papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

Yawn...

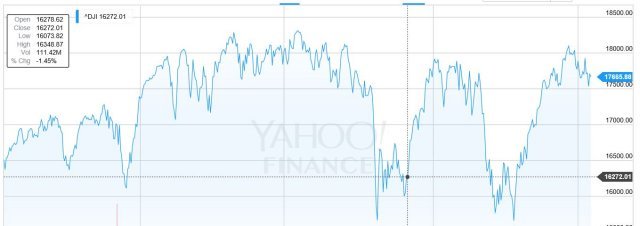

Approaching 2 years of the 2K grind... A few little loop-de-loops has been about it...

Nice to wring our hands and do nothing ...

Collect that 2.5% dividend.. And keep waiting.

Two years of a 1 percent annualized real return after inflation ...

Bogle so far is proving to be correct !

Approaching 2 years of the 2K grind... A few little loop-de-loops has been about it...

Nice to wring our hands and do nothing ...

Collect that 2.5% dividend.. And keep waiting.

Two years of a 1 percent annualized real return after inflation ...

Bogle so far is proving to be correct !

I guess it's all in how we look at it. I suppose the bumpiness could be a lot worse. And yes, I agree that like I said, the *overall* movement hasn't been too extreme in the past two years.

I guess it's all in how we look at it. I suppose the bumpiness could be a lot worse. And yes, I agree that like I said, the *overall* movement hasn't been too extreme in the past two years.