Very curious. On the healthcare.gov site. Comparing yesterday's results to today. Yesterday my monthly estimated tax credit was in excess of $2100. Today it has dropped to $826. I didn't change any of my particulars. Clearly the insurers are still tweeking the plans.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Preview of 2018 ACA plans is LIVE

- Thread starter Sue J

- Start date

GTFan

Thinks s/he gets paid by the post

The bad news for us is that BCBS being replaced by Ambetter has resulted in an over 100% increase for our Silver plan, which we're stuck with if we want to keep our docs in the WellStar network. Only other option is Kaiser which is all new docs.

The good news is that it's only going from $36/mo. to $77/mo. (for two mid-50s folks). Yes, that's because we're playing the MAGI game of keeping income below 150% of FPL. Premium subsidy a little more than $1300/mo. now so unburdened cost would be just shy of $1400/mo. 94% CSR'd plan means deductible/max OOP is $600pp with no copay for PCP and $5 for specialists.

*ducking*

The good news is that it's only going from $36/mo. to $77/mo. (for two mid-50s folks). Yes, that's because we're playing the MAGI game of keeping income below 150% of FPL. Premium subsidy a little more than $1300/mo. now so unburdened cost would be just shy of $1400/mo. 94% CSR'd plan means deductible/max OOP is $600pp with no copay for PCP and $5 for specialists.

*ducking*

Last edited:

SomedaySoon

Recycles dryer sheets

- Joined

- Sep 15, 2009

- Messages

- 99

Well here in Eastern PA

For 2016 our SLCSP was $489 each at age 57.

For 2017 our SLCSP was $1011 each at age 58.

For 2018 our SLCSP is $1414 each at age 59.

With this high subsidy we qualify for a BCBS Bronze plan at $0 at 400% FPL.

For 2016 our SLCSP was $489 each at age 57.

For 2017 our SLCSP was $1011 each at age 58.

For 2018 our SLCSP is $1414 each at age 59.

With this high subsidy we qualify for a BCBS Bronze plan at $0 at 400% FPL.

zinger1457

Thinks s/he gets paid by the post

- Joined

- Jul 22, 2007

- Messages

- 3,229

Very curious. On the healthcare.gov site. Comparing yesterday's results to today. Yesterday my monthly estimated tax credit was in excess of $2100. Today it has dropped to $826. I didn't change any of my particulars. Clearly the insurers are still tweeking the plans.

Yes, it does appear they are still tweaking it. When I looked at it on Wednesday they were basing the 2018 subsidy calculation on using the 2017 FPL number but it is now updated with the 2018 FPL number.

Last edited:

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,698

Yes, it does appear they are still tweaking it. When I looked at it on Wednesday they were basing the 2018 subsidy calculation on using the 2017 FPL number but it is now updated with the 2018 FPL number.

I was trying to find the maximum %-of-FPL figure used in the ACA subsidy calculation (not Alaska or Hawaii). In 2016 it was 0.0966 (9.66%). It has risen slightly each year since 2014. Do you or anyone else know what it will be for 2017?

ncbill

Thinks s/he gets paid by the post

Yes, we found that some insurers have a narrow network for the ACA marketplace plans.

One plan was called SummaCare Select and the network was the same as the non-ACA plans. They offered another plan for a lower amount that was called SummaCare Connect. The provider network was much smaller.

Here BCBS offers 'limited' &'broad' networks.

Since it was only around $1/day extra (strangely enough) I opted for the broad network with the plan I chose.

Last edited:

0.0969 is the 300%-400% FPL contribution percentage for 2017. It will be 0.0956 for 2018.I was trying to find the maximum %-of-FPL figure used in the ACA subsidy calculation (not Alaska or Hawaii). In 2016 it was 0.0966 (9.66%). It has risen slightly each year since 2014. Do you or anyone else know what it will be for 2017?

Reference: http://www.tribalselfgov.org/wp-con...d-Payments-for-ACA-Provisions-2017-06-06a.pdf

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,698

0.0969 is the 300%-400% FPL contribution percentage for 2017. It will be 0.0956 for 2018.

Reference: http://www.tribalselfgov.org/wp-con...d-Payments-for-ACA-Provisions-2017-06-06a.pdf

Thanks. Strange how the %-of-FPL goes down in 2018 after slow rises every year since 2014.

If you are interested in the detail of how the expected percentage of your income is determined, there is a chart in the instructions for IRS form 8962 which is where your subsidy gets reconciled at tax filing time. It's a sliding scale based on your % of FPL.

This is the instructions for 8962 for 2016 and the chart is on page 8.

https://www.irs.gov/pub/irs-pdf/i8962.pdf

The instructions for 2017 aren't out yet.

I haven't found a chart like this for 2018.

