|

|

01-20-2016, 09:10 AM

01-20-2016, 09:10 AM

|

#41

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2011

Location: NC Triangle

Posts: 5,807

|

Quote: Quote:

Originally Posted by REWahoo

Another case for a well-balanced AA...

|

And maybe switching to decaf.

__________________

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

01-20-2016, 09:14 AM

01-20-2016, 09:14 AM

|

#42

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,726

|

Quote: Quote:

Originally Posted by papadad111

Recall here that we are fired and so not in accumulation phase. Money is either in the left pocket in equities or right pocket in bonds. No new money flowing into either pocket. (Assume we are spending the dividends or coupons to live off of).

|

Money flows from one pocket to the other on a regular basis. It's called rebalancing, and it is a critical component of portfolio management. It is especially important for those of us that intend to self-finance very long retirements.

|

|

|

01-20-2016, 09:32 AM

01-20-2016, 09:32 AM

|

#43

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2010

Posts: 2,301

|

Papadad

As per AnonEMouse's link, the reason we don't go all-in for US equities is that asset classes can have long periods of underperformance. Otherwise we would be 100% emerging markets which has way higher expected returns than US equities.

Also I think one very real danger with investing, especially among quantitative types, is that one can *over-optimize* their portfolio. They push their portfolio in the direction that historically looks like it will do very well not fully realizing the data is extremely limited and their analysis may be picking up on random/spurious correlation or missing some long-tail events.

Each asset class is robust to certain shocks/bad events and brittle to others. We want a mix (regardless of what the data says would perform the best historically) so that one bad extended shock doesn't sink us.

|

|

|

01-20-2016, 10:26 AM

01-20-2016, 10:26 AM

|

#44

|

|

gone traveling

Join Date: Oct 2007

Posts: 1,135

|

Good comments.

My opinion: Today we have what looks finally like capitulation.

|

|

|

01-20-2016, 10:31 AM

01-20-2016, 10:31 AM

|

#45

|

|

Moderator Emeritus

Join Date: Jan 2007

Location: New Orleans

Posts: 47,501

|

Quote: Quote:

Originally Posted by papadad111

Good comments.

My opinion: Today we have what looks finally like capitulation.

|

Otherwise known as a buying opportunity!  I'm pretty sure my portfolio will meet my written criteria for rebalancing and if so, I'll be buying at some point to make that happen.

__________________

Already we are boldly launched upon the deep; but soon we shall be lost in its unshored, harbourless immensities. - - H. Melville, 1851.

Happily retired since 2009, at age 61. Best years of my life by far!

|

|

|

01-20-2016, 10:36 AM

01-20-2016, 10:36 AM

|

#46

|

|

Moderator Emeritus

Join Date: May 2007

Posts: 12,901

|

Quote: Quote:

Originally Posted by papadad111

Yes. Not making a mistake - not selling at a market bottom. But again in a "never sell" mentality which is the case if WR is down at the dividend yield rate.... That won't happen. Much bigger risk is inflation even at 2 percent will erode principle and your bond face value amount over the long term

Recall here that we are fired and so not in accumulation phase. Money is either in the left pocket in equities or right pocket in bonds. No new money flowing into either pocket. (Assume we are spending the dividends or coupons to live off of).

So aside looking at the account balance at a particular point in time, being in your 40s meaning you hope to live another 40-50 years, I don't see why one would limit their upside potential of principle by being in bonds at such a young age, especially when yield covers expenses. Just live on that yield/ dividends, wait for the market increases.... It always does. At least in modern times. The daily monthly or yearly fluctuation doesn't matter much.

That's a better shot than buying bonds, holding to maturity, earning a return that barely covers long run rates of inflation but having to spend it to live on. At the end of 40 years and having spent the bond coupon /interest, you're left with dollars returned that are seriously devalued due to inflation. Your principle is intact but it's worth way less ... Equities at least have a fighting chance over the long term to increase your principle return equal to or maybe a little beyond inflation.

Long term , equities simply outperform.

