Our DD and her DH have asked us to help them select investments for their Roth in Vanguard.

Their retirements accounts total about 70k currently, in Roth IRA's and 401's. They are 29 and 30 respectively, have a healthy equity balance in their home and a decent emergency fund. They fully fund IRAs each year and do 401Ks up to the match amounts.

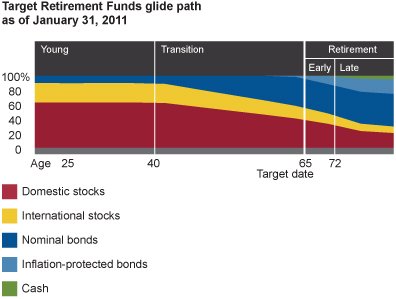

We are thinking 75/25 stocks/bonds overall is a good mix right now and they are comfortable with that. What funds would you recommend within Vanguard if these were your kids? They want growth and hope to retire at 55!

Their retirements accounts total about 70k currently, in Roth IRA's and 401's. They are 29 and 30 respectively, have a healthy equity balance in their home and a decent emergency fund. They fully fund IRAs each year and do 401Ks up to the match amounts.

We are thinking 75/25 stocks/bonds overall is a good mix right now and they are comfortable with that. What funds would you recommend within Vanguard if these were your kids? They want growth and hope to retire at 55!