This is the instructions for 8962 for 2016 and the chart is on page 8.

https://www.irs.gov/pub/irs-pdf/i8962.pdf

The instructions for 2017 aren't out yet.

I haven't found a chart like this for 2018.

- Joined

- Oct 13, 2010

- Messages

- 10,733

I'm a low utilizer of medical services, so it has always made sense for me to get the cheapest plan to reduced the impact of a sudden, unexpected need for medical services. In years past, the price of the SLCSP compared to the HSA eligible Bronze was such that as my income varied, so did the amount I'd pay (after subsidy).

Because this year's SLCSP is so high, changing my income doesn't do anything (unless I go over 400% FPL, of course). My Bronze HSA policy is going to be "free" to me, after the PTC is applied.

I created a little spreadsheet that does the calculations in the Form 8962. I had to use the 2016 values for "Applicable Figure", but the spreadsheet results agree exactly with what I'm seeing on the healthcare.gov site.

8962 Spreadsheet If you're logged into Google, you can do "File > Make a Copy", then you can input your own values into the blue fields.

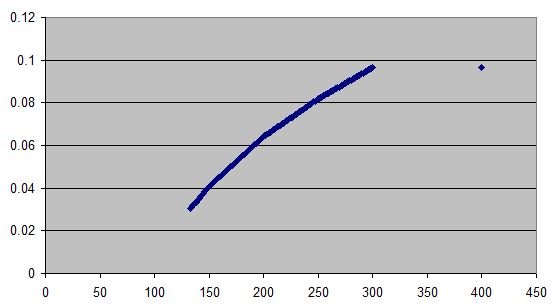

Just for grins, I plotted the values in the 8962 instructions.

Because this year's SLCSP is so high, changing my income doesn't do anything (unless I go over 400% FPL, of course). My Bronze HSA policy is going to be "free" to me, after the PTC is applied.

I created a little spreadsheet that does the calculations in the Form 8962. I had to use the 2016 values for "Applicable Figure", but the spreadsheet results agree exactly with what I'm seeing on the healthcare.gov site.

8962 Spreadsheet If you're logged into Google, you can do "File > Make a Copy", then you can input your own values into the blue fields.

Just for grins, I plotted the values in the 8962 instructions.

Attachments

Last edited:

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,698

Because this year's SLCSP is so high, changing my income doesn't do anything (unless I go over 400% FPL, of course). My Bronze HSA policy is going to be "free" to me, after the PTC is applied.

I created a little spreadsheet that does the calculations in the Form 8962. I had to use the 2016 values for "Applicable Figure", but the spreadsheet results agree exactly with what I'm seeing on the healthcare.gov site.

I have a similar set of calculations in my income tax skeleton spreadsheet. I don't have the fancy lookups in mine because my MAGI is so close to the upper limit, resulting in the highest possible value (the reason I asked for the max value in an earlier post).

I did, unfortunately, have to make a small but crucial change to my mini-spreadsheet today. I saw Fidelity's estimated year-end cap gain distributions for many of their funds. The main stock fund I own is going to make a huge distribution, 50% larger than last year's big one. My mini-spreadsheet always assumed I was qualifying for a subsidy, so I had to modify a cell to allow for this. In short, it looks like I am going over the MAGI cliff by a few thousand dollars and with all the fund NAVs so high, I can't see any way of tax-loss harvesting to get me down to 399% FPL which would get me a $700 subsidy.

- Joined

- Oct 13, 2010

- Messages

- 10,733

That's gotta hurt

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,698

That is the system....OTOH if you want to bunch any income or put off some deductions until next year now is the time to figure that out. Perhaps get an HSA eligible plan for next year if you don't have one now.

Bunching deductions won't make any difference because MAGI does not depend on how big or small any itemized deductions are. I do look at bunching deductions and have mentioned it often in this forum. I had a few unexpected medical bills in the last month or so, and I will exceed the SD in 2017 if I bunch or not bunch. Maybe next year, unless tax reform raises the SD enough to make my bunching plans moot.

wmc1000

Thinks s/he gets paid by the post

zedd - we had a similar drop in subsidy today but in our case it was attributable to only 1 of the two of us being eligible for subsidy as DW is starting Medicare. Prior to today, even though I checked the box saying she was eligible for other coverage the subsidy reflected an amount for a couple. Today it shows the proper amount based on only 1 of us qualifying for subsidy. The monthly insurance plan costs remained the same because they were being handled correctly prior to today.

GTFan - We have been covered by Ambetter this year falling under the 94% cost sharing where we are paying $73.00 per month. All of our doctor visits and generic prescriptions have been covered 100%. Additionally, Ambetter has a wellness benefit program which provides you a VISA card and gives you $50 for completing a welcome questionnaire and $25 when you get your flu shot which is also fully paid for by them. This money can be used for health costs or towards your monthly premiums. You can also get $20 per mo. towards gym memberships. We have been pleased and have had no difficulties with the Ambetter services.

