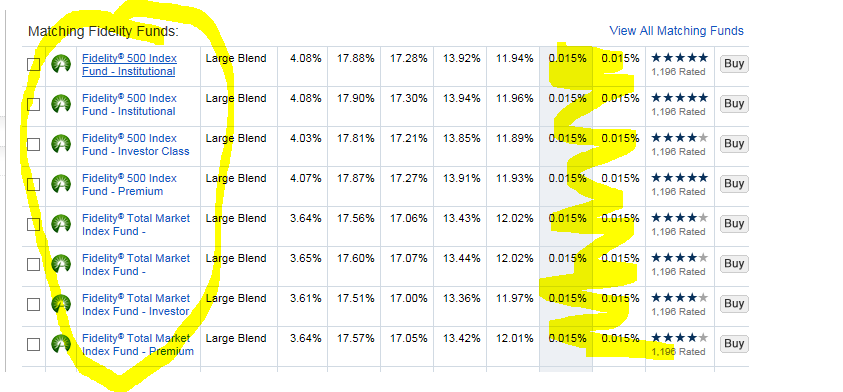

My biggest question is whether this is just a Fido marketing move, a sincere decision on their part to compete even more aggressively for business at the ultra-low cost end--but one that will be reversed when new managers take over, or an enduring commitment that will last as long as I do. The "zero cost" thing strikes me as a bit of flash/gimmick, and means these are either loss-leaders or they are making money on the "float."

With Vanguard, we have a decades-long track record, a corporate culture, and even a unique corporate legal structure that give me confidence that their commitment to rock-bottom costs is gonna endure.

I've got money at both places. The stuff at Fido is in a tax deferred account, so there would be no tax hit for me to move it on a moment's notice, and that's the way I like it. The stuff with a lot of accrued cap gains is at Vanguard, and there's no way I'd move that to Fido. Even if I were starting a new account with after-tax money subject to cap gains, I'd go to Vanguard rather than risk getting locked in at Fido and having them decide to change their approach. The difference in costs isn't much, not worth the tax risk.