I notice that my recent test did not bring up the spreadsheets (links on results page).

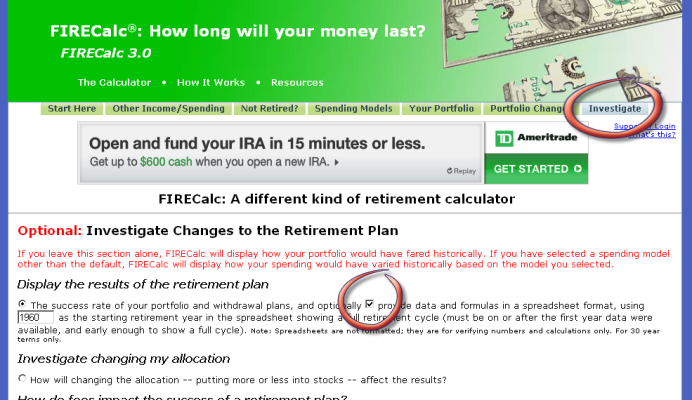

Make sure to click on the investigate tab and check the box to provide data in spreadsheet format. See the attachment for location of these.

Is the FIRECalc development continuing?

In the last push on FIRECalc we cleaned up a lot of stuff but made zero changes to the logic (code) that powers the results. We then applied a new look/feel to the front end form which collects the data (

link). What we discovered is that the new look which is more of a simple walk through process lacks space for providing users with details about each field. The currently live version is loaded with helpful text about each field and we need a way to show that while also keeping things simple. I feel the new skin looks nice but lacks the ability to show details about each field in an efficient manner.

Our plan is to go back to the drawing board to try and come up with another revision that would have a simple form on the left (about 2/3 of the space) and then an area on the right (1/3) of the space which would display text about each field when you click on it. Our designer has a 5 week old baby and has limited time at the moment. No ETA on the next iteration of the front end design is available at this time.

Keep in mind the above is all just front end input changes and does not change any of the calculations.

When it comes to the logic of what is going on with the calculator, I have yet to find a programmer capable and willing to tackle this project at a reasonable cost. It's a big project and needs to be done right.

To be honest, many other calculators have sprung up in the decade since FIRECalc came on the scene, many of which were built with multi-million dollar budgets by the large custodians. It would be unrealistic to think that we will be able to expand the logic of the calculations to handle some of the more sophisticated modeling that some of those other calcs will do with such a limited budget. I recall a discussion on here where people were discussing what they like from each and FIRECalc was respected for what it does but if you want to dig deeper into more complex scenarios then maybe one of the others would be better. IIRC one was not available to the public, only clients of the custodian.

Once we get the next iteration of the front end done then we will look at the change requests and knock out any low lying fruit. After that we will have to analyze the code and see what can be done to re-factor it to an architecture that will allow for changes to be made more easily.