Have not pulled the trigger yet, hoping to in 2018. Curious for feedback on any expense surprises once you retired. Any blind spots that you did not plan for? Anyone feeling like they have retired into a situation where they have to pinch pennies too much and wish they had worked one more year or decided to get some part time work so you don't have to watch how you spend every dollar?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Were expenses what you thought after you retired?

- Thread starter beachfire

- Start date

PawPrint53

Recycles dryer sheets

- Joined

- May 25, 2012

- Messages

- 194

Getting a crown with no dental insurance. While I had dental insurance, I had a crown and a filling done two years ago. Now the filled tooth needs a crown, which I wish had been done in the first place. Oh, well. While it's not super expensive, I'd rather use the money for something fun. From what I've read here, dental expenses are one of the most unexpected.

No offense, but you really need to examine your planning assumptions. If you don't build a substantial cushion into all your spending categories, including the "once in a while" expenses, you could easily be in trouble.

Total spending is about what I expected, so no need to be extra thrifty or go back to work.

Spending in some categories is higher than expected - healthcare notably. Figured it would be about $15K annually for me and 2 kids, but was $25K last year, with braces about $5,000 of that. Figuring $20K/yr going forward and keeping enough in an HSA to cover max O-O-P.

Haven't traveled as much as originally budgeted and some discretionary spending has been lower than expected.

I had not thought through "one-time" expenses very well - an additional car, setting up a new house, new musical instruments, etc. Had enough slack between what I planned to spend and what I could theoretically spend to be able to take care of those without being stressed.

As Braumeister wisely stated, have a cushion, and bigger is better. Stuff happens, and things rarely go exactly as planned.

Spending in some categories is higher than expected - healthcare notably. Figured it would be about $15K annually for me and 2 kids, but was $25K last year, with braces about $5,000 of that. Figuring $20K/yr going forward and keeping enough in an HSA to cover max O-O-P.

Haven't traveled as much as originally budgeted and some discretionary spending has been lower than expected.

I had not thought through "one-time" expenses very well - an additional car, setting up a new house, new musical instruments, etc. Had enough slack between what I planned to spend and what I could theoretically spend to be able to take care of those without being stressed.

As Braumeister wisely stated, have a cushion, and bigger is better. Stuff happens, and things rarely go exactly as planned.

Last edited:

Pretty close. I have monthly spending figures for the past five years, and started projecting forward in 2014. My first projections always included a ten percent finagle factor, and a hefty cushion besides. We retired in 2015, and have not had any unpleasant surprises yet. I no longer worry about a monthly finagle factor; the cash accounts are more than adequate to handle anything without forcing me to liquidate tax-deferred holdings at an unfavorable time.

Rustic23

Thinks s/he gets paid by the post

General expenses are about the same. i.e. utilities, house, etc.

Getting old expenses, I forgot about. Now these are not medical and such but things I now have other's do because I can't or just don't want to. like mowing the yard

Repairs are about what I expected, New house on retirement and those have not hit. However, I planned and continue to save for those.

If you read enough on here, you will come up with just about every expense you can think of! Hurricanes, tornadoes, relatives, as the Farmer's commercial says 'You name it and It's happened!'

The only one that has not happened is run away inflation! And, I hope it does not, and I am not sure how I would deal with it. But, I know I would not work another min to worry about it!

Edit: Any onetime thing that has come up, like a 50th anniversary party, has been able to work into the budget. If it had not we would not do it.

Getting old expenses, I forgot about. Now these are not medical and such but things I now have other's do because I can't or just don't want to. like mowing the yard

Repairs are about what I expected, New house on retirement and those have not hit. However, I planned and continue to save for those.

If you read enough on here, you will come up with just about every expense you can think of! Hurricanes, tornadoes, relatives, as the Farmer's commercial says 'You name it and It's happened!'

The only one that has not happened is run away inflation! And, I hope it does not, and I am not sure how I would deal with it. But, I know I would not work another min to worry about it!

