|

|

08-03-2016, 06:58 AM

08-03-2016, 06:58 AM

|

#41

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,376

|

You're just plain wrong on that... the ACA included a protection against health insurers trying to gouge customers by requiring that 80% of premiums be paid out in claims.. with the remaining 20% available for overhead and profit. In fact, there are notable instances where the insurer's exceeded this threshold and (as required under the law) sent refunds for the excess.

So while it is easy for the uninformed to perceive that the problem is greedy health insurers, those protections ensure that doesn't happen. Sorry to disappoint you.

Quote: Quote:

|

A basic financial measurement used in the Affordable Care Act to encourage health plans to provide value to enrollees. If an insurer uses 80 cents out of every premium dollar to pay its customers' medical claims and activities that improve the quality of care, the company has a medical loss ratio of 80%. A medical loss ratio of 80% indicates that the insurer is using the remaining 20 cents of each premium dollar to pay overhead expenses, such as marketing, profits, salaries, administrative costs, and agent commissions. The Affordable Care Act sets minimum medical loss ratios for different markets, as do some state laws.

|

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

08-03-2016, 07:05 AM

08-03-2016, 07:05 AM

|

#42

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,726

|

Quote: Quote:

Originally Posted by pb4uski

What I don't get is why the individual market isn't the same as having one big, diverse group. The plus is that the insurer gets to adjust premiums for age (unlike group) with a corresponding minus that they need to bill and collect individually (somewhat unlike group). Perhaps we need to have the marketplaces do signup and premium billing and collections and reinsure the claim risk and claim administration to the health insurers, similar to how some large groups work.

|

It is, sort of. Composed mostly of people who were denied insurance because they had health problems. When the ACA was passed there was a type of reinsurance to help insurers deal with too many claims, but that was retroactively de-funded after the fact. Now there is no reinsurance and each state individual market is separate from all other groups in the state and all other states. This is not really insurance (like life or homeowners), it is more like healthcare intermediation between users and providers.

This problem with ACA insurance coverage is not happening in California, Florida, downstate NY or upstate Illinois, where there are higher population densities and State Insurance commissions more active in dealing with the insurers. It is taking place across the country where populations are more spread out. In all the areas where insurers are withdrawing their ACA coverage they continue to provide policies for group, Medicare and Medicaid.

I don't think we have enough information to determine why this is happening, as there has been no public scrutiny at all on the insurers, and the last two announcements about ACA plans came after the insurers were denied permission to merge. There should be no doubt, though, that if an insurer is going to measure profitability just on individual plans in states like Montana, Wyoming, Alaska, etc., then coverage in those areas will be challenging.

More effort needs to be put into defining larger groups and dismantling the artificial barriers that separate inssured population into smaller insured groups. Otherwise people living in low density and rural areas will always be unfairly disadvantaged.

|

|

|

08-03-2016, 07:06 AM

08-03-2016, 07:06 AM

|

#43

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2003

Location: Florida's First Coast

Posts: 7,723

|

Quote: Quote:

Originally Posted by pb4uski

You're just plain wrong on that... the ACA included a protection against health insurers trying to gouge customers by requiring that 80% of premiums be paid out in claims.. with the remaining 20% available for overhead and profit. In fact, there are notable instances where the insurer's exceeded this threshold and (as required under the law) sent refunds for the excess.

So while it is easy for the uninformed to perceive that the problem is greedy health insurers, those protections ensure that doesn't happen. Sorry to disappoint you.  |

Ouch!

I meant NON ACA Plans. The Individual Private NON Employee subsidized.

Without ACA I for one am insurable. I was Quoted a silly number when I tried for individual Non ACA Coverage.

__________________

"Never Argue With a Fool, Onlookers May Not Be Able To Tell the Difference." - Mark Twain

|

|

|

08-03-2016, 07:30 AM

08-03-2016, 07:30 AM

|

#44

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,376

|

Perhaps, but the MLR restrictions apply to all health insurance plans... even group (but 85% rather than 80%). if does not apply to employer self funded plans where the insurer provides claim administration for a fee along with stop-loss coverage.

Quote: Quote:

Health insurers collect premiums from policyholders and use these funds to pay for enrollees’ health care claims, as well as administer coverage, market products, and earn profits for investors. The Medical Loss Ratio provision of the ACA requires most insurance companies that cover individuals and small businesses to spend at least 80% of their premium income on health care claims and quality improvement, leaving the remaining 20% for administration, marketing, and profit.1, 2 The MLR threshold is higher for large group plans, which must spend at least 85 percent of premium dollars on health care and quality improvement. .....

