It can't fail, because your report told you that 3.3% was 100% successful in all periods, and this is just one of those periods.

I think you are making a mistake here. ...

I'll be concise and factual -

no, I'm not mistaken.

Now I'll add, I appreciate when people point out mistakes I make - that's how I learn. But in this case, I'm not mistaken.

The tool will tell you 100% success in all periods that are in the historic dataset. If history repeats itself, you are covered! But, your upcoming retirement STARTS now, so it covers periods that are NOT YET IN THE DATASET. The 100% success in the historic record is NOT a guarantee of 100% in the future.

I fully realize that my postings on this subject are repetitive, yet, I add to that repetition by attempting to point out the plainly obvious in each post, that my comments are

within the historical data set. I mean, really, how could it be otherwise? This gets to the point that I feel I will be attacked for being condescending, you can't win!

In that same post, I said (bold mine):

Of course, this is just a strict reading of the numbers...

but you can't fail within that data set.

And I mention something similar in every post I made to this thread (bold mine):

think about how a historical reporter like FIRECalc works,

Actually, that is not true (historically).

Historically, it has to work. If I had 100% success at all points in history, then I had... 100% success at all points in history!

We know the future may look different,

But when applied to the historical data,

... though clearly it is only a look at history

Was I unclear?

Moreover, a 100% success in FIRECalc with more near misses is not the same as a 100% success with no near misses. If all you see is 100%, you are not necessarily comparing two equal scenarios.

I addressed this in my post as well (once again, emph mine):

If we want to look at this in a more general sense, increasing your withdrawal will of course reduce your portfolio in relative terms going forward. It may bring you closer to failure,

If after a more careful reading, and attempt at understanding my posts, you have some supported reasons to inform me that my analysis of

what FIRECalc tells us about the historical data is somehow flawed, misleading, or unclear, please help me by pointing those out, so I can clarify, or correct myself....

another datapoint that I look at with firecalc is the lowest value the the portfolio reaches @ 100% success rate. ...

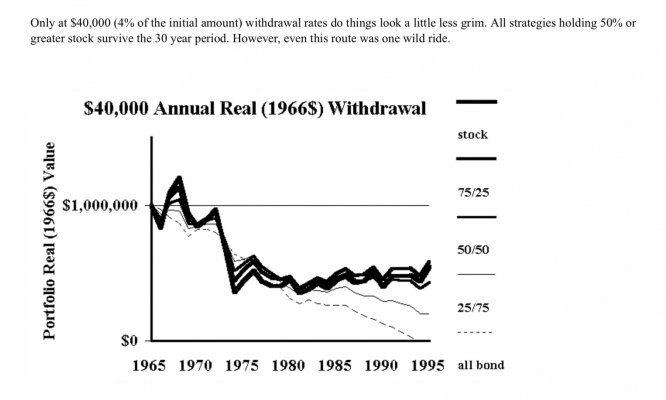

Agree, looking at the dips can be very informative. I suspect that many here have not fully appreciated how deep those dips can go, even with a conservative approach and variable withdrawals. I started a thread on this, probably years ago, try searching for 'scary dips'.

If I am getting down to one or two years of expenses, I know my margin is small to failure. If it is large, there is already a buffer built in vs historical. ....

Well, one to two years is probably too late to react, but yes, a look forward is a prudent step. I think the modified-RMD type approaches are a valuable analysis. in overly-simple terms, if your life expectancy is not expected to exceed 15 years, you want at least 15x portfolio, conservatively invested.

bold mine...

... If the future is worse than historical, FC doesn't help much.

Sure it does. It gives you something to use as a base. How you account for future unknowns is up to you.

If you plan to vacation somewhere, it can be helpful to know the average, and record high/low temperatures for the time you will be there. A new record may be set while you visit, and how you plan for that is up to you, but I sure would not ignore history -

it is useful.

.... But when valuations are high and interest rates are low, I still maintain that firecalc will understate your failure rate if it shows one. ...

A thousand times, no! Again, this is not my opinion, this is fact (assuming no actual calculation or data table errors in FIRECalc).

The failures that are shown

are from those bad periods. It doesn't understate them, it states them!

Personally, my planning consisted of saving 25 times spending and investing to keep pace with inflation. I don't need any equities to do that. Any funds in excess of 25X are invested in equities. It's as good as any plan I have seen. No guarantees of course.

I'm curious if you can really expect the 25x portion to keep pace with inflation if not invested in some equities (that much in TIPS?). But if the above 25x is in equities, and is large enough, that would probably work (historically).

-ERD50