Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

With all the understandable angst about no good choices for fixed income or cash, despite lots of bits and pieces of info, I wonder what our non-equity portfolios all look like - percentages in various bond, funds, cash, etc.?

In case someone wonders, I wouldn't think annuities, real estate, Soc Sec or pensions should be included, but to each his/her own.

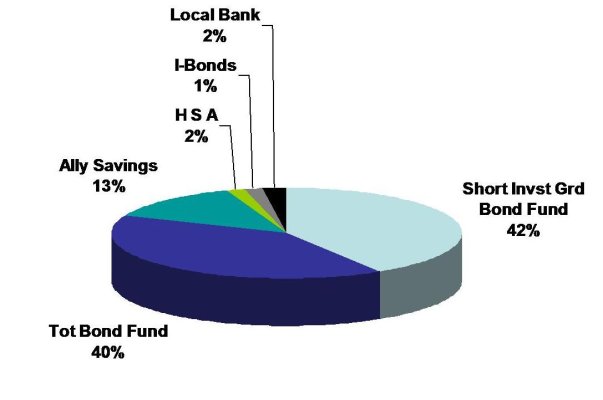

I don't recommend what we're currently holding (below), there will be some substantial changes this month.

Of course only if you're comfortable sharing your percentages...might be interesting.

In case someone wonders, I wouldn't think annuities, real estate, Soc Sec or pensions should be included, but to each his/her own.

I don't recommend what we're currently holding (below), there will be some substantial changes this month.

Of course only if you're comfortable sharing your percentages...might be interesting.

Attachments

Last edited: