dex

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 28, 2003

- Messages

- 5,105

I read another board of financial traders to get an idea of their thoughts.

All three of the stories below are from 3 different posters but, they stuck a cord with me.

Gold For Bread - Zimbabwe

YouTube - Gold For Bread - Zimbabwe

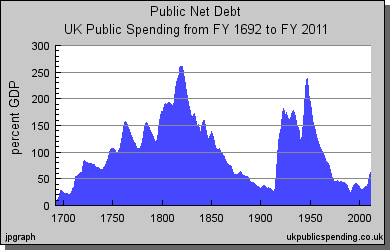

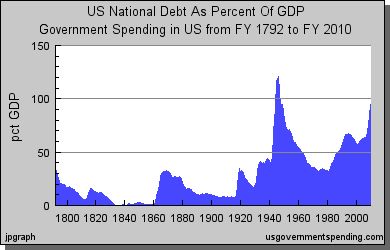

THE Most Important Chart of the CENTURY

Swarm USA - THE Most Important Chart of the CENTURY

Obamacare and the Death of Detroit, the First U.S. City To Face Extinction

http://www.marketoracle.co.uk/Article18136.html

(Don't focus on the Obamacare part but on Detroit)

I manage the little amount of my money my mother has. The money I manage is the allows here to live in a adult care home. (She confuses me with another relative at this point.)

Now imagine what we - in the USA - all the financial issues we will need to negotiate over the next 30 to ? years. I'm am really convinced that buy and hold as a strategy is dead or it will kill you eventually.

All three of the stories below are from 3 different posters but, they stuck a cord with me.

Gold For Bread - Zimbabwe

YouTube - Gold For Bread - Zimbabwe

THE Most Important Chart of the CENTURY

Swarm USA - THE Most Important Chart of the CENTURY

Obamacare and the Death of Detroit, the First U.S. City To Face Extinction

http://www.marketoracle.co.uk/Article18136.html

(Don't focus on the Obamacare part but on Detroit)

I manage the little amount of my money my mother has. The money I manage is the allows here to live in a adult care home. (She confuses me with another relative at this point.)

Now imagine what we - in the USA - all the financial issues we will need to negotiate over the next 30 to ? years. I'm am really convinced that buy and hold as a strategy is dead or it will kill you eventually.

Agile, mobile and hostile.

Agile, mobile and hostile.