Edit: Any onetime thing that has come up, like a 50th anniversary party, has been able to work into the budget. If it had not we would not do it.

Last edited:

Fedup

Thinks s/he gets paid by the post

I had a huge buffer as in I took the last two years expense of my exact spending. That's included paying for one kid in college. Plus car insurance was high too, it has dropped to half over the years. And other cost will drop off as in my youngest child will be paying for a lot of her expense when she starts working. So I think the margin is more like 25%.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Except for medical insurance, most of my pre-retirement basic living expense estimates were higher than what my cost have actually been. Medical insurance has been about 50% higher than what I expected/planned.

Now my hobby/vice costs have been significantly more than planned but that of course is totally under my control.

Now my hobby/vice costs have been significantly more than planned but that of course is totally under my control.

Last edited:

W2R

Moderator Emeritus

Have not pulled the trigger yet, hoping to in 2018. Curious for feedback on any expense surprises once you retired. Any blind spots that you did not plan for? Anyone feeling like they have retired into a situation where they have to pinch pennies too much and wish they had worked one more year or decided to get some part time work so you don't have to watch how you spend every dollar?

No, my financial expectations were about right. I took what I was spending while working, and then examined each category and tried to visualize what changes retirement would make in my spending in that category. That seemed to work, with a few exceptions.

I really missed on how much taxes would be - - I did not believe income taxes could be as low in retirement as forum members were reporting. Forum members were reporting around ~ 10% and I just didn't believe it so I multiplied by more than two for planning purposes. Even though I have always withdrawn disproportionately from my tax advantaged accounts during retirement (withdrawing more than my RMDs will be, thus incurring more taxes), still that estimate was crazy, way too high. Even the year when I sold enough to buy my dream home in cash, my taxes were only a little over 10%. Taxes just aren't that high in retirement for many/most of us, because the tax system favors retirees in so many ways. Also, I didn't realize that I would want to drop my landline and TV service and go to a cheaper cell phone service.

But all this was balanced out by buying a new (to me) house that I love. Also, I was surprised at how bad my teeth got and how fast; I have had quite a bit of uninsured dental work done. Medical and dental costs have gone up quite a bit for me.

Overall, I am doing fine and could be spending a little more.

Last edited:

athena53

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 11, 2014

- Messages

- 7,377

One-time costs of downsizing far steeper than expected. Health insurance premiums have nearly doubled in the 3 years since retirement. Taxes vary: zero Fed for 2015, $4K for 2016. There's enough cushion that I can handle most bumps and keep the w/d rate reasonable; will likely stay at 3% this year.

Fedup

Thinks s/he gets paid by the post

Tax is low but if you convert some of your regular IRA to Roth IRA that should plug the hole.

nvestysly

Full time employment: Posting here.

- Joined

- Feb 19, 2007

- Messages

- 599

Most individual spending categories such as food, utilities, fuel, and similar quantifiable expenses have been +/- 10% of what we expected. Even our "rainy day" expenses have been about what we expected. However, what we spend our rainy day fund on has almost always been a surprise.

We didn't realize we were going to spend many $$ on a new HVAC system. We knew the HVAC was 20 years old but we were hoping for a few more years. Another surprise was many, many $$$ on "waterproofing" the basement. Yes, we knew we had a wet basement now and then but didn't realize a 100 year rain would cause such a problem. Other surprises are $ here and there for automobile repairs. Our plan allows for up to $10k per year on such expenses so spending the money wasn't a surprise, it's what we spend the money on, and when, that's eluded us.

A former co-worker initially retired at the same time as me in 2011. However, he went back to work because he didn't feel comfortable with rising medical insurance costs and was equally uncomfortable with unplanned expenses such as a new water line from the water meter to his house, a new water heater, and the possibility of more unforeseen outlays. I suggested that he plan for the unexpected but that just didn't sit well with him.

