Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

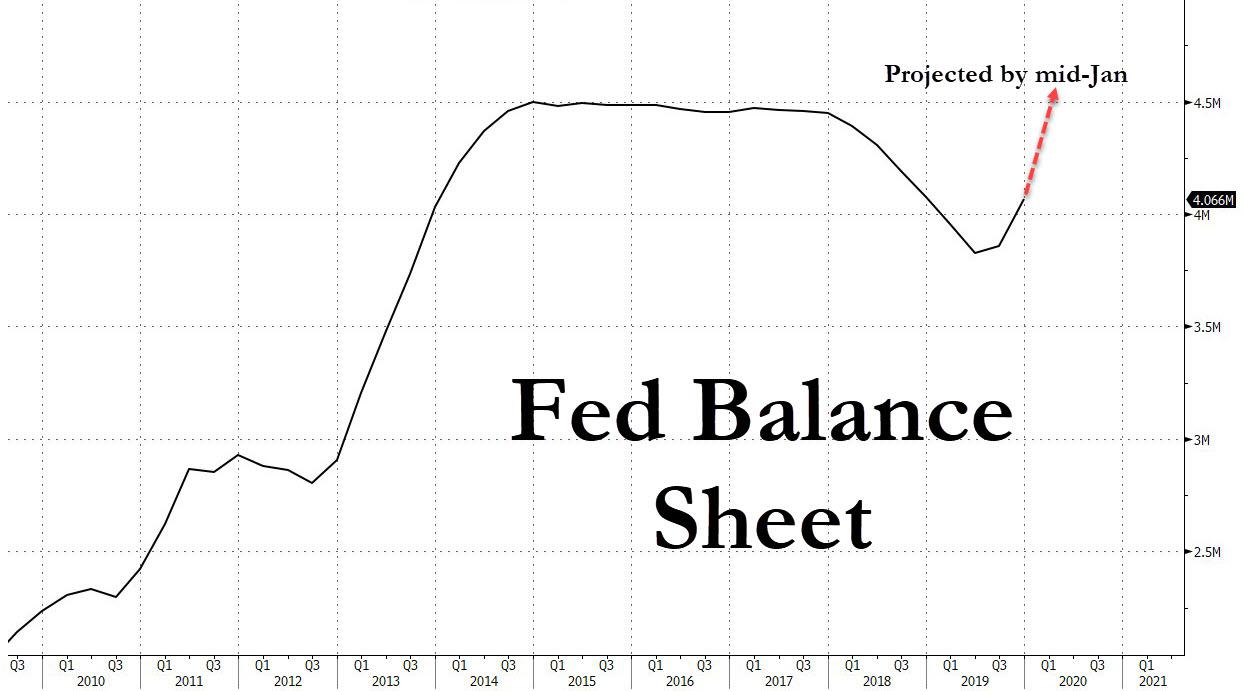

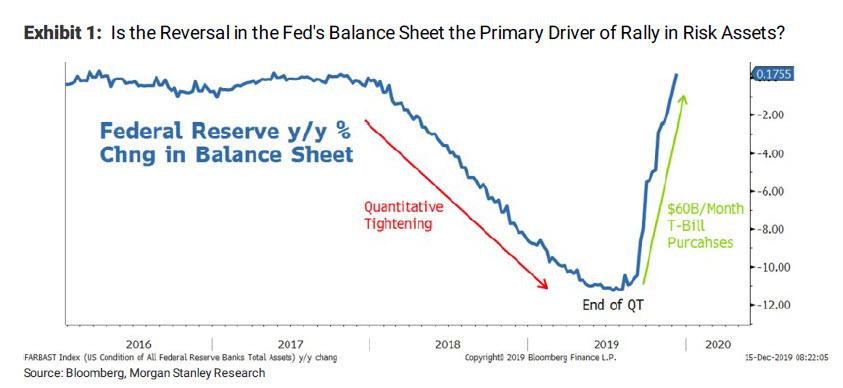

FED TO TOTALLY REVERSE BALANCE SHEET REDUCTION WITH LATEST ANNOUNCEMENT

The day that people with a crystal ball would see we'd be up about 22% from there today?

Also, "Dow plunges 1,175 -- worst point decline in history": https://www.c-span.org/video/?c4620112/user-clip-donald-trump-jesse-jackson-rainbowpush-coalition

-ERD50

Feb 5, 2018 also was largest DOW drop:No it was the first day in the history of the S&P500 that every single stock in the S&P500 moved in the same direction for the day - all 500. It had never happened before, and has happened twice more since.

