|

|

08-21-2019, 08:54 AM

08-21-2019, 08:54 AM

|

#81

|

|

Dryer sheet wannabe

Join Date: Jul 2019

Posts: 15

|

Quote: Quote:

Originally Posted by Running_Man

The reason the FED is forced to cut is otherwise the US dollar will become too highly valued and the fall in import prices will exert a deflationary influence on US markets of goods and reduce profitability. The FED has a boatload of debt to deal with that needs inflation and they will try and get inflation ignited. If the FED in September does not cut rates you will see the US stock market fall thousands of points.

|

I've seen little evidence that cutting rates leads to broad inflation. It inflates asset bubbles. I've also seen little evidence that cutting rates weakens the dollar. Maybe that's how it's supposed to work in Econ 101, but it doesn't. If you have examples from the past 20 years fire away.

Again, this goes back to lack of demand. We don't have an issue with money supply. Case in point- all the unicorn $1B+ startups. Nobody is hurting for a supply of money.

Inflation happens when more dollars chase fewer goods. Unless those dollars get in the hands of people who spend them, negative interest rates aren't going to do anything except inflate stock and real estate asset bubbles.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

08-21-2019, 02:42 PM

08-21-2019, 02:42 PM

|

#82

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,722

|

Quote: Quote:

Originally Posted by Running_Man

Whose Estimates? Currently I see estimates are in general for 15-20% earnings Growth.

|

One would have to go to the site, and dig in. Double click a company name, for example.

I believe that a red coloring of the square indicates the value has decreased from previous. But I do not see any attribution for data, so can't answer this for sure.

|

|

|

08-21-2019, 04:16 PM

08-21-2019, 04:16 PM

|

#83

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

Quote: Quote:

Originally Posted by target2019

One would have to go to the site, and dig in. Double click a company name, for example.

I believe that a red coloring of the square indicates the value has decreased from previous. But I do not see any attribution for data, so can't answer this for sure.

|

I believe the coloring on the map has to do with the relative level of forward PE and whether or not it is a "value" company

|

|

|

08-23-2019, 10:48 AM

08-23-2019, 10:48 AM

|

#84

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

Based on the long term trend we should be at -5 percent in another decade and the economy will be humming as well as it is today!

I wonder if -100% is really the lower bound or if we could get to the point where if it takes less than a year to lose 100% might become the minimum investors will accept as a safe investment.

|

|

|

08-23-2019, 11:10 AM

08-23-2019, 11:10 AM

|

#85

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

These tweets are driving me crazy. Bizarre. Today down -2% on tweets.

|

|

|

08-23-2019, 02:12 PM

08-23-2019, 02:12 PM

|

#86

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2016

Posts: 1,961

|

Quote: Quote:

Originally Posted by Cichon_007

I've seen little evidence that cutting rates leads to broad inflation. It inflates asset bubbles. I've also seen little evidence that cutting rates weakens the dollar. ....

|

A couple of perspectives:

1. inflated asset bubbles is still inflation. All that printed money flowed into financial markets instead of the supermarkets. Businesses borrowed and "invested" in their own stocks via buybacks instead of growth/inflation causing capex or wages.

2. one reason cutting rates hasn't weakened the dollar is because "everybody is doing it". The USD is still the cleanest dirty shirt in the hamper because everybody else is cutting rates and doing QE too... the so called beggar thy neighbor race to the bottom.

|

|

|

08-23-2019, 06:33 PM

08-23-2019, 06:33 PM

|

#87

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2005

Location: northern Michigan

Posts: 2,215

|

Better get used to it........it's going to get worse before it gets better. I'll see your tariff and top it........take that! Wonderful way to run an economy...

|

|

|

08-23-2019, 07:44 PM

08-23-2019, 07:44 PM

|

#88

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

Tweets are merely a convenient scapegoat. When the world is saying that a good yield for safe investments is a negative yield, this implies there is less than no systemic risk, which is the proof in itself that systemic risk is prima facia for everyone to see vastly under priced and it is not going to take much to upset the market. But if anyone thinks a tweet sent an Austrian 100 year bond up 50% in two weeks, then you should sell all of your assets because that would mean there is no market only insanity.

This is the single biggest financial bubble in the history of finance. It involves every pension fund and Central bank around the world. The German billion dollar issue of 30 year bonds if financial interest rates went to two percent interest, a near historic low for Germany, the bonds would lose nearly 60 percent, that is the insanity in which this financial world lives, and pension funds are buying these bonds with a need for a long term return of seven percent.

What is going to be more interesting is the contortions that are going to be necessary to keep this afloat, again once any one of the major countries says no mas,(GERMANY, ITALY, FRANCE,NETHERLANDS,LUXEMBOURG, US, CHINA or JAPAN) this implodes worldwide in days.

|

|

|

08-23-2019, 07:50 PM

08-23-2019, 07:50 PM

|

#89

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2017

Posts: 2,555

|

Quote: Quote:

Originally Posted by Running_Man

This is the single biggest financial bubble in the history of finance. It involves every pension fund and Central bank around the world. The German billion dollar issue of 30 year bonds if financial interest rates went to two percent interest, a near historic low for Germany, the bonds would lose nearly 60 percent, that is the insanity in which this financial world lives, and pension funds are buying these bonds with a need for a long term return of seven percent.

What is going to be more interesting is the contortions that are going to be necessary to keep this afloat, again once any one of the major countries says no mas,(GERMANY, ITALY, FRANCE,NETHERLANDS,LUXEMBOURG, US, CHINA or JAPAN) this implodes worldwide in days.

|

What I don't get, is who buys negative interest bonds? Is there really a market for these? Why not just buy gold, or bitcoin, or something else of nebulous value that isn't guaranteed to lose value?

__________________

Balance in everything.

|

|

|

08-24-2019, 04:20 AM

08-24-2019, 04:20 AM

|

#90

|

|

Full time employment: Posting here.

Join Date: Jun 2016

Posts: 889

|

Quote: Quote:

Originally Posted by Running_Man

Tweets are merely a convenient scapegoat. When the world is saying that a good yield for safe investments is a negative yield, this implies there is less than no systemic risk, which is the proof in itself that systemic risk is prima facia for everyone to see vastly under priced and it is not going to take much to upset the market. But if anyone thinks a tweet sent an Austrian 100 year bond up 50% in two weeks, then you should sell all of your assets because that would mean there is no market only insanity.

This is the single biggest financial bubble in the history of finance. It involves every pension fund and Central bank around the world. The German billion dollar issue of 30 year bonds if financial interest rates went to two percent interest, a near historic low for Germany, the bonds would lose nearly 60 percent, that is the insanity in which this financial world lives, and pension funds are buying these bonds with a need for a long term return of seven percent.

What is going to be more interesting is the contortions that are going to be necessary to keep this afloat, again once any one of the major countries says no mas,(GERMANY, ITALY, FRANCE,NETHERLANDS,LUXEMBOURG, US, CHINA or JAPAN) this implodes worldwide in days.

|

I try to keep my bond allocation domestic and shorter term or cd’s. Any other moves to protect oneself as this plays out?

|

|

|

08-24-2019, 07:11 AM

08-24-2019, 07:11 AM

|

#91

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2016

Posts: 1,961

|

Quote: Quote:

Originally Posted by HNL Bill

What I don't get, is who buys negative interest bonds? Is there really a market for these? Why not just buy gold, or bitcoin, or something else of nebulous value that isn't guaranteed to lose value?

|

Some institutions/pensions are required to hold "government bonds", which is part of it. I'm only guessing that these institutions bought the bonds when issued and it paid a 1-2% coupon. The subsequent price appreciation had driven the yield negative.

But there are others that buy them just because the value goes up when rates fall even further... people paid "single tulip bulbs sold for more than 10 times the annual income of a skilled craftworker" during tulip mania. The Greater Fool theory says they'll find another sucker to take it off their hands before it matures.

|

|

|

08-24-2019, 07:14 AM

08-24-2019, 07:14 AM

|

#92

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2016

Posts: 1,961

|

Quote: Quote:

Originally Posted by BeachOrCity

I try to keep my bond allocation domestic and shorter term or cd’s. Any other moves to protect oneself as this plays out?

|

There is always diversification into other assets such as gold/silver and a well stocked pantry...

|

|

|

08-25-2019, 07:16 PM

08-25-2019, 07:16 PM

|

#93

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

Note to S&P500: PLEASE do not break 2,650

|

|

|

08-25-2019, 07:45 PM

08-25-2019, 07:45 PM

|

#94

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2016

Posts: 8,968

|

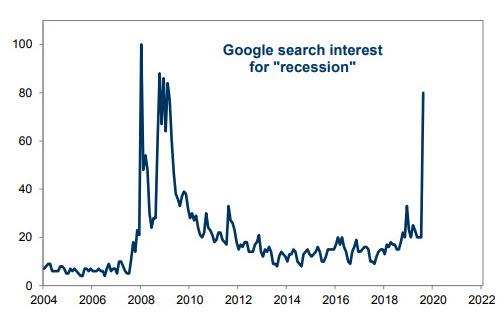

The best way to have a recession is for everyone to talk about it and not buy anything.

|

|

|

08-26-2019, 06:22 AM

08-26-2019, 06:22 AM

|

#95

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,722

|

I appreciate the simplicity of this Fidelity chart for international business cycles.

https://institutional.fidelity.com/a...le-update.html

Quote: Quote:

Mature U.S. and Global Business Cycle

Global growth momentum continued to slow, and most major economies have progressed toward more advanced stages of the business cycle. The U.S. is firmly in the late-cycle phase but with low near-term risk of recession. Policy stimulus in China has stabilized that country's growth trajectory, but most economic indicators in Europe continue to point to lackluster activity.

