I love this board!

Wow. That's very interesting. Thanks for digging that up. Gives me some perspective.

And thanks to all for the posts. Very interesting - seems like I have sparked a good debate. That's why I love this board. Great stuff. I have read all the posts, some clarification about my situation:

1. Yes, not saying I would never be in the stock market again - keeping my powder dry by being able to live off my cash and not worry about the stock market at all UNTIL I see a good buying oppty. Today, I think it is a house of cards. Tomorrow - who knows, could come down to earth and represent something more stable - way way too much volatility in the market today for me. Why be in it if you don't have to?

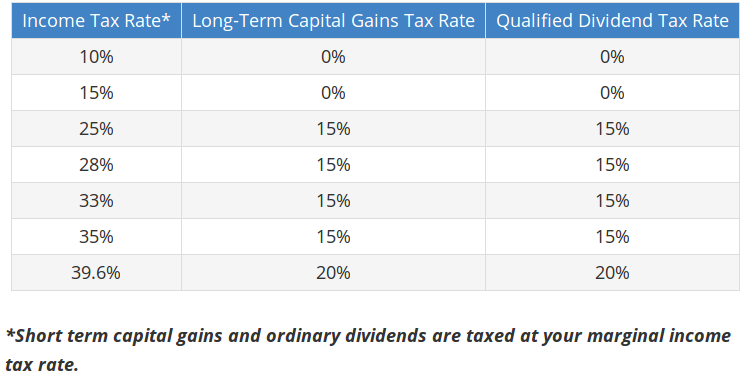

2. I am now thinking more about more about 30% of my cash in the market when I see a good buying oppty - using the above $85K no taxes strategy of investing it all in Vanguard Total Stock Market. That post was very helpful. Maybe not immediately, but down the road after I see what Yellen and the Fed do over the course of the next 12 months.

3. I love the links to the "if you won the game why play" posts. It is exactly what I am thinking about. But many good posts on the other spectrum on this thread are changing the way I am looking at an all cash strategy. So thanks for that.

In closing - I think many people are in the market because they have to - because fixed returns return nothing and bonds are going to get hammered because of rising interest rates. If a 5 year CD was giving a 5% return, would you still be so inclined to invest in the stock market? ...

But thanks again for all the posts. Very interesting.

Appears to be that way !! Just plugged 85K into tax caster with no other income and it's showing as zero tax. Perhaps it's because you are in the 0% bracket of "earned" income.

Wow. That's very interesting. Thanks for digging that up. Gives me some perspective.

And thanks to all for the posts. Very interesting - seems like I have sparked a good debate. That's why I love this board. Great stuff. I have read all the posts, some clarification about my situation:

1. Yes, not saying I would never be in the stock market again - keeping my powder dry by being able to live off my cash and not worry about the stock market at all UNTIL I see a good buying oppty. Today, I think it is a house of cards. Tomorrow - who knows, could come down to earth and represent something more stable - way way too much volatility in the market today for me. Why be in it if you don't have to?

2. I am now thinking more about more about 30% of my cash in the market when I see a good buying oppty - using the above $85K no taxes strategy of investing it all in Vanguard Total Stock Market. That post was very helpful. Maybe not immediately, but down the road after I see what Yellen and the Fed do over the course of the next 12 months.

3. I love the links to the "if you won the game why play" posts. It is exactly what I am thinking about. But many good posts on the other spectrum on this thread are changing the way I am looking at an all cash strategy. So thanks for that.

In closing - I think many people are in the market because they have to - because fixed returns return nothing and bonds are going to get hammered because of rising interest rates. If a 5 year CD was giving a 5% return, would you still be so inclined to invest in the stock market? ...

But thanks again for all the posts. Very interesting.