So .... With such a long time horizon, why the conservatism? Unless the reality is one needs to spend principle too... Early on in retirement. Like during the 50s or early 60s.... Or If dividends are at risk...or the actual WR is moving higher than just the dividend yield due to lifestyle spending creep.

Otherwise I just don't get it. Perhaps it's the sleep at night factor that I'm missing.

Or the desire to draw down principle and buy that big house/car/yacht etc at a moments notice rather than treat the principle sorta like a permanent and untouchable investment with a stream of cash flows like an annuity .

I see a different scenario toward older age where you may have huge expenses for health care beyond dividend yield amount and need that principle. That's when you might want or need some bond assets or cash - in 60s and 70s ... And then SPIA in 80s for longevity insurance.

Good discussion. I historically was overly conservative but have changed my habits over time... Maybe I'm overly aggressive now holding just stocks in broad market funds and some cash ...

Early early retirement is truly unique with long long time horizons to manage, little if any safety nets such as defined pensions , and even uncertainty about SS...

|

Being all stock sounds great in theory (a chance to maximize your returns, although not all of us care about hitting a homerun as photoguy wrote above), but you have to take into account human psychology. You wrote earlier that you would start to get nervous with a 30% drop from the recent highs. So you are not a INTJ robot. Are you sure that your "never sell" convictions will hold when the market corrects 50% or more, as it has done on now 2 occasions over the past 16 years? Will you still feel serene when your dividend income gets cut as well? Dividends were cut by the financial sector in 2008 and now another big dividend-paying sector, energy, is starting to cut dividends as well. If you have alternative sources of income to fall back on, then this may not be such a big deal. But will the fact that "equities simply outperform" be of much comfort to you when you see your capital -the only thing that keeps you retired- melt like snow in the sun and everybody is seemingly hitting the panic button?

|

|

|

Younger retirees... Your game plan?

01-20-2016, 03:32 PM

01-20-2016, 03:32 PM

|

#47

|

|

gone traveling

Join Date: Oct 2007

Posts: 1,135

|

Younger retirees... Your game plan?

That conviction is definitely individual.

I held firm as a new investor in 1987 and in 1991, in 2000 and in 2008.

But others may be more risk averse. I was less exposed to equities (50:50) earlier in my investing days and every recovery, I said I wished I had been more exposed. I'm now 90:10

As an aside, look at 20 years of sp500 dividends. 1995-2015. The SP500 dividend amount only declined one year of the past 20 years and that was the financial crisis in 2009- payout that year fell by 20% While Market was down 58 percent. . Dividends climbed steadily there after and returned to all time highs by 2012. Even the dot com crash did not impact the SP500 dividends much. Certain sectors were hit. ... But that's the advantage of holding broad market.

The actual dividend payment has doubled from what it was 10 years ago.

Let's not discuss bond defaults as I think we are referring to treasuries.

Great discussion. All very good thoughts and commentary. I appreciate everyone's participation and perspective especially those early early retirees with no backstops other than a whiff of SS decades out in time.

Today was interesting for sure in the markets.

|

|

|

01-20-2016, 07:32 PM

01-20-2016, 07:32 PM

|

#48

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 7,746

|

Quote: Quote:

Originally Posted by FIREd

Being all stock sounds great in theory (a chance to maximize your returns, although not all of us care about hitting a homerun as photoguy wrote above), but you have to take into account human psychology. You wrote earlier that you would start to get nervous with a 30% drop from the recent highs. So you are not a INTJ robot. Are you sure that your "never sell" convictions will hold when the market corrects 50% or more, as it has done on now 2 occasions over the past 16 years?

|

I can't speak for papadad but for me, I would start feeling "worried" at around a 40% correction because that's where my budgeted spending would drop below a 4% of portfolio value withdrawal rate.

Not worried in the sense of wanting to sell everything, but rather worried in the sense that I might need to cut back on spending or shift spending on big capital items into future years. The constraints on my spending would be the worry, not the fluctuations in the market.

At least that's my story. And I'm sticking to it.

