Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

A few questions for you NYEXPAT. Every time I think of doing short term trading, I get turned off by this line of reasoning:

OK, you don't have to answer any of my worries. But how do you view this and what does a successful year do for your overall portfolio in percentage terms?

Note I am just trying to learn something here and not at all critical. I do trading in a 60/40 portfolio and am not a strictly buy-hold investor. More of a buy-mostly-hold investor with some exchanges during the year (like growth funds to value funds, US to foreign).

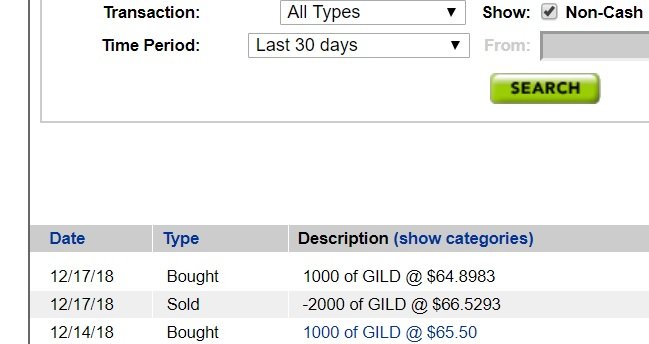

1) I don't want to loose too much money (if I blow it) so that means trading with a small amount of assets, say no more then 5%

2) That 5% might go up only about 20% if I really do things right over a year. Note I cannot imagine using leverage.

3) That means an increase of assets of 5% * 20% = 1% which is pretty nice in our case but won't change our basic financial position

4) For that 1% asset increase I will have to spend a lot of time/energy/worry.

5) Will I miss out on other opportunities because I'm looking at that small position instead of the big picture? Will I miss out on other life experiences because I get caught up in market movements and such?

OK, you don't have to answer any of my worries. But how do you view this and what does a successful year do for your overall portfolio in percentage terms?

Note I am just trying to learn something here and not at all critical. I do trading in a 60/40 portfolio and am not a strictly buy-hold investor. More of a buy-mostly-hold investor with some exchanges during the year (like growth funds to value funds, US to foreign).