|

|

08-04-2012, 11:17 AM

08-04-2012, 11:17 AM

|

#21

|

|

Moderator Emeritus

Join Date: Jan 2007

Location: New Orleans

Posts: 47,501

|

Quote: Quote:

Originally Posted by Live And Learn

W2R - I'm going to go back to the threads where you talked about your home expenses. I'd love to figure out how to trim that bill.

|

I updated my post in this thread, above, with my monthly expenses so far this year. Since some expenses aren't monthly (like property tax, insurance, etc), I added in the yearly amount divided by 12. Hope this helps!

But remember, there is only ONE of me, not two, and I suspect that the old maxim "two can live as cheaply as one" might be misleading/untrue.

__________________

Already we are boldly launched upon the deep; but soon we shall be lost in its unshored, harbourless immensities. - - H. Melville, 1851.

Happily retired since 2009, at age 61. Best years of my life by far!

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

08-04-2012, 11:18 AM

08-04-2012, 11:18 AM

|

#22

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2005

Location: Chicago

Posts: 13,186

|

Quote: Quote:

Originally Posted by Live And Learn

My budget is $84k and I think its pretty bare bones.

|

I do too. Considering you're calling out $12k of taxes on div and int, leaving you with $72k of actual "spending," I don't see any inappropriate indulgences or waste. As long as you can afford what you're spending and your allocation among the various categories maximizes your enjoyment of life, go for it!

Quote: Quote:

I could probably take 10k out of this budget (dog 2k, vacation 3k, boat 1k, cellphones 1k, entertainment 1k, pocket money 2k) but thats all I see.

|

Why are you looking at taking these things out of the budget? Are you having a problem meeting your current budget with these expenses included? You don't feel they are a good value?

Quote: Quote: Absolutely nothing that I can see. Assuming there is nothing you can do about the high HI costs and you can afford this spending level, have a nice time and enjoy yourself.

Always remember that everyday you spend time as well as money. You will run out of time whether you max the enjoyment of how you've spent it or not. I'd worry more about spending your time than spending your money. (I understand there is an interconnection between those things........ You have to sort them out yourself.)

__________________

"I wasn't born blue blood. I was born blue-collar." John Wort Hannam

|

|

|

08-04-2012, 11:21 AM

08-04-2012, 11:21 AM

|

#23

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2012

Location: Tampa Bay Area

Posts: 1,866

|

Quote: Quote:

Originally Posted by Moemg

At first glance I thought the electric and insurance were high so I checked your location .I also live in Florida and my electric bill is the same as yours but my house is twice the size . My insurance including flood comes out to be almost the same but my house is larger and sits on Sarasota Bay so I would look into those two items .The rest of the budget looks fine .If you really needed to save more you could cut the vacations to less and trim some other items.Lots of the forum members live in low cost areas and practice extreme LBYM's .

|

I'd like to ask more about your electric bill and homeowners insurance. I have my A/C set really low (75) so I know I could up it and save money. Is your house rather new with much better insulation perhaps ? My homeowners deductable is $1k (and 3% of home value for wind damage) and I also have flood insurance ($350 / yr). Maybe I've overinsured the contents ?

__________________

"For the time being no discipline brings joy, but seems grievous and painful; but afterwards it yields a peaceable fruit of righteousness to those who have been trained by it." ~

Hebrews 12:11

ER'd in June 2015 at age 52. Initial WR 3%. 50/40/10 (Equity/Bond/Short Term) AA.

|

|

|

08-04-2012, 11:33 AM

08-04-2012, 11:33 AM

|

#24

|

|

Recycles dryer sheets

Join Date: May 2009

Location: Tampa

Posts: 212

|

Quote: Quote:

Originally Posted by Live And Learn

I keep reading threads where people can live on $30 - $50k per year. My budget is $84k and I think its pretty bare bones.

Home is fully paid - 1600 sq ft. No car payments (cars are 3 and 10 years old). Boat is a 16 ft jon boat - nothing fancy. Dog expenses are high - even tho she's only 6 yo she has some health challenges.

"Future one time purchases" budget includes big ticket items - car replacements, applicance replacements. Ongoing purchases includes replacements of smaller items (televisions, small appliances) and purchase of new things (towels, books, etc).

I could probably take 10k out of this budget (dog 2k, vacation 3k, boat 1k, cellphones 1k, entertainment 1k, pocket money 2k) but thats all I see.

What am I doing wrong ?

|

I am in your same situation. I figure my bills with taxes etc. I sat down last night and pulled up "how long will savings last" calculator. Never saw that before. We can pull a good amount of money every month for the next 25 years and die broke. I am almost fifty. Am I missing something? This is figuring health for wife and I at 20K per year. If we don't spend the money every year we can save that for big ticket items.

|

|

|

08-04-2012, 11:42 AM

08-04-2012, 11:42 AM

|

#25

|

|

Moderator Emeritus

Join Date: Jan 2007

Location: New Orleans

Posts: 47,501

|

Homeowners' insurance varies so much by location, and so does property tax. These two plus flood insurance, all added together come to $3198/year for me, here in Louisiana. I am carrying as much insurance as Allstate will sell me.

Live And Learn, our houses are almost exactly the same size and my electric bill in New Orleans averaged $87/month as opposed to your $225/month. I don't try to conserve, so I set the thermostat for what I think is ideal - - 75 daytime, 73 night, 85 whenever I'm not home (generally just in the afternoons). I have a relatively new HVAC system and a programmable thermostat, both of which help in that regard. Plus, I shut off the AC for about 3 months in the winter. Perhaps local differences in energy cost may also explain the huge difference in our average electric bills.

__________________

Already we are boldly launched upon the deep; but soon we shall be lost in its unshored, harbourless immensities. - - H. Melville, 1851.

Happily retired since 2009, at age 61. Best years of my life by far!

|

|

|

08-04-2012, 11:42 AM

08-04-2012, 11:42 AM

|

#26

|

|

Gone but not forgotten

Join Date: Jan 2007

Location: Sarasota,fl.

Posts: 11,447

|

Quote: Quote:

Originally Posted by Live And Learn

I'd like to ask more about your electric bill and homeowners insurance. I have my A/C set really low (75) so I know I could up it and save money. Is your house rather new with much better insulation perhaps ? My homeowners deductable is $1k (and 3% of home value for wind damage) and I also have flood insurance ($350 / yr). Maybe I've overinsured the contents ?

|

My deductible is $20,000 for homeowners. Plus my SO's son is an insurance broker so he always scouts for the best deals for me . This year I started setting my air at 76 .I did not notice the one degree difference.We also have a pretty new air conditioner and two years ago when we got a new refrigerator and dryer the bill dropped by $25 a month and it had already dropped $50 a month with the new ac system.

|

|

|

08-04-2012, 11:46 AM

08-04-2012, 11:46 AM

|

#27

|

|

Recycles dryer sheets

Join Date: Dec 2007

Posts: 482

|

I am FI but still working, so some of my expenses are less because of work. We spend about 50K a year and I think that is high. From looking at your expenses, I notice we spend less on the following:

Taxes and Insurance (about 3500 less)

Electricity

Phone and Cable

HOA Pool etc. (no HOA or pool)

Taxes on Dividends etc.

Health Insurance (spend 15K less)

We spend at least 25K less on the items above, maybe more.

We spend more on the following items:

gifts

vacation

food (16 y.o. male living in our house)

I have been working to lower our monthly expenses on a long-term basis. We replaced our HVAC system along with all the ducting and we've seen a substantial savings in electric bills. We are also growing more veggies in our garden, which cuts down on food costs and gives us what I think are higher quality foods. We are now looking at replacing our toilets which will take us from 7 or 8 gallons a flush down to 1.3 gallons. I also installed low flow shower heads and we actually like them better than the old mega-flow shower heads. We replaced our water heater with a tankless water heater that heats only the water we need at the time. The shower heads and water heater were my efforts to combat my 16 year old's fondness of 30 minute showers. We have replaced a lot of light bulbs with those new funky energy saver bulbs. I also walk to work much more which saves on gas and I'm even foregoing purchasing my annual parking pass at work. I wanted to install a Franklin stove and burn wood for heat, but DW was against it for aesthetic reasons. I am still thinking of ways to reduce spending though.

__________________

Retire date Jan. 10, 2018

|

|

|

08-04-2012, 11:59 AM

08-04-2012, 11:59 AM

|

#28

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2008

Posts: 13,150

|

Your health insurance is about 25% of your overall budget. Don't know if you have options to save on that, but it takes up a pretty good chunk.

__________________

Have you ever seen a headstone with these words

"If only I had spent more time at work" ... from "Busy Man" sung by Billy Ray Cyrus

|

|

|

08-04-2012, 12:03 PM

08-04-2012, 12:03 PM

|

#29

|

|

Recycles dryer sheets

Join Date: Dec 2007

Posts: 482

|

Oh, I also spend more on beer and wine. Beer/wine is its own category in my budget.

