audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We have two individual (separate) HSA accounts, and separate (individual) HSA qualified health insurance plans, and we are each over 55.

When I calculated our contribution limits for 2014, I used the family HSA limits of $6550, and added two 55+ contributions of $1000, for a total of $8550, and then divided by 2. So we each contributed $4275 to our HSA account in 2014.

After copious research I had gotten the strong impression that the family limit applied in our case, so I used that limit.

Well, the 2014 tax return didn’t figure it that way (computed by Turbotax). Two separate 8889 Forms used $4300 as the limit for excess contributions. This corresponds to the single limit of $3300 plus 55+ contribution of $1000.

So we each under contributed by $25 for 2014.

Maybe all these articles about couples assume that they always have a combined health insurance policy? When to apply “individual” and when to apply “family” limits is very confusing.

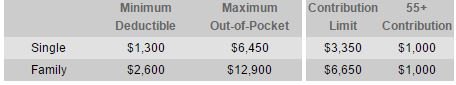

For 2015, family contribution limit is up $100 to $6,650, and individual is up $50 to $3,350. So I would normally increase our contribution each by $50 this year. But since we were behind by $25 in 2014, sounds like we can increase our contribution by $75 for 2015.

So is the moral of the story - family limits only apply for family insurance plans? If a couple has separate (individual) health insurance plans and separate HSA accounts, then the single limits apply?

When I calculated our contribution limits for 2014, I used the family HSA limits of $6550, and added two 55+ contributions of $1000, for a total of $8550, and then divided by 2. So we each contributed $4275 to our HSA account in 2014.

After copious research I had gotten the strong impression that the family limit applied in our case, so I used that limit.

Well, the 2014 tax return didn’t figure it that way (computed by Turbotax). Two separate 8889 Forms used $4300 as the limit for excess contributions. This corresponds to the single limit of $3300 plus 55+ contribution of $1000.

So we each under contributed by $25 for 2014.

Maybe all these articles about couples assume that they always have a combined health insurance policy? When to apply “individual” and when to apply “family” limits is very confusing.

For 2015, family contribution limit is up $100 to $6,650, and individual is up $50 to $3,350. So I would normally increase our contribution each by $50 this year. But since we were behind by $25 in 2014, sounds like we can increase our contribution by $75 for 2015.

So is the moral of the story - family limits only apply for family insurance plans? If a couple has separate (individual) health insurance plans and separate HSA accounts, then the single limits apply?