__________________

Retired in 2013 at age 33. Keeping busy reading, blogging, relaxing, gaming, and enjoying the outdoors with my wife and 3 kids (8, 13, and 15).

|

|

|

01-20-2016, 07:58 PM

01-20-2016, 07:58 PM

|

#49

|

|

gone traveling

Join Date: Oct 2007

Posts: 1,135

|

Well said Fuego. Very Similar concern... It's about WR and sequence of returns risk.

|

|

|

01-20-2016, 08:25 PM

01-20-2016, 08:25 PM

|

#50

|

|

Moderator Emeritus

Join Date: May 2007

Posts: 12,901

|

We all make a bet and hope it works out for the best. For us young retirees with no pensions or income backup, this is high flying with no safety net. So fingers crossed!

|

|

|

01-20-2016, 09:14 PM

01-20-2016, 09:14 PM

|

#51

|

|

gone traveling

Join Date: Oct 2007

Posts: 1,135

|

Indeed. It's inspiring to hear from so many early early retirees on this forum.

And truth be told - when I saw The one-day account balance down by 6 figures today and it wasn't even lunch time ... I had the "aw ****" moment .... and then remember to point into the wind and keep sailing.

|

|

|

01-21-2016, 04:04 AM

01-21-2016, 04:04 AM

|

#52

|

|

Recycles dryer sheets

Join Date: Jun 2013

Location: N/A

Posts: 55

|

This Q is targeted at those FIREd retirees who are 15 or more years out from collection of annuity, social security , and do not have a pension at all coming in today and will not have a sizable pension way out in time.. Ie, You rely on what assets you have right now.

Are you doing anything differently now that the market has corrected? Yes, I changed allocation last year to increase cash as I was concerned the market would make a major correction. However, I also have significant Real Estate and passive business interest with absolutely no debt.

What is your source of living expenses? Wife and I are covering 100% of our budget with income from part-time consulting, passive business and loans so we donít need to tap the Nest Egg. We figured might as well make some money part-time while we can. Thus, the withdrawal rate on the investable assets is zero. Also, I have my kids college education funds fully funded and very conservatively invested so no current or future drain on the budget. It's nice to give them a debt free start to life.

Are you selling anything. or spending principle (cash) or only living on dividend and interest income. Re-allocated in 2015 and use very little of the dividends.

Any other sources of passive ( you're retired right) income such as real estate or hobby income? Yes, consulting, passive business and loan income.

At what market level from the top do you start to be very concerned about capital preservation in the short run ? Down 10-20-30-50-66 percent etc

I always concerned about capital preservation but when get the cyclical economic correction that causes a 30+% drop in the market coupled with a slowdown in business, etc. that is a double whammy. A recession in the early years of retirement makes it more difficult to generate part-time work income one might want to help offset the loss in capital due to the market correction. So, as indicated above I felt it necessary to lighten up until I see the volatility normalize.

What's your asset allocation ? On a total NW basis, I am 20% Equities, 15% Bonds, 30% Cash and 35% real estate.

How many years of "cash" do you need to feel secure - for living expenses

Notwithstanding the above asset allocation, I keep 2 years of living expenses in cash in case things get tight. Probably overkill but, I have lived thru a couple recessions and I like having solid liquidity when the **** hits the fan. There will still be some income from dividends, passive business and loans, so two years really extends to more like 4 to 5 years and would get me thru the correction. Also, I have my kids college education funds fully funded and very conservatively invested so no current or future drain on the budget. Again, itís niice to give them a debt free start to life.

Do u have dry powder to throw at the market if so what percent of portfolio ? 30% or more if I were to sell some bond holdings in favor of stocks.

|

|

|

01-21-2016, 09:57 PM

01-21-2016, 09:57 PM

|

#53

|

|

Recycles dryer sheets

Join Date: Dec 2011

Location: Chicago area

Posts: 431

|

We're 46 and 45 and have been retired for roughly 3.5 years.

Are you doing anything differently now that the market has corrected?

- No, we are not changing anything investment or lifestyle wise.

What is your source of living expenses?

- We live off cash in our portfolio + income from PT consulting.