No it was the first day in the history of the S&P500 that every single stock in the S&P500 moved in the same direction for the day - all 500. It had never happened before, and has happened twice more since.Originally Posted by ERD50 View Post

The day that people with a crystal ball would see we'd be up about 22% from there today?

Also, "Dow plunges 1,175 -- worst point decline in history": https://www.c-span.org/video/?c46201...push-coalition

-ERD50

The Fed announced today that over the year end in order to keep the REPO market from exploding they will be taking up to 500 billion to head off year end REPO issuesNo? Aren't they both true? The drop would have been the largest point drop at the time.

Also, on the previous graph on Fed Bal sheet - what announcement?

-ERD50

No? Aren't they both true? The drop would have been the largest point drop at the time.

-ERD50

Feb 5 2018 was an extremely unusual day in the stock market for what reason?

No? Aren't they both true? The drop would have been the largest point drop at the time. ...

-ERD50

No the largest point drop in history had occurred many times previously and therefore was not unusual.

Silly comment.No the largest point drop in history had occurred many times previously and therefore was not unusual.

Silly comment.

You called it a "minor" correction. http://www.early-retirement.org/forums/f28/revisiting-my-asset-allocation-90771.html#post2011595 ....

Originally Posted by Running_Man View Post

No the largest point drop in history had occurred many times previously and therefore was not unusual.

That's in another thread! What the heck are you going on about?

The comment from pb4uski's quoted your statement that

So you divert to another unrelated thread? Very odd. Just admit it, a record point drop can be described as "unusual" ( which is a subjective term anyhow). Not sure why you can't simply acknowledge that.

-ERD50

You called it a "minor" correction. http://www.early-retirement.org/forums/f28/revisiting-my-asset-allocation-90771.html#post2011595

Technically true, it was unusual, certainly not false but as you pointed out and others on the thread stated, it was just a minor blip and was soon to be erased. There had been 4 previous "largest point decline ever just since 2000" and 4 "largest point increases" ever just since 2000. But the first time ever all the S&P500 stocks went in the same direction in one, even considering 1987, the Asian Contagion and the financial crisis of 2008-2009 and it has done it twice more since without anyone even taking notice.

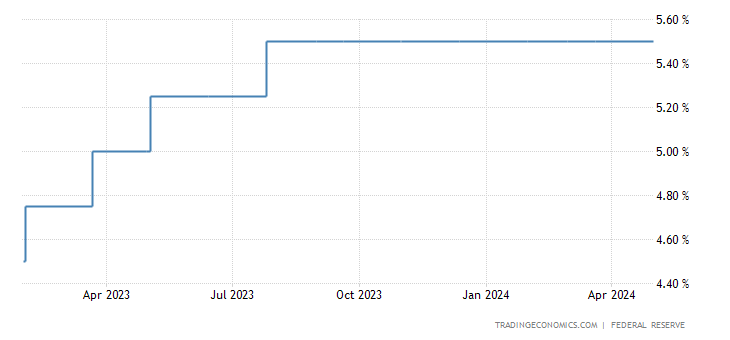

Which as the passive indexes take up an ever increasing percentage of the market, and the availability of stock is reduced by corporate buybacks, the market will move as a unit, not as 500 individually evaluated capital investment opportunities. So I am actually thinking a 50-60 percent move up in 6-12 months, very similar to the 90% increase the NASDAQ index did from November 1999 to March 2000 is an increasingly likely event as the supply of stock available to buy from individuals doing a market value approach, becomes a much lower percentage of the trading activity - passive stocks are presently 90% of all trading activity and about 38% of all stock assets, 50+ percent of funds and ETF's.

This is similar to the Nasdaq in 1999 as the float of those stocks was light and funds were developed to trade in the "internet" stocks of the NASDAQ and the lack of stock available, as the founders held the greatest share and didn't sell, caused an upward explosion. That was of course followed by a 40% drop in the following month as there were no "value" buyers in the space willing to step in and buy the stocks.

Extremely short term there is the annual RMD distribution required into year end as well as the annual re balancing of portfolios, which is going to provide sellers for the market going into year end. Partially I think that is why the FED is preemptively and aggressively publicizing 500 billion in REPO availability so that hedge funds with loans are not forced to also sell into the year end, causing a contagion. The FED has shown since 2008 it will do all it can to continue the upward trajectory of stock prices and prevent any sustained selling, and I am not going to bet against them again until they fail.

