I don't necessarily accept the implicit premise that some specific group has to pay. But at any rate, it's not my responsibility to say who. You're the one who says future generations must pay; the burden is yours to prove it.

Why not? (And I have some bad news for you about whether Congress is doing that ...)

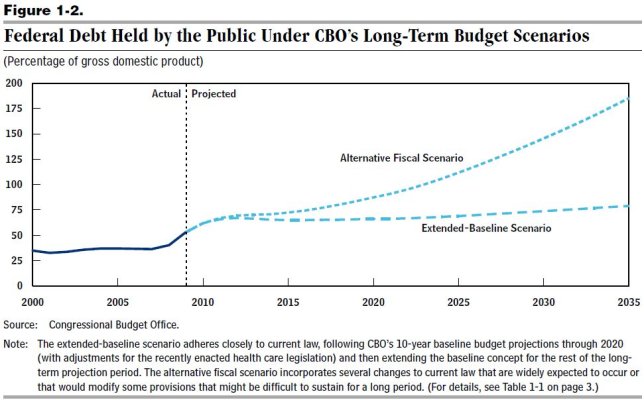

Why can't it grow forever? What's this "oxygen"?

GregLee,

I had a rather long reply, but deleted it. Your logic is so illogical it is not worth it. ...

Rustic23, I was tempted to take your stance, but I'm rather curious about this. So I'm going to probe and see if anything surfaces.

Government is not like a family, let me count the ways:

1) Government doesn't die of old age

2) Government can carry debt balances in perpetuity

3) Government should spend more when times are bad

4) Government should spend less when times are good

5) Government has enormous control over the amount of its revenue

6) Governments can generally run fiscal deficits every year and still improve their fiscal position (as long as the primary deficit is smaller than the real growth rate less than real interest rate on its borrowing)

The idea that government finances should be run like a family budget is preposterous.

G4G, I think those are good observations. It is different, but I also think there are limits somewhere along the way.

#1 is clearly true (I suppose no government lasts forever, but true enough).

And I agree with #2 - Government can carry debt balances in perpetuity. But I don't think they can

grow them into perpetuity. Your caveat in #6 appears to cover my issue - it can't keep growing.

There are differences, but not every analogy to a household budget is preposterous - we do need to take into account the powers the Govt has vs a household though.

OK, back to GregLee:

I don't necessarily accept the implicit premise that some specific group has to pay. But at any rate, it's not my responsibility to say who. You're the one who says future generations must pay; the burden is yours to prove it.

Well, if it isn't the present generation, and it clearly isn't the past generation, then that only leaves the future generations. The process of elimination is a valid logical process. Did I miss some entity that can pay the bill? Unless you can come up with one, I think I met my burden of proof.

It isn't your responsibility to say who pays? I think it is. And it should be you. Anything that I want to have delivered is my responsibility to pay for. If I say "let's feed every starving child in Africa", thats fine, but meaningless if I don't pony up my share of the money. Someone else should pay? Why - it was my wish, I should pay for it?

Now I'm agreeing with Rustic23, this seems silly.

-ERD50