GTFan - We have been covered by Ambetter this year falling under the 94% cost sharing where we are paying $73.00 per month. All of our doctor visits and generic prescriptions have been covered 100%. Additionally, Ambetter has a wellness benefit program which provides you a VISA card and gives you $50 for completing a welcome questionnaire and $25 when you get your flu shot which is also fully paid for by them. This money can be used for health costs or towards your monthly premiums. You can also get $20 per mo. towards gym memberships. We have been pleased and have had no difficulties with the Ambetter services.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I can let you know the exact numbers for us next week. I have an appointment with our Florida Blue Agent to set up our 2018 coverage. She insists that with the subsidy increases things should not change much for us. That still remains to be seen. She told me to ignore the numbers on Healthcare.gov as they did not include the CSRs that are still in play in Florida.

ivinsfan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2007

- Messages

- 9,962

Bunching deductions won't make any difference because MAGI does not depend on how big or small any itemized deductions are. I do look at bunching deductions and have mentioned it often in this forum. I had a few unexpected medical bills in the last month or so, and I will exceed the SD in 2017 if I bunch or not bunch. Maybe next year, unless tax reform raises the SD enough to make my bunching plans moot.

Duh, you are correct on the deductions but you could add some income since you are already over the cliff. and its too late if you don't have an HSA compatible plan for 2017. But you might want to get the HSA plan for 2018 just in case. I'm not sure if you mean 700 bucks total or 700 bucks a month.

GTFan

Thinks s/he gets paid by the post

GTFan - We have been covered by Ambetter this year falling under the 94% cost sharing where we are paying $73.00 per month. All of our doctor visits and generic prescriptions have been covered 100%. Additionally, Ambetter has a wellness benefit program which provides you a VISA card and gives you $50 for completing a welcome questionnaire and $25 when you get your flu shot which is also fully paid for by them. This money can be used for health costs or towards your monthly premiums. You can also get $20 per mo. towards gym memberships. We have been pleased and have had no difficulties with the Ambetter services.

Thanks for the datapoint, good to know that someone has had a decent experience with them. Guess the real proof will be if you have to contact them about a claim, all the bad stuff I saw on the web was about their horrible customer service. We had no issues with BCBS claims this year and no reason to contact them, hope that is the case going forward with Ambetter.

I saw their rewards program, will definitely take advantage of that.

GTFan

Thinks s/he gets paid by the post

I can let you know the exact numbers for us next week. I have an appointment with our Florida Blue Agent to set up our 2018 coverage. She insists that with the subsidy increases things should not change much for us. That still remains to be seen. She told me to ignore the numbers on Healthcare.gov as they did not include the CSRs that are still in play in Florida.

Your agent finally has the correct info - you should see little change (either premium or coverage) with CSR'd Silver plans.

I don't go through an agent for enrollment, healthcare.gov has been working for us the last couple of years.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,698

Duh, you are correct on the deductions but you could add some income since you are already over the cliff. and its too late if you don't have an HSA compatible plan for 2017. But you might want to get the HSA plan for 2018 just in case. I'm not sure if you mean 700 bucks total or 700 bucks a month.

I see what you mean about trying to "bunch" income into 2017, like a reverse bunching of deductions, in order to protect me from going over that cliff again in 2018. But my income has no real discretion because it comes from monthly and quarterly dividends as well as annual cap gain distributions. Only the rare redemption of mutual fund shares in my taxable account is discretionary. And I don't plan on making any more redemptions this year.

The $700 cost for going over the cliff in 2017 is a year total, not a month total.

A HSA would not benefit me because all of my medical bills I pay OOP which go toward my annual deductible are already deductible on Schedule A. The health insurance premiums are roughly equal to the 10%-of-AGI excluded from my deductible medical expenses, leaving the OOP expenses for medical services all deductible on my federal income tax return.

ivinsfan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2007

- Messages

- 9,962

I see what you mean about trying to "bunch" income into 2017, like a reverse bunching of deductions, in order to protect me from going over that cliff again in 2018. But my income has no real discretion because it comes from monthly and quarterly dividends as well as annual cap gain distributions. Only the rare redemption of mutual fund shares in my taxable account is discretionary. And I don't plan on making any more redemptions this year.

The $700 cost for going over the cliff in 2017 is a year total, not a month total.

A HSA would not benefit me because all of my medical bills I pay OOP which go toward my annual deductible are already deductible on Schedule A. The health insurance premiums are roughly equal to the 10%-of-AGI excluded from my deductible medical expenses, leaving the OOP expenses for medical services all deductible on my federal income tax return.

for a total of 700 dollars I'd just be happy with my nice dividend payment and not sweat it too much.

wmc1000

Thinks s/he gets paid by the post

GTFan - Ambetter has also reached out to us throughout the year to make sure everything has been handled well and also to let us know about their care management services if one has any complex health needs ie, Diabetes management or similar situations.