But once the RMD and Pension re balancing selling completes, a great deal of the RMD distributions, which are growing each year, are investments that were of a managed nature and largely go into passive funds upon reinvestment and taxes. Tax money is increasingly going to fund pension deficits which since the rule change of April 2016 has forced pension funds increasingly into passive funds. (the rule change was that pension administrators were to be fiduciaries for the beneficiaries and best effort was no longer a defense in not fulfilling fiduciary duties, so that investing even in an active fund could be held as not being in the fiduciary interest of the beneficiary and could make the pension manager personally liable). This provides a kick-off for another rally into the start of next year. This could start a 3-4 year period of 30-80% moves comparable to the 1995-2000 period of the Nasdaq for as long as the FED can hold recessionary forces at bay.

After spending the last 11 months studying what was occurring in the market after my successful put buying into the year end of 2018, this is what I am looking for in 2020-2023.

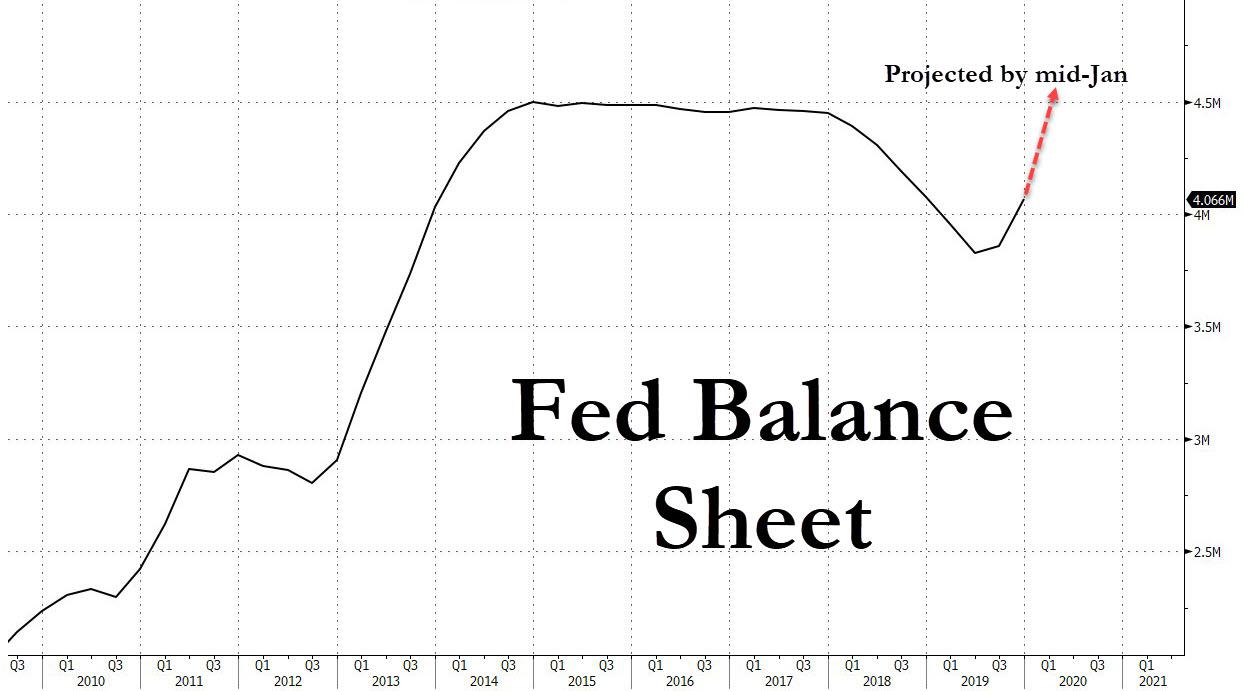

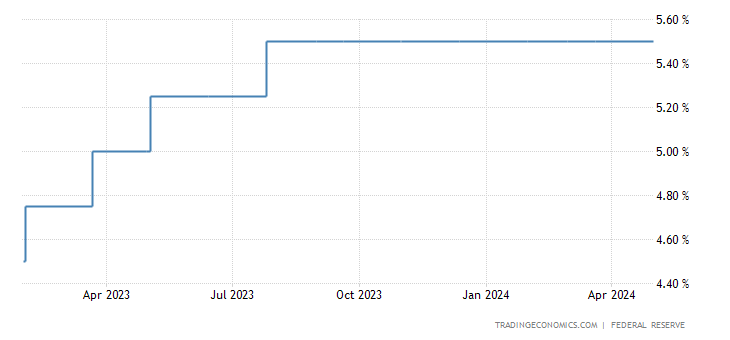

I am not looking at the end of a bull run - I am quite the opposite expecting the biggest bull market run in the history of the stock market with months of 10% gains to occur. Only a FED mistake would change my mind, such as the rate hikes of September and December 2018, when I thought they erred amd should have cut and led to my put buying, but now with the 3 rate cuts in 2019 instead of the 3 hikes projected a little over a year ago and assuming the FED continues to accommodate the market we will have a tremendous bull run.Yes, we are closer to the end of the bull run, but it is difficult to predict the end. That is why back in early and again in late 2018 I thought we hadn't yet seen the end of the bull run. No inversion of the yield curve, positive federal reserve action, and surprisingly little impact from the trade disputes. This end of year run up sure feels like a lot of players have been caught under-invested and don't want to put out statements showing themselves this way. Whether this will be the blow off top remains to be seen. As late as October, we were still seeing large retail investor outflows from the market (which I see as a positive market sign). I can't ever remember a market that topped without a large amount of "buy high" retail inflow. This makes me think that we may not have a repeat of 2008 (market selloff prior to a presidential election). I've mentioned this before, maybe a better analogy is the semi-slowdown during late 1993 (Clinton administration), followed by an upturn.

Dunno. 2019 YTD has been a great year financially, so there is also some lock in some gains "thoughts" going through my head.