__________________

Retire date Jan. 10, 2018

|

|

|

08-04-2012, 12:06 PM

08-04-2012, 12:06 PM

|

#30

|

|

Moderator Emeritus

Join Date: Jan 2007

Location: New Orleans

Posts: 47,501

|

Quote: Quote:

Originally Posted by ikubak

Oh, I also spend more on beer and wine. Beer/wine is it's own category in my budget.

|

I spend $0.00/year on beer and wine, but I spend more on food (per capita), on utilities, and probably on some other categories than Live And Learn does.

__________________

Already we are boldly launched upon the deep; but soon we shall be lost in its unshored, harbourless immensities. - - H. Melville, 1851.

Happily retired since 2009, at age 61. Best years of my life by far!

|

|

|

08-04-2012, 12:08 PM

08-04-2012, 12:08 PM

|

#31

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2008

Posts: 13,150

|

Quote: Quote:

Originally Posted by ikubak

I am FI but still working, so some of my expenses are less because of work. We spend about 50K a year and I think that is high. From looking at your expenses, I notice we spend less on the following:

Taxes and Insurance (about 3500 less)

Electricity

Phone and Cable

HOA Pool etc. (no HOA or pool)

Taxes on Dividends etc.

Health Insurance (spend 15K less)

We spend at least 25K less on the items above, maybe more.

We spend more on the following items:

gifts

vacation

food (16 y.o. male living in our house)

I have been working to lower our monthly expenses on a long-term basis. We replaced our HVAC system along with all the ducting and we've seen a substantial savings in electric bills. We are also growing more veggies in our garden, which cuts down on food costs and gives us what I think are higher quality foods. We are now looking at replacing our toilets which will take us from 7 or 8 gallons a flush down to 1.3 gallons. I also installed low flow shower heads and we actually like them better than the old mega-flow shower heads. We replaced our water heater with a tankless water heater that heats only the water we need at the time. The shower heads and water heater were my efforts to combat my 16 year old's fondness of 30 minute showers. We have replaced a lot of light bulbs with those new funky energy saver bulbs. I also walk to work much more which saves on gas and I'm even foregoing purchasing my annual parking pass at work. I wanted to install a Franklin stove and burn wood for heat, but DW was against it for aesthetic reasons. I am still thinking of ways to reduce spending though.

|

Which low-flow shower head do you use? I was trying several different ones about a year ago for a friend and only found one that I really liked. It did do a good job of saving money and still giving a comfortable shower -- until I tried it at my place (the water pressure at my place must have been lower). The cost of water usage is already paid for in my monthly maintenance fee (condo), but I don't like to waste if I don't have to. So, instead of a low-flow, I have a full flowing shower head that has a shut valve button. I can use that to have almost none to very low flow as I soap up and then back to full as I rinse off. Best of both worlds. Also, one can get a shut off valve (for about $10) that installs between the shower pipe and shower head if the head doesn't come with a shut off valve.

A good percentage of the light bulbs at my place are LED. None of them have failed yet. Initially cost is high (though prices on the way down), but I really like them.

__________________

Have you ever seen a headstone with these words

"If only I had spent more time at work" ... from "Busy Man" sung by Billy Ray Cyrus

|

|

|

08-04-2012, 12:08 PM

08-04-2012, 12:08 PM

|

#32

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Talk about the electric bill, I just pulled up Quicken and saw that I paid a total of $2057 $2437 for the last 12 months for my 2,700 sq.ft. home. It's in the "dry heat" part of the country (122F record high!), and I keep the temperature at 77F most of the day, and raise it to 78F during the peak hours of 1PM-8PM. Electric cost goes up more than 2x during peak hours, I think, when the AC is needed the most. Refrigeration is a 5-ton central air that is less than 10 yr. old. I do not remember the EER. I also have a 1HP pool pump running 6 hrs/day. No nat gas, all electric for cooking and water heating.

Just want to provide a comparison point to the OP's $2700/yr. Wonder if dry heat costs less for cooling than humid climate.

PS. Missing the month of Aug, where the highest bill was! Correction made above.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

08-04-2012, 12:14 PM

08-04-2012, 12:14 PM

|

#33

|

|

Gone but not forgotten

Join Date: Jul 2012

Location: Peru

Posts: 6,335

|

Always interesting to see budgets/expenses.

