NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

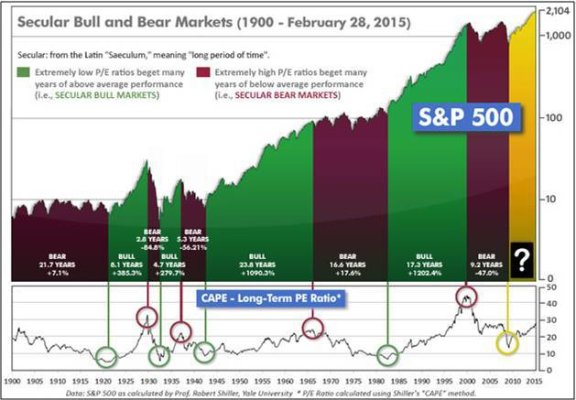

The widely accepted definition of a correction is a 10% drop.

From 5/21/2015 to 2/11/2016, the S&P lost 14%. That certainly counts as a correction.

Even now, it still has not recovered to the old high. They will say that the correction has ended when the market recovers the loss.