mickeyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

As a taxpayer, this situation is beginning to get my attention because I feel that someone will have to pay for these obligations to our public servants. I think that that someone is me.

Why Public Pensions Are About To Look Less Healthy : Planet Money : NPR

Public pension systems, of course, are hurting in many states and cities. Some haven't been funded sufficiently to provide promised retirement benefits to teachers, firefighters or other public-sector workers. Poor investment returns have taken their toll across the board. Benefits are being curbed in some places because the costs of these pensions compete with other priorities like schools, parks, transportation and public safety.

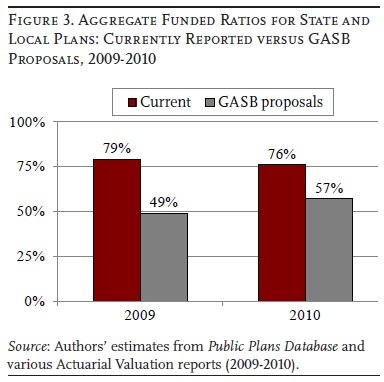

The new problems come from the green eyeshade crowd — the Government Accounting Standards Board. Under new rules from the board, state and local governments will have to change how they present the financial health of their pension plans to the public. Although the changes are dramatic at first glance, there are some important caveats.

Today, public pension plans are allowed to smooth out the ups and downs of their investment returns. Losses from the financial crisis of 2008 aren't reflected in many plans, but neither are most gains from 2010, an up year in the stock market. The idea is that pension plans must look far into the future so short-term ups and downs are less important. At the same time this smoothing can mask serious problems for years.

The new rules would stop the smoothing. Instead, pension funds would have to show gains and losses each year. That could mean big swings in a plan's heath from year to year, especially for plans heavily invested in stocks, hedge funds or other unpredictable investments. In many ways, it's a more precise presentation. And for employees with pensions at stake, it may be a stomach churning one

Why Public Pensions Are About To Look Less Healthy : Planet Money : NPR