NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

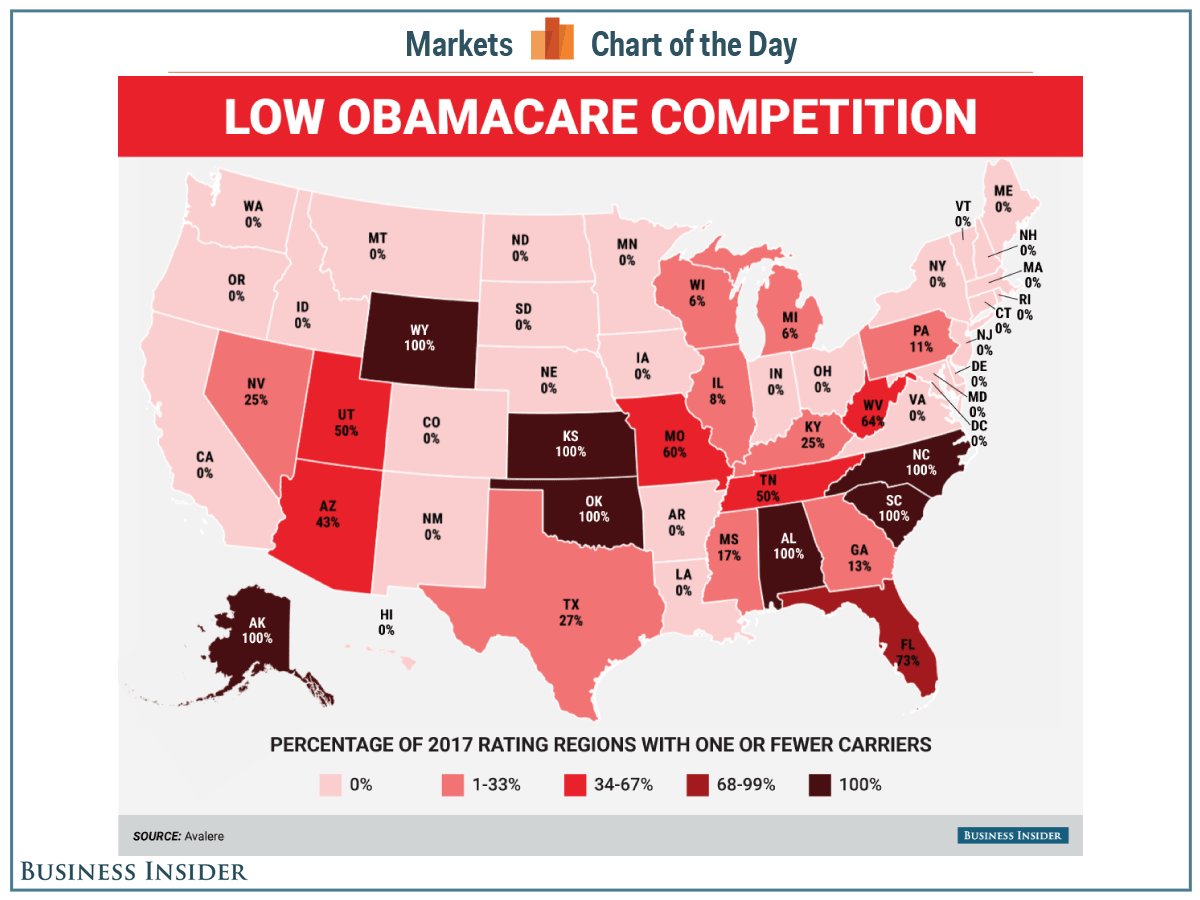

With insurers dropping out of individual health insurance market, and my corner of the wood not being exempted, some of us will not have much of a choice next year, if any!

I just saw this following map showing that 6 entire states are down to one or fewer insurers for 2017. Fewer? Like in zero?

Holy moly, this can't be right! What are we going to do?

The map below comes from this Web site: See this map of Obamacare's insurance-competition problem - Business Insider.

Somebody, please tell me that they have a mistake, and this is not true.

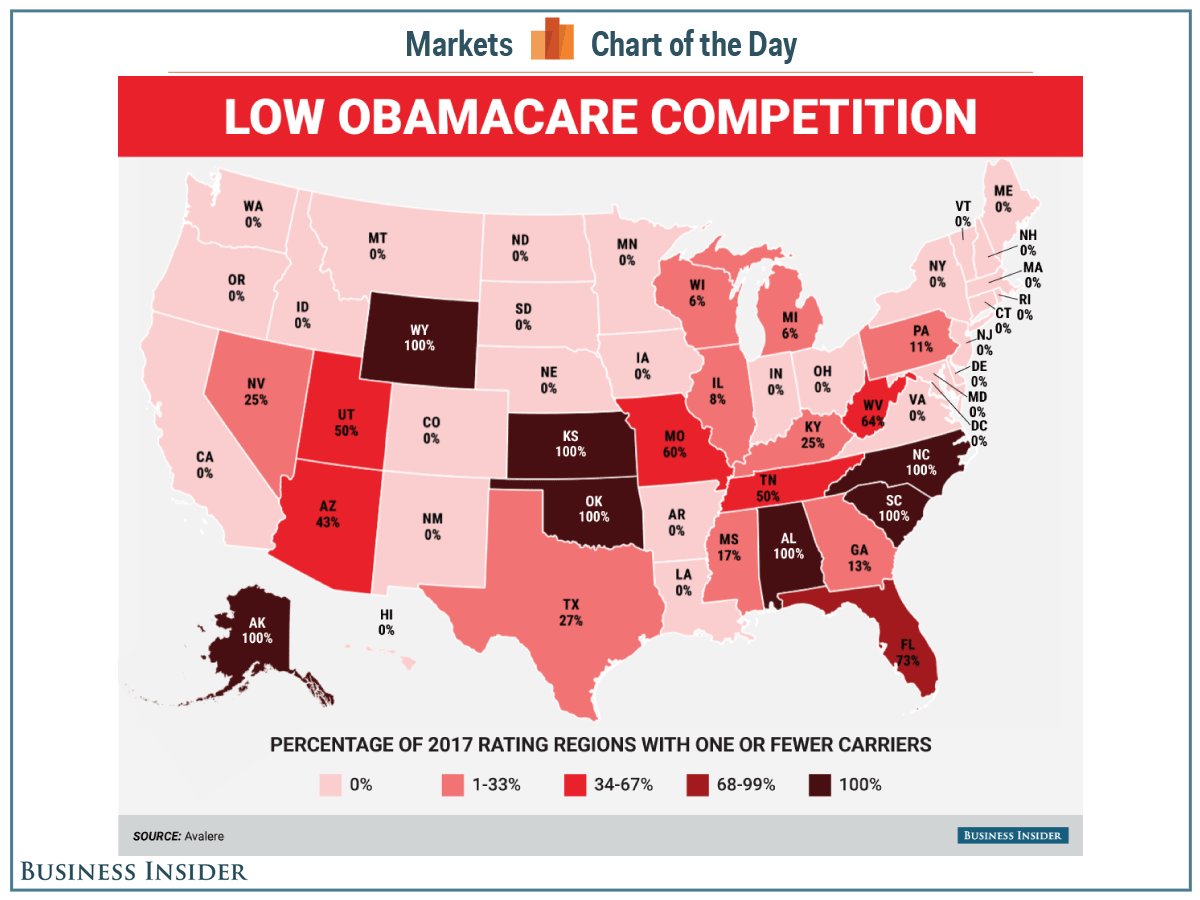

I just saw this following map showing that 6 entire states are down to one or fewer insurers for 2017. Fewer? Like in zero?

Holy moly, this can't be right! What are we going to do?

The map below comes from this Web site: See this map of Obamacare's insurance-competition problem - Business Insider.

Somebody, please tell me that they have a mistake, and this is not true.

Hope this will happen before too long.

Hope this will happen before too long.