Not the same format, but for the most part similar. Big difference in taxes. to do with no taxable earnings.

Budget includes 3 residences, of which 2 will disappear in a year or two, total $15,600. Also 2 old cars.

OP

US

Re electric bill... our current rate (permanent home) is $.0676/KWH, vs. $.145/KWH in loc. 3.

In fact, our fun/sin expense is about $2000 less and dental/med expenses are about $2000 less than budget.

|

|

|

08-04-2012, 12:14 PM

08-04-2012, 12:14 PM

|

#34

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,726

|

Quote: Quote:

Originally Posted by Live And Learn

What am I doing wrong ?

|

I don't think you're doing anything wrong. Everything looks fine as long as you are saving enough to fund your retirement and you have a rainy day fund for expensive repairs and auto replacement.

|

|

|

08-04-2012, 12:25 PM

08-04-2012, 12:25 PM

|

#35

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 5,596

|

Quote: Quote:

Originally Posted by MichaelB

I don't think you're doing anything wrong. Everything looks fine as long as you are saving enough to fund your retirement and you have a rainy day fund for expensive repairs and auto replacement.

|

My thoughts exactly. DH and I also carry a high health insurance cost which makes our total spending much higher than those with subsidized coverage. Our other expenses vary, but not by that much. We consider ourselves pretty frugal, but don't deny ourselves reasonable enjoyment in life.

__________________

I purr therefore I am.

|

|

|

08-04-2012, 12:29 PM

08-04-2012, 12:29 PM

|

#36

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2012

Location: Mississippi

Posts: 1,894

|

Your health insurance expenses are more than my total budget. I don't currently pay for HI ( J*b provided ) but it will $300/month for COBRA. I don't include income/dividends/cap gains taxes as an expense. Big difference in the "spending money" category. I DIY all my car maintence, get oil/filters for free with sales/rebates. $200/month for a pet seems a lot.

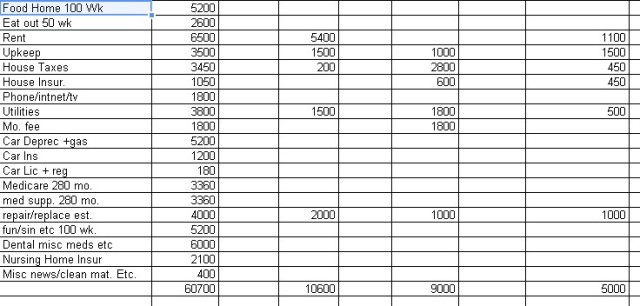

My totals for 2011 are attached ( if I did it correctly )

|

|

|

08-04-2012, 12:47 PM

08-04-2012, 12:47 PM

|

#37

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Wow! I look at the above budget, and everything is listed. I just did not see travel expenses. But still...

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

08-04-2012, 12:47 PM

08-04-2012, 12:47 PM

|

#38

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 5,596

|

Quote: Quote:

Originally Posted by rbmrtn

Your health insurance expenses are more than my total budget. I don't currently pay for HI ( J*b provided ) but it will $300/month for COBRA. I don't include income/dividends/cap gains taxes as an expense. Big difference in the "spending money" category. I DIY all my car maintence, get oil/filters for free with sales/rebates. $200/month for a pet seems a lot.

My totals for 2011 are attached ( if I did it correctly )

|

Yup, you did it correctly. Very impressive! Love the line item for WalMart

__________________

I purr therefore I am.

|

|

|

08-04-2012, 12:49 PM

08-04-2012, 12:49 PM

|

#39

|

|

Gone but not forgotten

Join Date: Jan 2007

Location: Sarasota,fl.

Posts: 11,447

|

Quote: Quote:

Originally Posted by W2R

But remember, there is only ONE of me, not two, and I suspect that the old maxim "two can live as cheaply as one" might be misleading/untrue.

|

I think two living together live cheaper than two maintaining separate households.

|

|

|

08-04-2012, 12:53 PM

08-04-2012, 12:53 PM

|

#40

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by Moemg

I think two living together live cheaper than two maintaining separate households.

|

Yes. If we are in a race to see who spends less, I reserve the right to divide our expenses by 2 to reflect the fact that I am married. Heck, I may be running neck-to-neck with some single people here, or if I lose, it would not be by much.

I am a bigger spender than my wife with my toy purchases, so together she averages down my costs.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|