I am not looking at the end of a bull run - I am quite the opposite expecting the biggest bull market run in the history of the stock market with months of 10% gains to occur. Only a FED mistake would change my mind, such as the rate hikes of September and December 2018, when I thought they erred amd should have cut and led to my put buying, but now with the 3 rate cuts in 2019 instead of the 3 hikes projected a little over a year ago and assuming the FED continues to accommodate the market we will have a tremendous bull run.

I am not looking at the end of a bull run - I am quite the opposite expecting the biggest bull market run in the history of the stock market with months of 10% gains to occur. Only a FED mistake would change my mind, such as the rate hikes of September and December 2018, when I thought they erred amd should have cut and led to my put buying, but now with the 3 rate cuts in 2019 instead of the 3 hikes projected a little over a year ago and assuming the FED continues to accommodate the market we will have a tremendous bull run.

I have been thinking the same way - there could be a good run ahead. You can't fight the Fed,

My current AA is 55/40/5 (stocks/cash/CDs) due to home sale. I have been adding preferreds (thanks to the discussions here) and waiting for a decent SP500 drop to move to 75/20/5 AA.

Should I just plunk down 5% at a time into a SP500 etf?

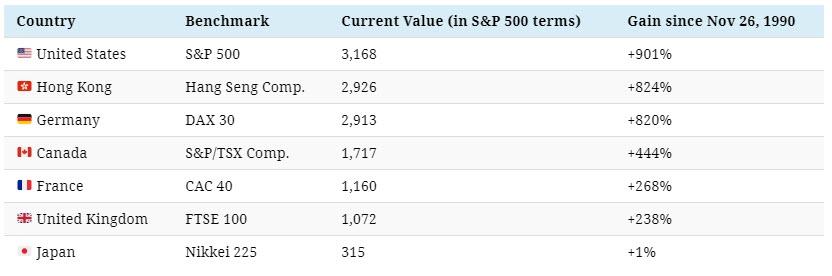

What would FIRECalc results be like, for stocks in countries like Japan or even European countries?

Maybe that's why very few people outside of the US even contemplate ER.

We are a lucky bunch, and we take things for granted.

That is a personal risk assessment, I am going to start a thread on the reason I am anticipating a bull market of extremely large proportions, but always when investing I think investors should be wary of the probability of being wrong and what that would mean to them if they were wrong, kind of a personal stress test prior to the incorporation of any changes to a portfolio before one were to do it. Even at 55/40/5 if a large bull market occurs you will be doing very well, comparing one's self to other gains is a FEAR that must be avoided, being able to stay a course is more important that any one road and it is incredibly important to take time to understand what that means for yourself and don't let someone decide that for you.

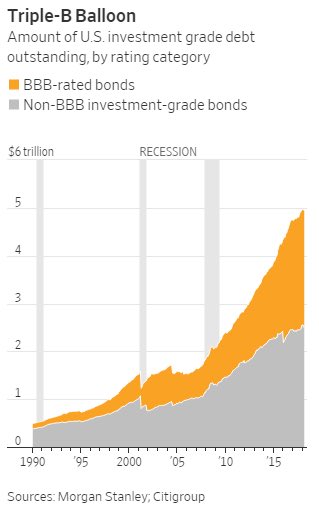

Lowest quality investment grade debt is not only rising as a % of total investment grade debt but investment grade debt in US to GDP has gone from GDP 10 times IGD in 2008 to 3.9 times IGD in 2018. In 1990 before the FED embarked on its long decline of interest rates the ratio was 14.5 times (BBB was about 10% of total investment grade debt.