You don't compare, but now you compare, you didn't compare in the past because you didn't have time, but you know you lagged in the 90's?

Interesting.

I wonder if there is anyone who has studied the markets that doesn't consider that a 'possibility'?

A friend of mine goes on and on about his options strategy, spends a LOT of time on it. Refuses to compare his results with S&P 500. I don't understand.

-ERD50

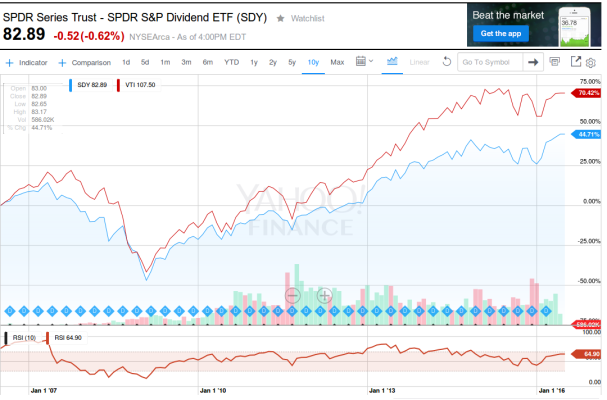

I did not compare to the S&P500 because that was meaningless to me. I already know a great deal of people feel like indexing is the way to go and I agree with that if that is how you invest but it is not how I do. I review my stocks, listen to conference calls, review why I bought a stock and why I sold it, follow future progress to identify mistakes and see how my stocks performed versus my expectations to determine if I am thinking about the market correctly. If by now you have not realized my picks crush the S&P500 you are just not paying attention. Yet I am quite conservative and only utilze 25% of my portfolio, so you can see while I am confident I am not willing to put my funds to the ultimate test but it allows me to invest in my decisions without any fear and that I think is what I need to be successful when I have gone through the analytics of a situation. Posting here clears my mind and thought process further, especially with all the indexers challenging the very notion of individual investing.

When I analyzed the oil industry in 2014 on the I like oil thread started because of the belief the oil industry had bottomed and the oil stocks were now cheap (yowzers people reccomended stocks there that fell 80-90%) and foresaw many problems in that area and sold all my oil and energy stocks I did not stop and try to compare what that would mean for the S&P500. I did offer that I thought at 70-75 Exxon would be a decent price it fell to a low of 66, I offered that at 85 Chevron would be a good price it had a closing low of 75 though it flash crashed to 66, but from a financial standpoint only Exxon Mobil met my critera. I put up an analysis of BHP and tried to stop people from investing in what I thought was a coming train wreck even though it had fallen from a high of 100 to 46 on that date it eventually dropped another 60 percent to 18.46 and with the recent oil recovery still sits down over 40percent at 26. fell

http://www.early-retirement.org/forums/f44/i-like-oil-74689-8.html#post1550162 So yes I think I can analyze individual stocks quite well, and mostly because I don’t have to report to anyone but myself and can think for myself in my own time frame and don’t have a single index I am competing against, other than the inflation rate.

I was surprised that my CEF DNP was a lot more exposed to the oil industry as it fell far further than I expected and realized I made a mistake in not selling DNP. How DNP did in comparison to the S&P500 I couldn’t even say though I think it was worse though now it has recovered, and with the 7% annual distribution who knows it might be doing better than the S&P500 I really don’t know.

I spend time trying to see if I can gleam enough of a look at China’s economy and determine if I still want to hold the 1000 shares of VFC I hold with a basis of $20 from 2010 or if I should let a strong management team try to work out those problems. AMGN is a stock and company I really like with really strong management and a great dividend policy but it is really affected by the BIOTECH ETF’s and potential generic competition and legal changes should certain politcal factions gain control.

When I analyzed Kinder Morgan I sold the stock before the takeover because I though it was fully valued, many thought the new structure would be great, I didn’t like it much and there was risk in holding on, but I continued to follow the company because I knew it and then I posted the thread about it being a potential disaster, when the disaster hit I knew the financials well enough to know the new Preferred was a steal when it had fallen to 32 from 50 when the preferred dividend was totally safe for the next 4 years, a quick 38% profit was nice in that preferred when the markets realized the same thing in 3 weeks. this was similar to what happened when I had sold my Cullen Frost stock but listened to the CEO talk about how the hedged oil production for the next year would save his loans, instantly it hit me that everyone just assumed oil would not stay down, certainly Pickens thought so but because I answer to no one I could easily disagree with him and find his ideas foolish and mere hope.

I analyzed CAT when someone had a question, gave an opinion on a price to target to buy - 60 low was 57 after that and Sunset was going to sell because of loss and I cautioned not to, at least for me only the outlook of the company should matter not taxes. Turns out that was the low in the stock and now it is at 57 paying a 5% dividend on the original investment and up 32% in 5 months.

http://www.early-retirement.org/forums/f44/any-one-have-any-thoughts-on-cat-78910-2.html#post1687362 How would that have done compared to the S&P500, doesn’t matter to me is the dividend secure and can I count on it, I thought most likely it would though CAT doesn’t meet my investment criteria because of too much fluctuations in earnings. Once you allow yourself to worry about how you are doing against an index you will change the manner in which you invest. But you can count on this, my individual stock performance has crushed the S&P500 in the time I have been on this forum. It is not even close. From 2010 to 2013 I was working 70 hours per week on corporate mergers, pension dissolutions and ERP implementations so with the additions to the portfolios and the various accounts I don’t have exact figures nor do I really care what they were, I track now because I work zero hours and have set up a spreadsheet that breaks my components out for me quite nicely.

You can review my posts here I make many on individual stocks and put up most of my ideas, a couple of wrong ones were PMT and SO which did not work out as I thought and realize I should never of bought because it did not have the earnings consistency I usually require and a closed end fund RVT I bought at a 14% discount to market but should just buy my own stocks.

We are at a point in the investing world that is incomparable to any point in history yet academics are finding comfort in their indexes and results back to 1926 when 15 trillion of government debt has a negative yield. At some point in the future academics will be studying this period and wondering what in the hell were they thinking. But when you have Banks giving mortgages out at negative rates (paying people to borrow) as one has done in Spain, you have to wonder if banks really will be around in another 10 years. If only I could get 15 trillion dollars borrow at -0.5% and then pay back the debt in a year while earning nothing on the loan but then being able to save 75 billion for myself in just a year I will know I have made it. And yet it is possible that 75 billion would be an underperformance to the S&P500 based on the 15 trillion of capital, but would it really make that a poor choice of investment?