Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

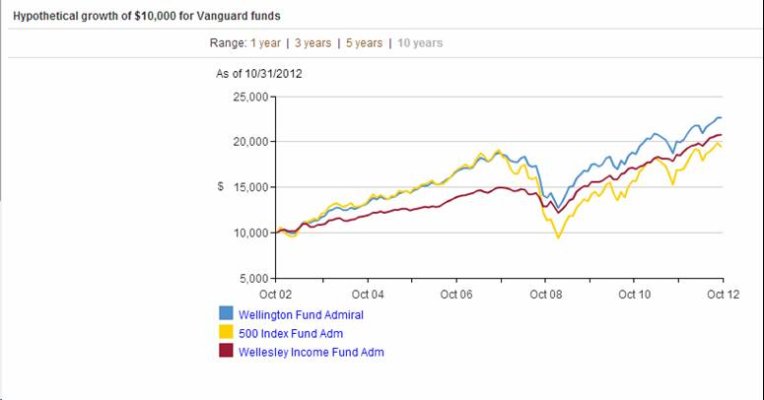

Yes I realize they're different AA's and I'm not suggesting one is preferable over the other. But they appear to have similar investment philosophies, so I'm surprised I've never heard Pssst...Wellington. Surely some here have target AA's closer to Wellington than Wellesley, and less interest in dividend/income?

Last edited:

)

)