OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

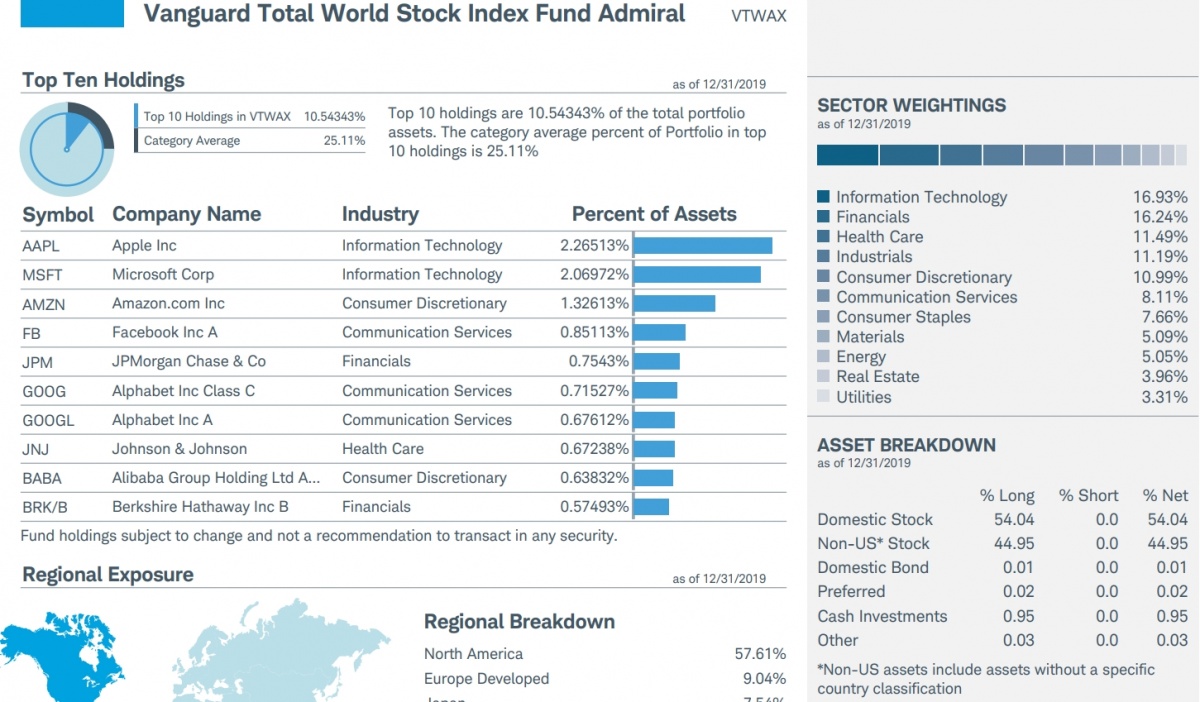

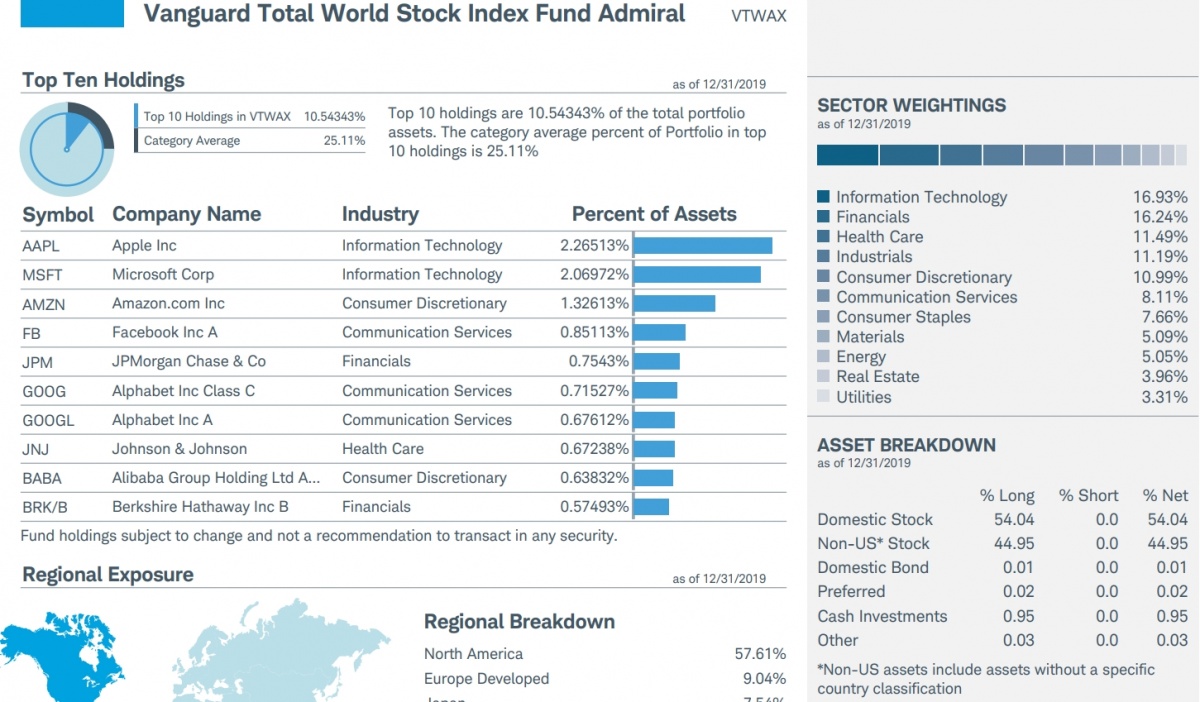

I was looking at our portfolio this morning, primarily to see what our AA was doing and I ran across a Schwab "Mutual Fund Report Card" for VTWAX, our primary holding:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

There is a lot of sturm und drang around here about index funds being concentrated in tech and about passive investing's effect on price discovery. In the report I find that tech is weighted about the same as financial services, at 17%. This is less tech concentration than I expected, though truthfully I have not given it much thought. The report also shows a portfolio turnover of 7%. I would have guessed about 5%, so no surprise there. The fund holds about 7,400 stocks, so that trading is spread pretty thin across the world market.

I don't have any particular conclusions to argue. I just thought people might like to see some real numbers. (The concentration numbers would be quite different, of course, for an S&P 500 fund. Which is one of the reasons why I haven't and won't buy any US large cap sector fund.)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

There is a lot of sturm und drang around here about index funds being concentrated in tech and about passive investing's effect on price discovery. In the report I find that tech is weighted about the same as financial services, at 17%. This is less tech concentration than I expected, though truthfully I have not given it much thought. The report also shows a portfolio turnover of 7%. I would have guessed about 5%, so no surprise there. The fund holds about 7,400 stocks, so that trading is spread pretty thin across the world market.

I don't have any particular conclusions to argue. I just thought people might like to see some real numbers. (The concentration numbers would be quite different, of course, for an S&P 500 fund. Which is one of the reasons why I haven't and won't buy any US large cap sector fund.)