The MLR provision of the ACA applies to all types of licensed health insurers, including commercial health insurers, Blue Cross and Blue Shield plans and health maintenance organizations. The provisions apply to all of an insurer’s underwritten business (i.e. when risk is transferred to the insurer in exchange for premium), including plans that were grandfathered under the ACA. Health insurance provided by an insurer to an association or to members of an association is subject to the MLR provision.

|

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

08-03-2016, 08:23 AM

08-03-2016, 08:23 AM

|

#45

|

|

Full time employment: Posting here.

Join Date: Sep 2010

Location: Orlando, Fl

Posts: 952

|

Wendall Potter previously work for Cigna and has a blog that is sometimes reprinted in Huffington Post. He provides some data about insurance company profits, and describes some possible consequences of Anthem wanting to buy Cigna, and Aetna wanting to buy Humana.

It's Way Past Time For Us To Stop Deluding Ourselves About Private Health Insurers?

Having worked in health care for over 30 years I am very jaded about our health care system. Providers and researchers want to help people. They are most definitely at odds with pharmacy companies, insurance companies, and hospital systems who just want to make money. As a VP of a hospital, I worked in the no-man's land between providers and hospital administration for many years....it was no fun.

__________________

"Some people describe themselves as being able to see things as a glass half full. For some, the glass is half empty. Me? I can't even find the f***king glass."

Silver

|

|

|

08-03-2016, 08:38 AM

08-03-2016, 08:38 AM

|

#46

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2007

Posts: 9,962

|

Quote: Quote:

Originally Posted by MichaelB

This is only individuals not eligible for healthcare from employers, Medicare, Medicaid, or TriCare. About 15% of US population.

If we could "self-insure" and pay health care providers the same rates the insurers get it would be different. Self-payers, however, are charged 10x - 15x more, for no good reason (other than unbridled greed) with no regulation or guardian angel to help.  |

I see this number all the time, yet I wonder how they arrive at the stats. More then a few companies have such pricey plans that offer employees no options. My young nephew works for one of the largest privately owned companies in the US. He is a low management level employee he's only 25. He makes a decent wage compared to the front line retail helpers. Yet, the insurance offered him would have taken the equivalent of 30% of his paycheck. He opted out and went private pay,makes too much for ACA. So when hiring this company brags they have employee health care and yet that is not the whole story.

Believe me there are a huge amount of people who are paying more for less insurance thru their workplace.

|

|

|

08-03-2016, 09:17 AM

08-03-2016, 09:17 AM

|

#47

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,376

|

Quote: Quote:

Originally Posted by ivinsfan

I see this number all the time, yet I wonder how they arrive at the stats. More then a few companies have such pricey plans that offer employees no options. My young nephew works for one of the largest privately owned companies in the US. He is a low management level employee he's only 25. He makes a decent wage compared to the front line retail helpers. Yet, the insurance offered him would have taken the equivalent of 30% of his paycheck. He opted out and went private pay,makes too much for ACA. So when hiring this company brags they have employee health care and yet that is not the whole story.

Believe me there are a huge amount of people who are paying more for less insurance thru their workplace.

|

Even though he makes too much for ACA subsidies, since his insurance is unaffordable (more than 8.15% of his income) he would qualify to buy ACA catastrophic coverage through his exchange. In most cases, particularly at his age, catastrophic coverage is reasonably affordable and if he is in good health, a good fit for someone his age.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

08-03-2016, 09:26 AM

08-03-2016, 09:26 AM

|

#48

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2008

Posts: 7,438

|

Aren't there still a lot of states which refused to set up exchanges?

A lot of these southern states sound like those which wouldn't have set up exchanges.

|

|

|

08-03-2016, 09:28 AM

08-03-2016, 09:28 AM

|

#49

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,726

|

Quote: Quote:

Originally Posted by explanade

Aren't there still a lot of states which refused to set up exchanges?

A lot of these southern states sound like those which wouldn't have set up exchanges.

|

The Federal marketplace Exchange is used in any case a state chooses not to set up it's own exchange.

|

|

|

08-03-2016, 09:38 AM

08-03-2016, 09:38 AM

|

#50

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by pb4uski

You're just plain wrong on that... the ACA included a protection against health insurers trying to gouge customers by requiring that 80% of premiums be paid out in claims.. with the remaining 20% available for overhead and profit. In fact, there are notable instances where the insurer's exceeded this threshold and (as required under the law) sent refunds for the excess.

So while it is easy for the uninformed to perceive that the problem is greedy health insurers, those protections ensure that doesn't happen. Sorry to disappoint you.  |

+1

It's this HUGE misconception that focuses the public attention on the insurers and not the real problems that causes them to not get fixed.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

08-03-2016, 09:39 AM

08-03-2016, 09:39 AM

|

#51

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2007

Posts: 9,962

|

Quote: Quote:

Originally Posted by pb4uski

Even though he makes too much for ACA subsidies, since his insurance is unaffordable (more than 8.15% of his income) he would qualify to buy ACA catastrophic coverage through his exchange. In most cases, particularly at his age, catastrophic coverage is reasonably affordable and if he is in good health, a good fit for someone his age.

|

Even his high deductible HSA BCBS plan is affordable and offer him good coverage. However BCBS is pulling out of the exchange and individual plans in our state, so he will be shopping for new insurance once again.

|

|

|

08-03-2016, 09:45 AM

08-03-2016, 09:45 AM

|

#52

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Without cost control, how can this not happen? Private insurers do not work for free.

In a single-payer system, do government workers and bureaucrats work for free? In fact, if they do not take a profit and there's no competition, what is the incentive for them to control the costs?

There has to be cost control measures. Money supply is not unlimited, even for a government.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

08-03-2016, 09:52 AM

08-03-2016, 09:52 AM

|

#53

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2008

Posts: 7,438

|

Insurance is not the problem. They take in a small percentage of all health care spending.

Doctors, hospitals and big pharmaceutical companies take in much bigger slices of the pie.

Drugs which cost over $100k are becoming more and more common and they're not all fancy biopharmaceuticals.

|

|

|

08-03-2016, 10:20 AM

08-03-2016, 10:20 AM

|

#54

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,376

|

Quote: Quote:

Originally Posted by Silver

|

Well to begin with, Wendell Potter is a journalist by background. While he touts himself as an insurance industry executive, he was a corporate communications executive.... in my experience in industry not people who really understand the business. It would be like a journalist who becomes White House Press Secretary claiming credibility on complex foreign policy issues.

From the article:

Quote: Quote:

|

Here’s the bottom line: Aetna made significantly more money between April 1 and June 30 of this year than it made during the same period last year—far more than even those Wall Street analysts had expected (in other words, the profit “exceeded their expectations”). But Aetna executives said that because some of the people enrolled in the Obamacare exchanges were sicker than they had anticipated, consequently making it necessary for them to pay more in medical claims than they had wanted to pay—it was thinking about pulling out of a lot—maybe even most—of the Obamacare markets next year.

|

Second, he seems to believe that Aetna should retain a losing product because it is making money elsewhere. That is stupid and no company, health insurance or otherwise, would continue to offer an unprofitable or less profitable product.... they will smartly allocate their capital that is provided by shareholders and for which shareholders expect a return.. to more profitable products and business opportunities regardless of the public good. Be it right or wrong, Aetna's responsibility is to its shareholders... not to continue to write ACA plans that are unprofitable or even if profitable, less profitable than other business alternatives available to it.

Finally, he seems to think that Aetna is hugely profitable. While the numbers are big because it is a big company and moron journalist focus on numbers because they can command more attention... the numbers need to be assessed in relative terms. Aetna's ROE is in the mid-to-high teens over the last few years... solid but not outrageous... and declined to 14.7% for the most current quarter... again solid but not outrageous and in line with ROEs for their health insurance peers.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

08-03-2016, 01:21 PM

08-03-2016, 01:21 PM

|

#55

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by explanade

Insurance is not the problem. They take in a small percentage of all health care spending.

Doctors, hospitals and big pharmaceutical companies take in much bigger slices of the pie.

Drugs which cost over $100k are becoming more and more common and they're not all fancy biopharmaceuticals.

|

The patients are also a big part of the blame. They clamor for drugs that cost $100K's just to prolong people's life for a month or two, and not without hideous side effects. They want a chance to live forever, costs be damned.

If an insurance balks at paying for some experimental drugs, the public decries it and says the insurer is heartless and all for profits. If a government refuses to allow the drug, it is called a "death panel".

Doctors know that the drugs are not that great, but how can they say no to pleading desperate patients? Some doctors at Sloan-Kettering did, but I guess the patients just went elsewhere.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

08-03-2016, 02:35 PM

08-03-2016, 02:35 PM

|

#56

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2008

Posts: 7,438

|

I really doubt those expensive drugs only prolong for a month or two.

The most expensive drugs are for Hepatitis C, which is an infectious disease. It's curable and preventable, though in many cases, patients don't know they have it:

Quote: Quote:

This week my patient died from a curable, preventable disease.

I met John, a 61-year-old man when came to me for hepatitis C treatment. John had been shocked to find he had hepatitis C during a routine screening test which is recommended for all Baby Boomers , regardless of risk factors. Unfortunately, like John, at least half of the more than 3 million Americans with hepatitis C don’t know they are infected. By the time of diagnosis, John already had severe liver scarring, known as cirrhosis, meaning hepatitis C had been silently at work for many years.

As an infectious diseases physician, I love treating hepatitis C because unlike many chronic diseases, I can actually cure most patients. John was delighted to hear that his disease should be curable and that his liver damage could even improve after treatment. Despite the high price of hep C treatment, I reassured John that medications would be available through insurance because of his cirrhosis. Unfortunately treatment is still not available for many patients with less advanced disease, even though we know all hepatitis C patients can benefit from being cured.

I sent John for a scan to look for liver cancer, which can be caused by cirrhosis. We were both devastated to find that he had a large liver cancer which was not curable. Despite aggressive care, he died of complications from his liver cancer.

|

Hepatitis C is Curable | Perspectives | Perspectives | KQED

It sounds like the author of the article is saying insurance won't pay for the expensive drugs until the Hepatitis C advances to a certain stage. But if you don't treat it, then the patient is vulnerable to liver cancer.

Gilead owns the rights to Solvadi but it didn't develop it. Instead it acquired the company which had developed it. Pharmasset, the original developer, intended to charge less than half of what Gilead charges now:

Quote: Quote:

The U.S. Senate Finance Committee launched an investigation into Sovaldi and Harvoni that concluded in late 2015, finding that “Gilead’s own documents and correspondence show its pricing strategy was focused on maximizing revenue — even as the company’s analysis showed a lower price would allow more patients to be treated.”

“Review of company documents reveals that the return on investment for acquiring Pharmasset and additional research and development were not key considerations in determining the pricing of these drugs,” the report said, though it noted that Gilead spent billions of dollars acquiring the drug’s developer and hundreds of millions in the clinical trial and FDA approval process.

Gilead said in a statement that the prices of its two list-topping drugs “reflect the innovation of the medicines,” because by curing hepatitis C, they realize “significant savings to the health-care system over the long-term.”

|

This is the most expensive drug in America - MarketWatch

|

|

|

08-03-2016, 02:53 PM

08-03-2016, 02:53 PM

|

#57

|

|

Full time employment: Posting here.

Join Date: Dec 2013

Posts: 774

|

"Money supply isn't unlimited even for government" I don't think they got the memo

|

|

|

08-03-2016, 03:15 PM

08-03-2016, 03:15 PM

|

#58

|

|

Full time employment: Posting here.

Join Date: Sep 2010

Location: Orlando, Fl

Posts: 952

|

Quote: Quote:

Originally Posted by pb4uski

Well to begin with, Wendell Potter is a journalist by background. While he touts himself as an insurance industry executive, he was a corporate communications executive.... in my experience in industry not people who really understand the business. It would be like a journalist who becomes White House Press Secretary claiming credibility on complex foreign policy issues.

From the article:

Second, he seems to believe that Aetna should retain a losing product because it is making money elsewhere. That is stupid and no company, health insurance or otherwise, would continue to offer an unprofitable or less profitable product.... they will smartly allocate their capital that is provided by shareholders and for which shareholders expect a return.. to more profitable products and business opportunities regardless of the public good. Be it right or wrong, Aetna's responsibility is to its shareholders... not to continue to write ACA plans that are unprofitable or even if profitable, less profitable than other business alternatives available to it.

Finally, he seems to think that Aetna is hugely profitable. While the numbers are big because it is a big company and moron journalist focus on numbers because they can command more attention... the numbers need to be assessed in relative terms. Aetna's ROE is in the mid-to-high teens over the last few years... solid but not outrageous... and declined to 14.7% for the most current quarter... again solid but not outrageous and in line with ROEs for their health insurance peers.

|

I take no issue with what you say, but I found his primary focus to be something different.

From the article:

"The country’s private health insurers have been doing a lousy job of controlling medical expenses for many years. It is the big failure of our multi-payer system that insurance company executives hope we will never catch on to.

The truth: Because we have many private insurers, none of them—not even the big ones like Aetna—have enough leverage with drug companies and huge hospital systems to strike a decent bargain on behalf of their customers. Yet we continue to be deceived by industry propagandists like I used to be and hold as a tenet of faith that competition among our many insurers will somehow magically control costs. (What insurers actually do is try to predict how much they think medical costs will rise in the future and jack up their premiums a few percentage points above that to ensure a profit.) "

My take is that his finger is pointed more at the greed of drug companies and larger hospital systems than insurance companies, and that with our current system, there is little to no negotiation with them related to cost containment.

We all talk about needing to control the cost of health care. HMO's were suppose to help with that when they started in the 1980's, but costs have continued to climb. So...how should costs be contained?

__________________

"Some people describe themselves as being able to see things as a glass half full. For some, the glass is half empty. Me? I can't even find the f***king glass."

Silver

|

|

|

08-03-2016, 05:00 PM

08-03-2016, 05:00 PM

|

#59

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2014

Location: South central PA

Posts: 3,486

|

Quote: Quote:

Originally Posted by Silver

Wendall Potter previously work for Cigna and has a blog that is sometimes reprinted in Huffington Post. He provides some data about insurance company profits, and describes some possible consequences of Anthem wanting to buy Cigna, and Aetna wanting to buy Humana.

It's Way Past Time For Us To Stop Deluding Ourselves About Private Health Insurers?

Having worked in health care for over 30 years I am very jaded about our health care system. Providers and researchers want to help people. They are most definitely at odds with pharmacy companies, insurance companies, and hospital systems who just want to make money. As a VP of a hospital, I worked in the no-man's land between providers and hospital administration for many years....it was no fun. |

The CEO of our hospital/health system told a pediatric group in the system that they had too many Medicaid patients and that it was a "quality of care" issue. So now the "quality of care" problem was transferred to newborns whose parents couldn't find any pediatricians who take the insurance.

My aunt's estate had to pay back her Medicaid. My cousin had me review her itemized bill from Medicaid. The most outrageous charges were the hospital room charges ($3000) for a pre-op room, and some drugs. BTW, OxyContin was $400+ a month. The doctor charges were predictable, at least.

Sent from my iPhone using Early Retirement Forum

|

|

|

08-03-2016, 08:40 PM

08-03-2016, 08:40 PM

|

#60

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by explanade

I really doubt those expensive drugs only prolong for a month or two.

The most expensive drugs are for Hepatitis C, which is an infectious disease. It's curable and preventable, though in many cases, patients don't know they have it...

|

Gilead and its Hepatitis C drug have been mentioned several times on this forum, but on the stock threads. Yes, the drug is expensive, but saves life and is much cheaper and surer than the alternative which is a liver transplant.

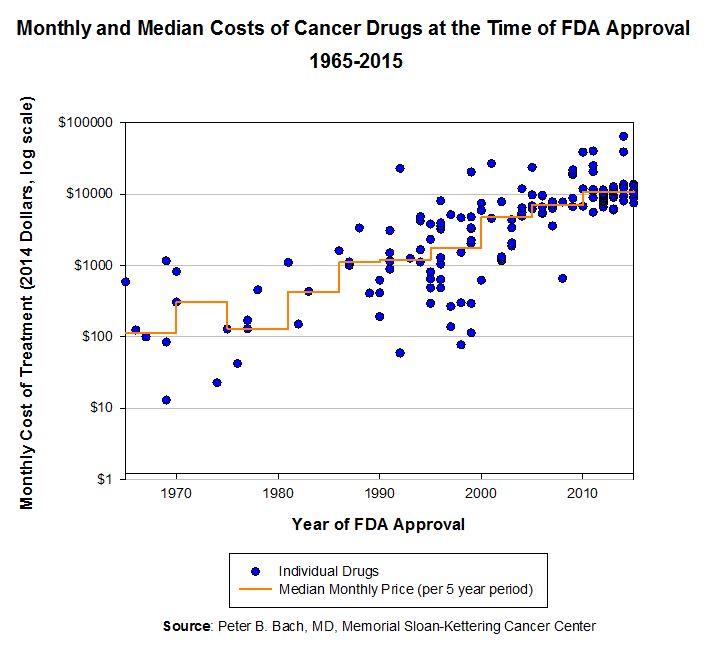

The ineffective expensive drugs that I talked about and that doctors of Sloan-Kettering Cancer Center refused to use are several last-ditch cancer drugs. I understand that many cancer patients take more than one drug.

Below is a chart prepared by Peter Bach, a doctor at Sloan-Kettering on that subject. Sloan-Kettering's Web site has the following statement about Dr. Bach.

In 2012, he and other physicians at MSK drew attention to the high price of a newly approved cancer drug and announced the hospital’s unprecedented move not to offer it to patients because of its high price tag with no notable improved clinical outcomes. Note the "no notable improved clinical outcomes".

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|