My 2 cents on the correct AA.

I suggest reviewing all the bear markets and stock market crashes and recovery times. The best link that I found for this information is at

https://www.cnbc.com/2018/12/24/whats-a-bear-market-and-how-long-do-they-usually-last-.html

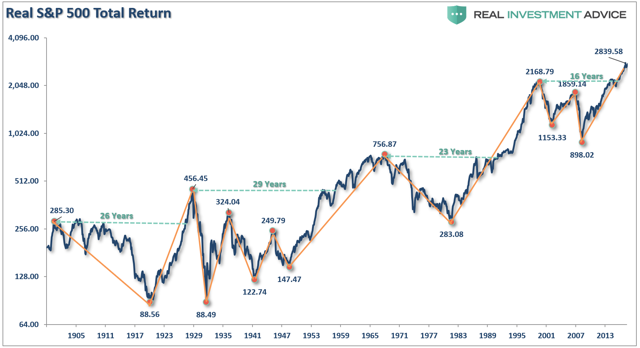

The very worst bear market was Jan 73 which had a duration of 21 months and a recovery time of 69 month for a total of 90 months. All other bear markets had a shorter duration and recovery time and this is based from 1946 to 2019.

Let's assume you are 65 and your life expectancy is 85 which is 240 months of income that you need.

Your portfolio should have a "rainy day" fund of 90 months. 90 months is 38% of 240 months.

This mean your AA should be 38% bonds and 62% stock. During a crash or bear market, your stock portfolio loses liquidity since you can't sell low. You are forced to live on your 38% bonds which is equal to 90 months.

The type of bond fund must maintain its value during a bear market or crash....such as VFSTX short term corporate bond or treasury bonds or CDs. The type of bonds that you have may be more critical than your AA because certain bond funds can lose it value during a bear market as well.

Please note that your stock portion will likely earn money so that your portfolio will likely last past your age 85. Reverse mortgage is also an option since banks will give a relatively large monthly payment if your age is older than 85.

If you have a 50/50 portfolio, then you are super conservative since the 50% bond fund will outlast the historical bear markets and crashes and recovery times since 1946.