kumquat

Thinks s/he gets paid by the post

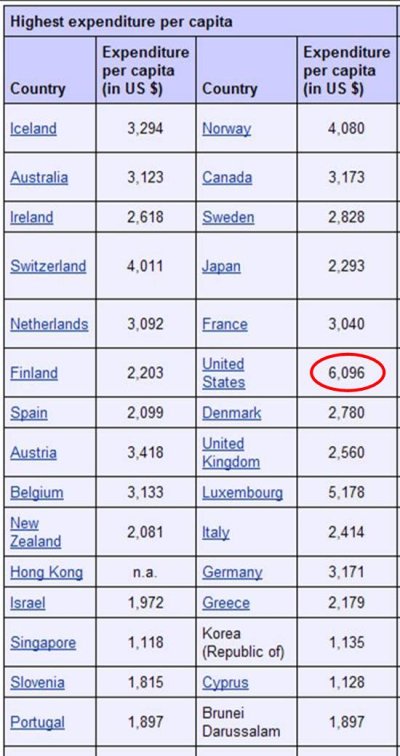

My understanding they have a pension that sounds considerably more generous (retire earlier, with more money and UHC) than US Soc Security, but I'm sure one of the natives can fill us in, eh?

For retirees, Canada has:

OAS (Old Age Security) ~6K/year, taxed back if other income is high enough

GIS (Guaranteed Income Supplement) ~7K/year depends on income

CPP/QPP (Canada/Quebec Pension Plan) max ~11K, depends on contributions while working, much like your SS

I have no idea how this compares to the US but am curious

BTW, OAS and GIS at 65. CPP at 60 (benefits drop ~6%/year that you are younger than 65)

Edit to add:

There are tax deferred ways of saving your own money (similar to your 401K?) but it's still your savings.

Last edited: