papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

Well... It never quite got to 70 and here we are at 57 ....

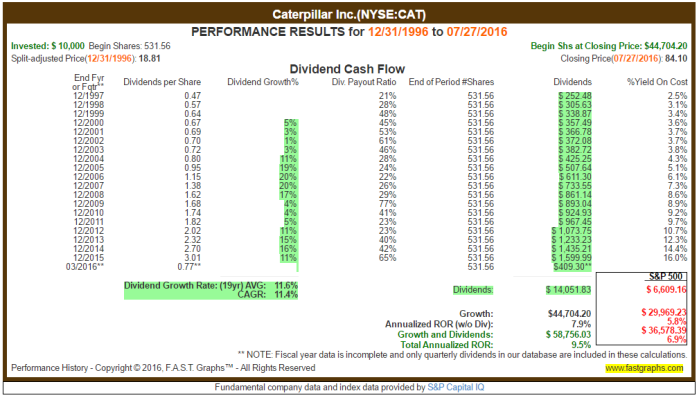

Anyway, I think it's a value play at the 50 dollar level

I don't play individual stocks any more but this one would be on my risky but interesting list.

Anyway, I think it's a value play at the 50 dollar level

I don't play individual stocks any more but this one would be on my risky but interesting list.