As braumeister said, you need a cushion. You don't want a modest withdrawal rate increase to kill your plan.

We didn't realize we were going to spend many $$ on a new HVAC system. We knew the HVAC was 20 years old but we were hoping for a few more years. Another surprise was many, many $$$ on "waterproofing" the basement. Yes, we knew we had a wet basement now and then but didn't realize a 100 year rain would cause such a problem. Other surprises are $ here and there for automobile repairs. Our plan allows for up to $10k per year on such expenses so spending the money wasn't a surprise, it's what we spend the money on, and when, that's eluded us.

A former co-worker initially retired at the same time as me in 2011. However, he went back to work because he didn't feel comfortable with rising medical insurance costs and was equally uncomfortable with unplanned expenses such as a new water line from the water meter to his house, a new water heater, and the possibility of more unforeseen outlays. I suggested that he plan for the unexpected but that just didn't sit well with him.

As braumeister said, you need a cushion. You don't want a modest withdrawal rate increase to kill your plan.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

My health insurance costs have been the most unstable in my nearly 9 years of ER. They rose by a lot in the first few years, way more than I had planned for, then dropped a lot when I voluntarily made myself underinsured for a few years until the ACA's exchanges went into effect. Then my HI costs returned to their 2009 levels and have increased at more usual paces.

I had my big spike in medical costs in 2015 with my 2-week hospital stay, then had a smaller spike last year with some extra dental work and some added costs related to a minor shoulder ailment.

To counter this, I have always had a buffer, or cushion, in my budget to cover these small, unforeseen expenses. This was always part of my ER plan when I was putting together the budget back in 2008. One strict condition of my ER was that there would be no change to my everyday life as far as general spending patterns go. My other expenses have been pretty much as I expected them to be.

One adjustment I have had to make to my ER plan, one I always thought would happen at some point, was that I would have to start taking my quarterly stock fund's dividends in cash instead of reinvesting them. This was caused by the slightly declining monthly dividend from my big bond fund. I made this change a few years ago.

I had my big spike in medical costs in 2015 with my 2-week hospital stay, then had a smaller spike last year with some extra dental work and some added costs related to a minor shoulder ailment.

To counter this, I have always had a buffer, or cushion, in my budget to cover these small, unforeseen expenses. This was always part of my ER plan when I was putting together the budget back in 2008. One strict condition of my ER was that there would be no change to my everyday life as far as general spending patterns go. My other expenses have been pretty much as I expected them to be.

One adjustment I have had to make to my ER plan, one I always thought would happen at some point, was that I would have to start taking my quarterly stock fund's dividends in cash instead of reinvesting them. This was caused by the slightly declining monthly dividend from my big bond fund. I made this change a few years ago.

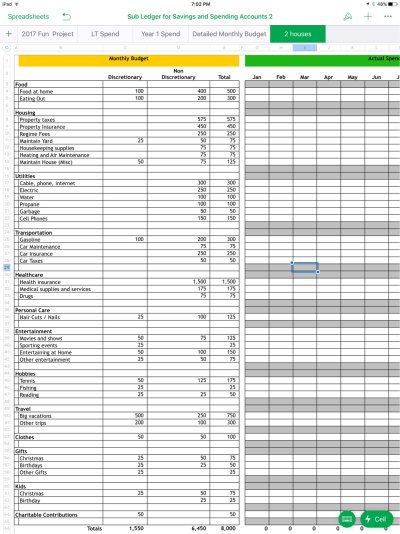

I don't see a category for big occasional expenses (what I referred to earlier as "once in a while").

By which I mean a new roof, a new car, a bucket list vacation, a sudden new HVAC system, etc.

By which I mean a new roof, a new car, a bucket list vacation, a sudden new HVAC system, etc.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

"Were expenses what you thought after you retired?"

They were higher, significantly higher. Good thing I had reserves.

Well, the truth is that, if I did not have the reserves, I would not have spent as much.

They were higher, significantly higher. Good thing I had reserves.