|

Even though reality is not a perfect cycle as shown in the chart...I look at the chart and see bezier handles which can be pulled in any direction to accelerate or delay the inevitable recession. Good to remember that there is recovery phase, too.

|

|

|

08-26-2019, 11:56 AM

08-26-2019, 11:56 AM

|

#96

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2007

Location: Upstate

Posts: 2,951

|

Quote: Quote:

Originally Posted by HNL Bill

What I don't get, is who buys negative interest bonds? Is there really a market for these? Why not just buy gold, or bitcoin, or something else of nebulous value that isn't guaranteed to lose value?

|

I've been pondering this question myself and have somewhat of a hypothesis: In looking at interest rates in terms of a product, the rate depends on the supply (of credit) vs the demand (borrowing). Maybe what we are seeing here is demographics in action. The vast majority of wealth is owned by aging populations: The United States, Europe, Japmany an. In each of these places the population is aging, and these populations (in total) have accumulated wealth. Some of that wealth is kept in buildings, land, investments in businesses, and other things. Some of that wealth is kept in 'savings', i.e. it represents buying power (deferred consumption) which can be lent to others.

Who are the borrowers? While there are plenty of businesses and others in the again societies, many have accumulated wealth themselves. One only needs to look at entities like Apple, Microsoft, and others with big cash hordes. Some borrowers are in lesser developing, faster growing and younger populations. But there is somewhat of a disconnect between borrow and lender.

The result is greater supply, lower demand and thus lower prices (yield).

Couple this with monetary policies that have inflated the amount of money. Traditionally, this would cause increased lending and as a result economic activity. But a funny thing happened after the great recession. While the money supply increased dramatically, the velocity decreased considerably. While velocity typically decreases during a recession, it has not appreciably increased since the 2008/9 recession. The following chart shows this in dramatic fashion:

https://fred.stlouisfed.org/series/M2V.

I don't know if the change in velocity is a cause of what we are seeing now, or a symptom of it. But this one chart explains why we haven't seen dramatically increased inflation even though we have had a major increase in the money supply post 2008.

Hey, maybe it is simply because not enough people are contributing to the "Blow that Dough" thread.

ETA: Yes, this theory could be out to lunch. I was even a bit hesitant to post it.

|

|

|

08-27-2019, 03:43 PM

08-27-2019, 03:43 PM

|

#97

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

|

|

|

08-29-2019, 10:10 AM

08-29-2019, 10:10 AM

|

#98

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

August 2019 is set to be a month where over 1/2 of the days S&P500 results in a up or down result in excess of one percent. Here are all the other month's where this has happened

|

|

|

08-29-2019, 11:36 AM

08-29-2019, 11:36 AM

|

#99

|

|

Dryer sheet aficionado

Join Date: May 2005

Posts: 35

|

Quote: Quote:

Originally Posted by copyright1997reloaded

I've been pondering this question myself and have somewhat of a hypothesis: In looking at interest rates in terms of a product, the rate depends on the supply (of credit) vs the demand (borrowing). Maybe what we are seeing here is demographics in action. The vast majority of wealth is owned by aging populations: The United States, Europe, Japmany an. In each of these places the population is aging, and these populations (in total) have accumulated wealth. Some of that wealth is kept in buildings, land, investments in businesses, and other things. Some of that wealth is kept in 'savings', i.e. it represents buying power (deferred consumption) which can be lent to others.

Who are the borrowers? While there are plenty of businesses and others in the again societies, many have accumulated wealth themselves. One only needs to look at entities like Apple, Microsoft, and others with big cash hordes. Some borrowers are in lesser developing, faster growing and younger populations. But there is somewhat of a disconnect between borrow and lender.

The result is greater supply, lower demand and thus lower prices (yield).

Couple this with monetary policies that have inflated the amount of money. Traditionally, this would cause increased lending and as a result economic activity. But a funny thing happened after the great recession. While the money supply increased dramatically, the velocity decreased considerably. While velocity typically decreases during a recession, it has not appreciably increased since the 2008/9 recession. The following chart shows this in dramatic fashion:

https://fred.stlouisfed.org/series/M2V.

I don't know if the change in velocity is a cause of what we are seeing now, or a symptom of it. But this one chart explains why we haven't seen dramatically increased inflation even though we have had a major increase in the money supply post 2008.

Hey, maybe it is simply because not enough people are contributing to the "Blow that Dough" thread.

ETA: Yes, this theory could be out to lunch. I was even a bit hesitant to post it. |

Banks lend when they see credible loan opportunities, not because they have excess reserves. This is even more true now that the Fed pays interest on reserves, so the banks can make money risk free doing nothing. Why bother lending unless you are pretty sure you will get your money back.

__________________

It is useless to attempt to reason a man out of a thing he was never reasoned into.-- Jonathan Swift

|

|

|

08-31-2019, 10:30 AM

08-31-2019, 10:30 AM

|

#100

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

GMO 7 year forecast

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|