Orchidflower

Thinks s/he gets paid by the post

- Joined

- Mar 10, 2007

- Messages

- 3,323

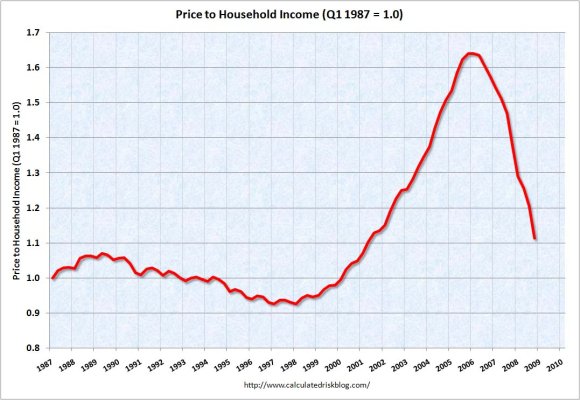

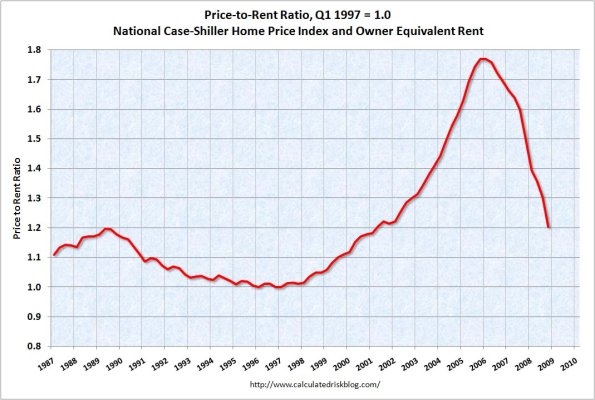

In case some of you don't use MarketWatch daily and might miss this, I felt many would possibly like to see when the homes in your State will rebound.

Don't open this link unless you are prepared for some not so pleasant news :

:

Home prices won't regain peak this decade: Moody's - MarketWatch

That map is pretty discouraging.....

Don't open this link unless you are prepared for some not so pleasant news

:

:Home prices won't regain peak this decade: Moody's - MarketWatch

That map is pretty discouraging.....