While our needs have been routine care such as doctors visits and a colonoscopy we have not had any billing issues we had to contact them about since everything was covered 100% except for a couple of blood draws in the drs. office that had a $2 co-pay which we used the VISA card we had wellness earnings on so even those were free.

My wife has 7 generic meds and I have 3 which were all free during the year.

Additionally I signed up for autopay to come out on the 20th of the preceding mo so there would be no late payment possibilities.

Since DW went on Medicare as of Oct. 1st I paid part of the Oct. premium earlier than the 20th with the money left on her VISA card and the balance from my VISA card and it correctly made the autopayment ZERO when the 20th of October rolled around so it appears they have their act together at least as it has applied to us. Hope it all goes as smoothly for you in 2018!

While our needs have been routine care such as doctors visits and a colonoscopy we have not had any billing issues we had to contact them about since everything was covered 100% except for a couple of blood draws in the drs. office that had a $2 co-pay which we used the VISA card we had wellness earnings on so even those were free.

My wife has 7 generic meds and I have 3 which were all free during the year.

Additionally I signed up for autopay to come out on the 20th of the preceding mo so there would be no late payment possibilities.

Since DW went on Medicare as of Oct. 1st I paid part of the Oct. premium earlier than the 20th with the money left on her VISA card and the balance from my VISA card and it correctly made the autopayment ZERO when the 20th of October rolled around so it appears they have their act together at least as it has applied to us. Hope it all goes as smoothly for you in 2018!

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,698

for a total of 700 dollars I'd just be happy with my nice dividend payment and not sweat it too much.

Remember, it's a cap gain distribution, not a dividend. And a cap gain distribution is simply the fund giving me back some of the price appreciation. Because I reinvest it back into the fund, I won't really "feel" any richer.

But back to the topic of bunching: I took another look at my spreadsheet and saw that I can go back to bunching my deductions for 2017. The huge increase in my AGI means my deductible med expense will drop by enough to put me under the SD by about $1,000. At 15%, I'll recover about $150 due to the bump-up to the SD this year, and a little extra next year due to the way state tax rebates received in a subsequent year are handled in the determination of MAGI and the ACA subsidy.

ivinsfan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2007

- Messages

- 9,962

Remember, it's a cap gain distribution, not a dividend. And a cap gain distribution is simply the fund giving me back some of the price appreciation. Because I reinvest it back into the fund, I won't really "feel" any richer.

But back to the topic of bunching: I took another look at my spreadsheet and saw that I can go back to bunching my deductions for 2017. The huge increase in my AGI means my deductible med expense will drop by enough to put me under the SD by about $1,000. At 15%, I'll recover about $150 due to the bump-up to the SD this year, and a little extra next year due to the way state tax rebates received in a subsequent year are handled in the determination of MAGI and the ACA subsidy.

Yes that's the problem with those capital gains distributions.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,235

That just means you couldn't withdraw out of the HSA based on those medical expenses. You can always take the HSA deduction now, and take withdrawals in a year you don't itemize, or pay medicare premiums with it. Worst case is you withdraw from it after age 65 without medical expenses to claim against, and you'll have to pay income tax on it. It would work just like a tIRA. Handy if an HSA policy works for you, and you need a few thousand more taken off your MAGI for the ACA subsidy.A HSA would not benefit me because all of my medical bills I pay OOP which go toward my annual deductible are already deductible on Schedule A. The health insurance premiums are roughly equal to the 10%-of-AGI excluded from my deductible medical expenses, leaving the OOP expenses for medical services all deductible on my federal income tax return.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,698

That just means you couldn't withdraw out of the HSA based on those medical expenses. You can always take the HSA deduction now, and take withdrawals in a year you don't itemize, or pay medicare premiums with it. Worst case is you withdraw from it after age 65 without medical expenses to claim against, and you'll have to pay income tax on it. It would work just like a tIRA. Handy if an HSA policy works for you, and you need a few thousand more taken off your MAGI for the ACA subsidy.

I don't actually qualify for a HSA because my plan's deductible ($7,150) is greater than the allowable maximum of $6,550. I had never really pursued it until now, although I recall being told at some point a few years ago that I wasn't eligible for one.

Similar threads

- Replies

- 115

- Views

- 5K

- Replies

- 11

- Views

- 812

- Replies

- 52

- Views

- 3K

Latest posts

-

-

-

-

-

-

MYGA Company Ratings. AMBest "A vs A+ vs A++" Does it really Matter?

- Latest: ShokWaveRider

-

-

-