Are you selling anything. or spending principle (cash) or only living on dividend and interest income.

- No.

Any other sources of passive ( you're retired right) income such as real estate or hobby income?

- PT consulting covers about 20% of our spending.

At what market level from the top do you start to be very concerned about capital preservation in the short run ? Down 10-20-30-50-66 percent etc

- I'll be concerned at 30% but will be rebalancing on the way down!

What's your asset allocation ?

We're at 45/50/5 but right now the bonds have a very high short term allocation.

How many years of "cash" do you need to feel secure - for living expenses

- Actual cash is about 2 years

Do u have dry powder to throw at the market if so what percent of portfolio ?

Yes, we have a lot in short term bonds that we would move to equities if the correction gets worse.

Sent from my SM-T237P using Early Retirement Forum mobile app

|

|

|

01-22-2016, 05:25 AM

01-22-2016, 05:25 AM

|

#54

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2014

Location: Williston, FL

Posts: 3,925

|

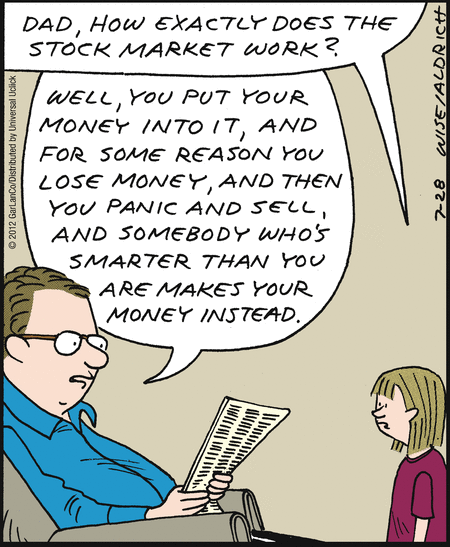

Here is some advice for you youngsters.

__________________

FIRE no later than 7/5/2016 at 56 (done), securing '16 401K match (done), getting '15 401K match (done), LTI Bonus (done), Perf bonus (done), maxing out 401K (done), picking up 1,000 hours to get another year of pension (done), July 1st benefits (vacation day, healthcare) (done), July 4th holiday. 0 days left. (done) OFFICIALLY RETIRED 7/5/2016!!

|

|

|

01-22-2016, 07:54 AM

01-22-2016, 07:54 AM

|

#55

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2015

Location: philly

Posts: 1,219

|

Quote: Quote:

Originally Posted by papadad111

This Q is targeted at those FIREd retirees who are 15 or more years out from collection of annuity, social security , and do not have a pension at all coming in today and will not have a sizable pension way out in time.. Ie, You rely on what assets you have right now.

Are you doing anything differently now that the market has corrected?

What is your source of living expenses?

Are you selling anything. or spending principle (cash) or only living on dividend and interest income.

Any other sources of passive ( you're retired right) income such as real estate or hobby income?

At what market level from the top do you start to be very concerned about capital preservation in the short run ? Down 10-20-30-50-66 percent etc

What's your asset allocation ?

How many years of "cash" do you need to feel secure - for living expenses

Do u have dry powder to throw at the market if so what percent of portfolio ?

|

Retiring April 1st from full time work. I'm 55. I agreed to work at megacorp for 6 months part time afterward for what they call "the orderly transition of knowledge". lol translation, I'm training my replacement.

1) no, not doing anything different.

2) I have a taxable account that I will live off of. I can actually start taking my pension without penalty in 4 years.

3) no I'm not selling anything. I padded my taxable account but yes I'll be drawing from principle there.

4) Yes I will probably have passive income. I'm simply not the stay at home type. I'm a chemist so if anything I can join a temp agency and work temp jobs. I'm also taking some classes at Temple U to see what I want to be when I grow up.

5) I kind of do the "bucket" system. I have a bucket of assets that I have for long term. that AA is 65% stocks, 35% bonds and other stuff. I also have an annuity that I will turn on at 60. My immediate need buckets is more conservative at 50/50

6) I like having 3 years of living expenses in the bank.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|