Does anyone know how to fund a Fidelity HSA directly from one's taxable Fidelity account? I'm in a qualified HDHP, haven't made my $4450 HSA contribution yet and would prefer to just put the money in a new Fido HSA. I can't see how to do this. Am I not to fund an HSA this way?

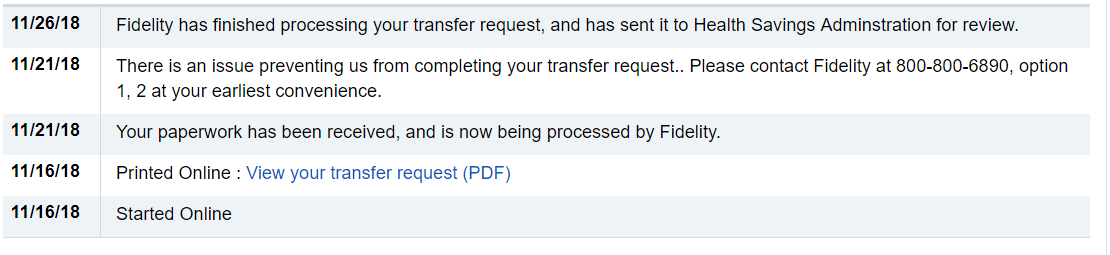

I see the option to transfer between Fidelity accounts, including the HSA, using this link https://www.fidelity.com/customer-service/how-to-transfer-between-accounts