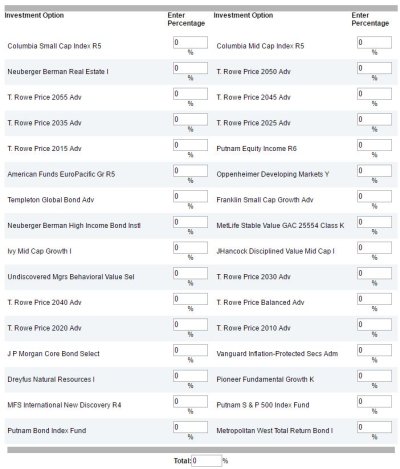

VAIPX - Vanguard Inflation-Protected Securities Fund Admiral Shares. I'm not seeing any other options that will allow me to more or less park my money in the 401k. I'm doing a full year's worth of 401k investment now and with the market this high I'd rather wait until next year to DCA it. Of all the fund options I have in the 401K VAIPX is the only one I see as somewhat safe? Any thoughts?

Last edited: