents/rp/InnovativeSocialSecurityNov2012.pdf

Attachments

Last edited: