eytonxav

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

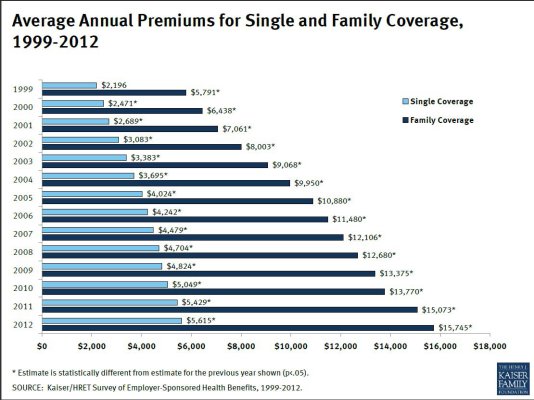

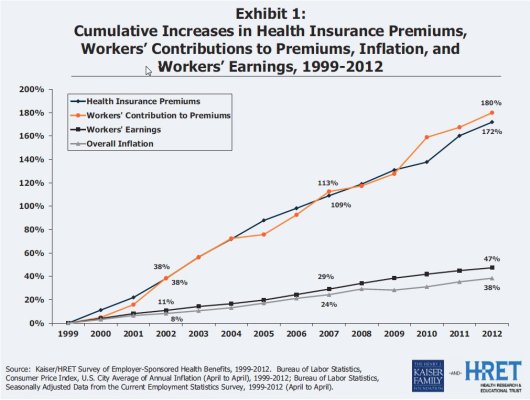

Just saw my price tag for my 2014 retiree medical and dental coverage (pre-medicare for DW and me) which is subsidized by my former mega corp at 64% and it increased 21% vs 2013. I can only imagine the cost driver behind this increase . I go on medicare in June of next year, so not sure how that might affect costs, as mega corp provides a medicare supplement and drug coverage, while DW will remain pre-medicare for another 5 years.

. I go on medicare in June of next year, so not sure how that might affect costs, as mega corp provides a medicare supplement and drug coverage, while DW will remain pre-medicare for another 5 years.

Don't think that ever happened when I was working.....

Don't think that ever happened when I was working.....