Well, the truth is that, if I did not have the reserves, I would not have spent as much.

Blue Collar Guy

Thinks s/he gets paid by the post

My expenses are in line with what I thought. As you can tell from my signature line its the opposite of what your worried about.

Rustic23

Thinks s/he gets paid by the post

suggestion for replacement cost spread sheet:

List all items that fall into this category i.e. car, roof, appliances, riding mower, etc.

How old is each of these

How long should a new one last

Life expectancy of current item

Divide Cost new by Life Expectancy (This is the amount you must save/ have available to meet this expected expense)

Add them all up. This is what you have to save each year to replace these items.

If you really want to get anal, add an inflation factor. Might be ok for roof and such but I would not bother for the small stuff..

List all items that fall into this category i.e. car, roof, appliances, riding mower, etc.

How old is each of these

How long should a new one last

Life expectancy of current item

Divide Cost new by Life Expectancy (This is the amount you must save/ have available to meet this expected expense)

Add them all up. This is what you have to save each year to replace these items.

If you really want to get anal, add an inflation factor. Might be ok for roof and such but I would not bother for the small stuff..

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Overall our expenses have been much less than we planned, except some health care years were more expensive. The ACA gave us some really low medical expense years so overall we've probably done better than planned on that front, too. The longer we are off the more time we have to optimize and tweak the budget, make the house more water and energy efficient, find the best places to shop for groceries and clothes, implement sustainable living projects, find free events for entertainment, etc.

Last edited:

mamadogmamacat

Full time employment: Posting here.

- Joined

- Dec 27, 2012

- Messages

- 751

Spending a modest amount more on eating out and entertainment than planned. Well worth it. Spending a bit less on things like utilities (estimated inflation on these was less than expected for my two yrs into ER) and taxes than planned, and this makes up for the additional spending on fun stuff. HC premiums are almost exactly as planned for, even with the increases (medical premium was $583 first month of ER, and will be $647 starting in August) for inflation, which were in the planning. MY OOP cost, apart from the premiums themselves, is half what I planned for, mainly for prescriptions, but also I'm at the doctor less as ER has been so much less stressful than work was, I don't get run down as often and therefore subject to illness.Even with some unplanned home expenses, I am spending right in the middle of my planned budget range. I do expect this to change as I age, especially the spending on prescriptions and the frequency of doctor visits. My hope is that the change will not be too severe so quality of life remains good (a more serious concern for me than just the expense) and once medicare kicks in the premiums should be less of an expense.

Last edited:

Agree with others about having $$ set aside for one-time expenditures, as you apparently have. Also I would add a contingency of 15-20% for "unknown" things you might need or want. So far our spending has been in line with expectations, slightly more than pre-ER excluding savings and taxes, since we have more free time. We increased our travel and entertainment budget by about 70%. It really helps if you have your actual historical spending to base your retirement budget on.

Overall total is pretty close to my original plan. We spend a lot more than I expected on "groundskeeping" - mainly removing and replacing trees. In the last 10 years we've taken out maybe 75 trees and planted about 25. Still have 40-50 trees to go and may have to replace those 1 for 1 due to critical area rules.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No expense surprises here and definitely no need to pinch pennies. Income taxes were much lower than I expected but other than that no surprises. We did decide to make some major purchases (built two-car garage and winter condo) that were not part of the plan but if we couldn't afford them we wouldn't have done them.

We have used Quicken to track income and expenses for years so we had a good handle on what our lifestyle costs were. Had we not had Quicken I would have done a deep dive into what we spent the two years before retiring to develop a retirement budget.

We have used Quicken to track income and expenses for years so we had a good handle on what our lifestyle costs were. Had we not had Quicken I would have done a deep dive into what we spent the two years before retiring to develop a retirement budget.

Last edited:

Similar threads

- Replies

- 42

- Views

- 4K

- Replies

- 15

- Views

- 807

- Replies

- 24

- Views

- 2K