mickeyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Interesting article on new LTC study indicating that previous LTC research may have been inaccurate.

Only one out of five men and 1/3 of woman benefit from LTC. Why purchase it?

Fewer Need Long-term Care Insurance | Squared Away Blog

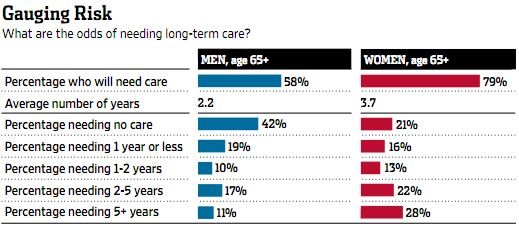

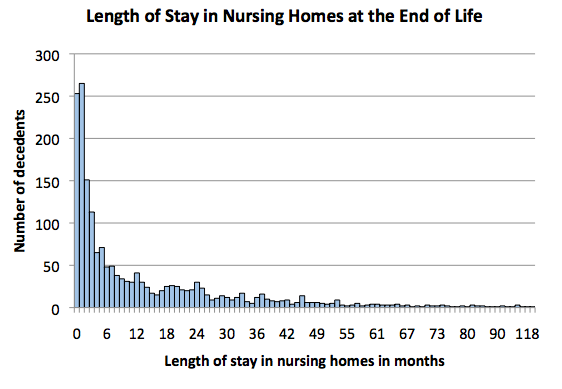

Undercutting this rationale is a new study led by senior economist Anthony Webb of the Center for Retirement Research, which sponsors this blog. He finds that U.S. nursing home stays are relatively short: 11 months for the typical single man and 17 months for a single woman. There’s some unpleasant news in the study, too, because the risk that an older person may one day need nursing home care is 44 percent for men and 58 percent for women.

Only one out of five men and 1/3 of woman benefit from LTC. Why purchase it?

But the new study added an assumption absent from previous attempts to estimate how many people might benefit from having insurance: Medicare also sometimes pays for shorter nursing home stays, accounting for about 15 percent of total long-term care spending.

Taking all of this into account, just 31 percent of women and 19 percent of men benefit from buying long-term care insurance – far fewer people than previous studies had estimated.

Fewer Need Long-term Care Insurance | Squared Away Blog