OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Here you go. Too easy, really.... I [would] like to see another thread based on "data and professional articles" only on the subject of passive investing versus active investing and NO PERSONAL OPINIONS. ...

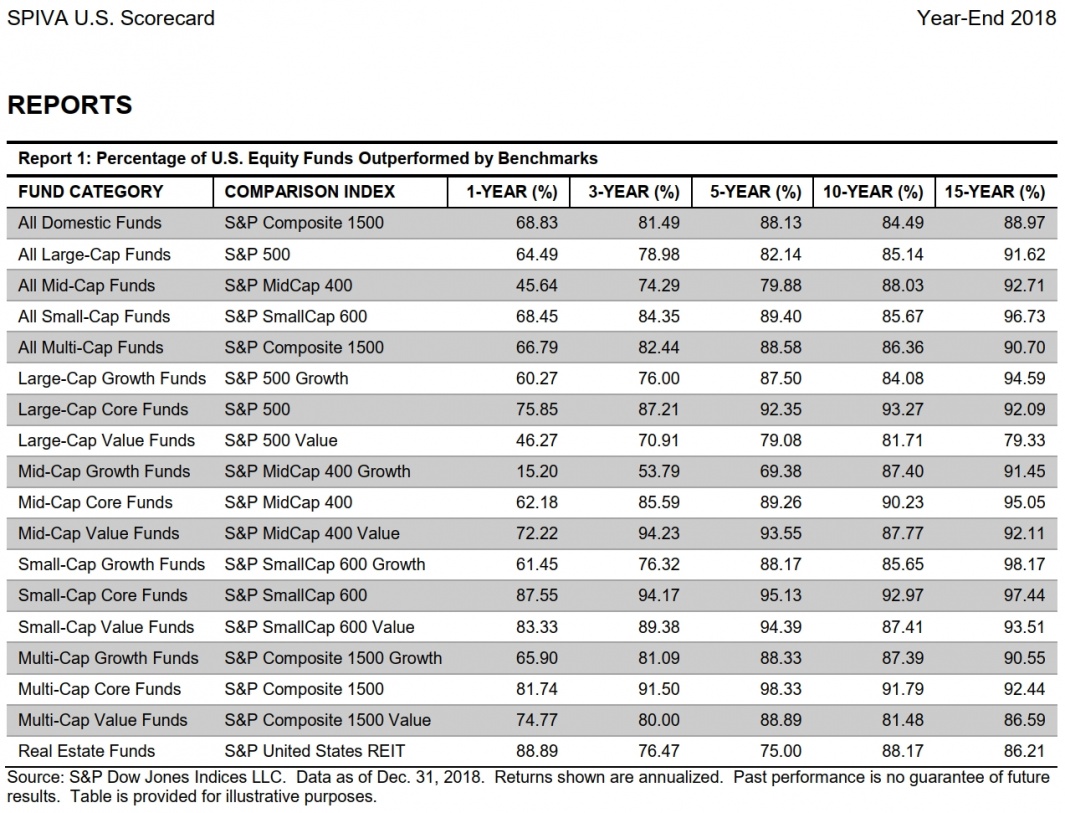

http://www.mkwinc.com/wp-content/uploads/2017/12/15-Years-of-SPIVA.pdf

https://thebamalliance.com/blog/2018s-active-vs-index-scorecard/

https://www.ifa.com/articles/despit...active_funds_fail_dent_indexing_lead_-_works/

https://www.indexologyblog.com/2019/03/27/can-you-beat-the-market-consistently/

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=244153

https://www.wsj.com/articles/the-dying-business-of-picking-stocks-1476714749 (behind WSJ paywall)

https://www.economist.com/finance-and-economics/2016/10/08/active-defence

https://www.early-retirement.org/forums/members/38349-albums210-picture1603.jpg

https://web.stanford.edu/~wfsharpe/art/active/active.htm

https://famafrench.dimensional.com/videos/is-this-a-good-time-for-active-investing.aspx

https://famafrench.dimensional.com/videos/identifying-superior-managers.aspx

https://www.spglobal.com/en/researc...-performance-matter-the-persistence-scorecard

https://www.aaii.com/journal/article/most-mutual-funds-do-not-outperform

https://www.early-retirement.org/forums/members/38349-albums210-picture1602.jpg